BSW Airdrop Scam Checker

If you’ve been scrolling through crypto forums lately, you’ve probably seen the phrase Biswap airdrop pop up everywhere. The buzz can be exciting, but it’s also a minefield of fake promises and confusing details. This guide cuts through the hype, explains what’s real, what’s a scam, and shows you the genuine ways to earn BSW without risking your wallet.

Quick Summary

- Biswap (BSW) does not currently run a public, official airdrop.

- Scam listings often use shortened links, Trust Wallet DApp prompts, and impossible dates.

- Earn BSW legitimately by providing liquidity on Biswap’s V3 farms or staking NFTs.

- Watch Binance’s delisting impact and the project’s decentralisation roadmap.

- Stay safe: verify announcements only on biswap.org and official social channels.

What is Biswap (BSW)?

Biswap (BSW) is a BEP-20 token that powers a decentralized exchange (DEX) on the Binance Smart Chain (BSC). Launched on July 4, 2021, the platform touts a 0.1% trading fee-far lower than the 0.25% or higher typical of other BSC DEXes. As of 2October2025, BSW trades around $0.0072, giving the project a market cap of roughly $8.6million.

The ecosystem bundles an automated market maker (AMM), liquidity pools, yield farming, an NFT marketplace, and an IDO launchpad. One standout feature is transaction‑fee mining: liquidity providers can claim up to 90% of swap fees, plus additional BSW farming rewards.

Official Stance on Airdrops

The Biswap homepage displays a banner that says “EARN & GET AIRDROP,” but it never reveals concrete details-no eligibility criteria, no distribution schedule, no official announcement link. The only verifiable way to receive BSW is through the platform’s built‑in farming programs, not a traditional airdrop.

When the project needs to boost token distribution, it typically rolls out new liquidity‑incentive farms or NFT‑Earn products. These methods are transparent, with smart‑contract addresses publicly visible on BscScan and APR figures displayed on the UI.

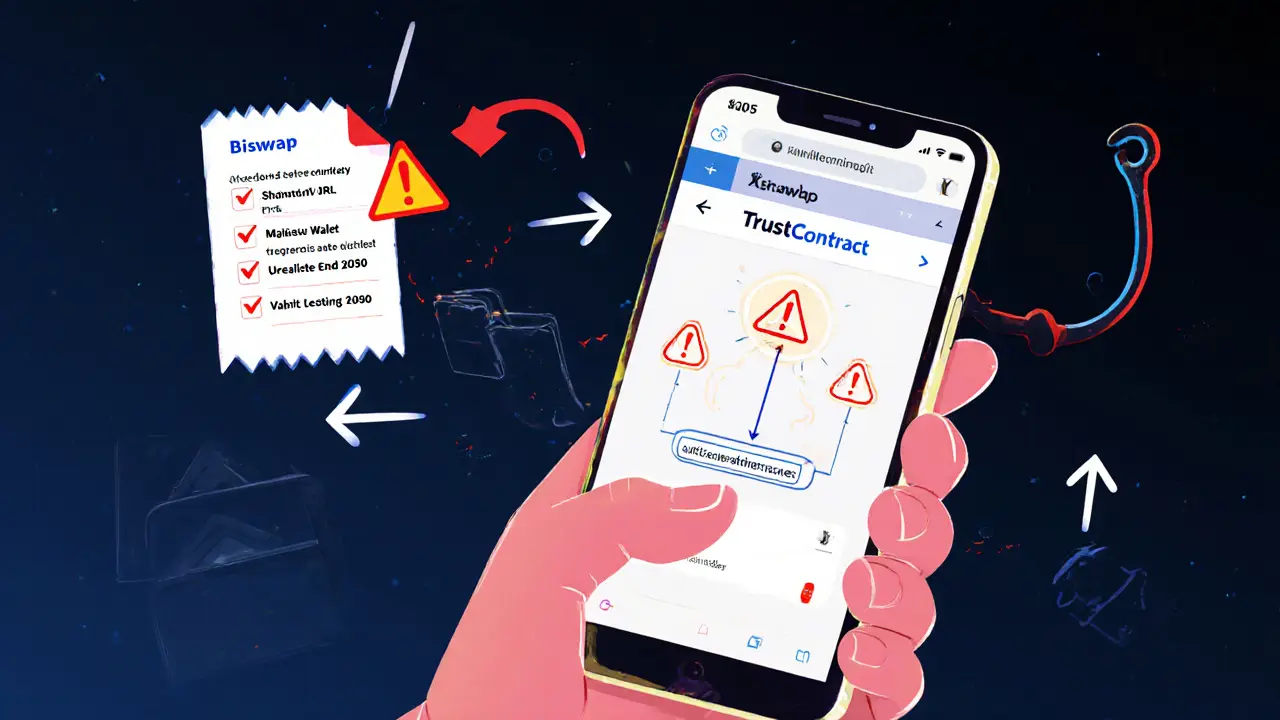

Red‑Flagged Scam Listings

Despite the vague official messaging, a slew of third‑party sites have tried to cash in on the hype. One notable example appears on CoinMooner a crypto‑airdrop aggregator that often hosts unverified campaigns

. Their listing claims an airdrop ending on 31December2050-a date that clearly signals a scam.The scam instructions typically read:

- Copy a shortened URL (e.g.,

https://bit.ly/GetFreeBswTokenEvery5Minutes). - Open Trust Wallet’s DApp browser.

- Paste the link, switch the network to Smart Chain, and connect your wallet.

These steps match classic phishing patterns: short links hide malicious contracts, and prompting a wallet connection gives attackers full control over your assets. Security researchers consistently warn against this exact flow.

How Binance’s Delisting Affects BSW

On 4July2025, Binance announced it would halt BSW spot trading, citing compliance and liquidity concerns. The price slumped 15% on the news, but a swift rally of 118% followed after Biswap unveiled a decentralisation roadmap on 26June2025. While the delisting reduced exposure on a major exchange, the project’s shift toward community‑driven liquidity pools aims to keep the token usable without relying on centralized listings.

Data from CoinMarketCap shows ongoing volatility, with BSW’s market cap fluctuating within a narrow band of $7‑9million since the delisting.

Legitimate Ways to Earn BSW

If you want BSW without walking into a scam, focus on the platform’s proven incentives:

- V3 Liquidity Farming: Deposit BNB‑BSW or other approved pairs into the V3 farms. APRs can reach double‑digit percentages, and rewards are auto‑claimed.

- Fee Reimbursement: Biswap reimburses up to 90% of swap fees directly to liquidity providers, effectively turning trading activity into passive income.

- NFT Earn: Purchase select NFTs from the Biswap marketplace, stake them, and collect BSW payouts. Some NFTs offer a fixed 15%‑30% annual return.

- Lottery Participation: Weekly lotteries distribute BSW prizes to ticket holders. While not a guaranteed income, the odds are transparent and the contract is openly verified.

Setting up takes about 15‑30minutes: connect a wallet (MetaMask or Trust Wallet), approve the token allowances, and add liquidity via the “Add Liquidity” button. Afterward, the platform automatically enrolls you in the highest‑yielding farm for that pair.

Scam‑Detection Checklist

| Indicator | Why It’s Suspicious |

|---|---|

| Shortened URLs (bit.ly, tinyurl) | Obscures the destination contract; often leads to phishing sites. |

| Requests to connect a wallet in a DApp browser | Gives full control of your assets to an unknown contract. |

| Unrealistic dates (e.g., 2050) | Signals that the “airdrop” is never meant to end-typical of rug‑pull schemes. |

| Absence of official announcement on biswap.org or verified socials | Legitimate airdrops are always publicized through the project’s official channels. |

| Guaranteed high returns with no risk | Defies market logic; genuine DeFi incentives always involve some volatility. |

Community Sentiment and Expert Views

Reddit threads and DeFi forums consistently praise Biswap’s low‑fee model and fee‑reimbursement scheme, but they also warn users to ignore any “instant free BSW” offers that lack verification. Security analysts note that after Binance’s delisting, the project’s survival hinges on the strength of its community‑driven liquidity and the successful rollout of its decentralisation roadmap.

Comparatively, competitors like PancakeSwap the leading BSC DEX with a broad ecosystem and deep liquidity

continue to dominate exchange volume, making Biswap a niche but viable option for traders who prioritize ultra‑low fees.Step‑by‑Step: Set Up a Legitimate BSW Farm

- Visit the official site biswap.org and click “Launch App”.

- Connect your wallet (MetaMask recommended for desktop, Trust Wallet for mobile).

- Navigate to the “Farms” tab and locate the V3 BNB‑BSW pair.

- Approve BSW token for spending when prompted (this is a one‑time transaction).

- Enter the amount of BNB you want to add, confirm the liquidity addition.

- After the transaction confirms, you’ll see your position auto‑enrolled in the highest APR farm.

- Harvest rewards manually or set the “Auto‑Harvest” toggle for convenience.

All steps are executed on‑chain, and you can verify each transaction on BscScan the block explorer for Binance Smart Chain. This transparency helps you confirm you’re interacting with the official smart contracts.

Future Outlook for BSW

Biswap’s roadmap includes a DAO‑governance layer, expanded NFT‑Earn products, and cross‑chain bridge integration. If these milestones hit on schedule, they could restore confidence among investors who left after the Binance delisting.

However, the broader regulatory environment is tightening. Projects that rely heavily on token incentives may face scrutiny from regulators in Europe and the U.S. Staying updated on official announcements will be key to navigating any compliance hurdles.

Frequently Asked Questions

Is there an official Biswap airdrop right now?

No. Biswap’s website only encourages users to “Earn & Get Airdrop” without providing a concrete airdrop program. The only legitimate way to receive BSW is through the platform’s farming, NFT Earn, or lottery features.

What should I do if I’ve already connected my wallet to a suspicious BSW airdrop link?

Immediately revoke the contract’s approval on BscScan (or use a wallet‑management tool). Then, transfer any remaining assets to a fresh address. Monitor the address for unexpected outgoing transactions.

How does the fee‑reimbursement program work?

When you provide liquidity, 90% of the 0.1% swap fees generated by that pool are automatically sent back to your wallet as BSW tokens, effectively reducing your cost of trading.

Can I earn BSW on other chains besides BSC?

Currently Biswap operates exclusively on Binance Smart Chain. Cross‑chain bridges are planned in the roadmap, but no official support exists yet.

What are the main risks of participating in Biswap’s farms?

Risk factors include impermanent loss on volatile pairs, smart‑contract bugs (though contracts are audited), and reduced liquidity after Binance’s delisting which can cause larger price swings.

Finance

Finance

Karl Livingston

May 1, 2025 AT 00:01I’ve been watching the Biswap hype since it first launched and it still feels a bit like a roller‑coaster. The low‑fee promise is seductive, but every time the token dips you hear whispers of “airdrop” that turn out to be smoke. If you’re tempted by a link that shortens to bit.ly, take a step back and ask who’s really behind that redirect. The contract you end up approving could instantly drain a wallet that was once pristine. A good rule of thumb I keep in my mental toolbox is: “no wallet connection, no free BSW.” The official Biswap site does a decent job of displaying its farms, and you can verify every contract on BscScan with a quick “copy‑paste.” Those “end dates” set in 2050 are a classic red flag, because nobody’s planning a distribution that far out into the future. I learned that the hard way when a friend sent me a meme about “free BSW every 5 minutes” and I almost fell for it. After revoking the suspicious approval, I moved the remaining tokens to a fresh address and slept better at night. The genuine ways to earn BSW – staking in V3 farms, fee reimbursement, or NFT‑Earn – all require a few transactions but they’re transparent. You’ll see the APR numbers on‑screen, and the smart contracts are open‑source for anyone to audit. Even the lottery is visible on‑chain, so there’s no magic behind the curtain. While Binance’s delisting rattled a few investors, Biswap’s roadmap shows they’re aiming for a DAO‑governed future. That shift could actually stabilize the token if the community steps up and provides liquidity without reliance on a single exchange. Bottom line: treat any “airdrop” that asks for a wallet connection as a phishing bait, double‑check the source, and stick to the official farms if you want real rewards. Stay safe, keep your keys in your hands, and remember that patience beats every too‑good‑to‑be‑true promise.

Kyle Hidding

May 3, 2025 AT 02:01The so‑called BSW airdrop is nothing but a phishing vector exploiting DeFi novices; the request for wallet connection instantly escalates the attack surface. Their “risk checklist” is essentially a rebranded copy‑paste of every scam signature we’ve cataloged.

Andrea Tan

May 5, 2025 AT 04:01I’ve seen a lot of folks get burned by the fake BSW links, so I always double‑check the URL and make sure the source is listed on biswap.org before I click anything. Keeping it simple and staying on the official site is the easiest way to avoid the drama.

Gaurav Gautam

May 7, 2025 AT 06:01If you’re looking to stack BSW without falling into a trap, just hop onto the V3 farms and let the fee‑reimbursement do the heavy lifting. The process is slick: connect MetaMask, approve the token once, and watch the rewards roll in while you sip your coffee.

Robert Eliason

May 9, 2025 AT 08:01Everyone's yappin about “free BSW” but honestly, the only thing free is the regret you get after a rug. I doubt any legit project would hand out tokens without a clear utility, so tak a step back.

Cody Harrington

May 11, 2025 AT 10:01I prefer sticking to the official farms; they’re transparent and worth the few gas fees.

Chris Hayes

May 13, 2025 AT 12:01From a risk‑management perspective, the legitimate BSW incentives are transparent on‑chain, which means you can audit the contract addresses yourself. The fee‑reimbursement model actually adds utility to the token, but it also introduces impermanent loss risk on volatile pairs. Overall, the trade‑off is reasonable if you keep your exposure small and monitor the APR.

Donald Barrett

May 15, 2025 AT 14:01Stop falling for the hype – the so‑called airdrop is a textbook phishing scam that anyone with a fraction of sense can spot. If you’re not willing to read the checklist, you’ll lose your assets.

vipin kumar

May 17, 2025 AT 16:01The real reason Binance pulled BSW is not compliance but a coordinated push to keep the market under centralized control, and the ‘official’ airdrop rumors are just a distraction. They want you to chase phantom tokens while the power players move the real money.

Mark Briggs

May 19, 2025 AT 18:01Nice try. Another fake airdrop.

mannu kumar rajpoot

May 21, 2025 AT 20:01While the speculation sounds dramatic, the blockchain data shows no hidden agenda beyond typical market volatility. The contract addresses linked to the fake airdrop are publicly flagged, so there’s nothing mysterious to uncover.

Tilly Fluf

May 23, 2025 AT 22:01Dear community members, it is my pleasure to address the concerns surrounding the purported Biswap airdrop. As a steward of responsible discourse, I encourage adherence to official communications emanating exclusively from biswap.org. Verification of any promotional link should involve a meticulous review of the contract address on BscScan, thereby ensuring utmost transparency. Should you encounter shortened URLs or unsolicited wallet connection prompts, I advise immediate abstention and report the incident to the platform’s support channels. Let us collectively uphold the integrity of our DeFi engagements.

Vaishnavi Singh

May 26, 2025 AT 00:01The allure of effortless token distribution often mirrors our deeper yearning for unearned abundance, yet the immutable ledger reminds us that value cannot be conjured without purpose. In pondering the Biswap narrative, one discerns a pattern where scarcity begets desire, and desire fuels speculation.

Peter Johansson

May 28, 2025 AT 02:01Hey folks 😊, if you want BSW the legit way just hop onto the V3 farms, add some liquidity and let the fees flow back to you 🚀. Remember to double‑check the contract address and keep your private keys safe 🔐. Happy farming!

Cindy Hernandez

May 30, 2025 AT 04:01For anyone unsure about the steps, the official guide on biswap.org walks you through connecting MetaMask, approving BSW, and selecting the appropriate farm. The APR figures are displayed in real time, and you can always verify transactions on BscScan for added peace of mind.

victor white

June 1, 2025 AT 06:01One must appreciate the subtle interplay between decentralised tokenomics and the grandiose theatrics of a fabricated airdrop; the latter merely serves as a parlor trick for the uninformed masses. True connoisseurs recognise that only verifiable on‑chain mechanisms merit our attention.

Angela Yeager

June 3, 2025 AT 08:01I’ve found that keeping a simple checklist-no shortened URLs, official announcement source, and a clear contract verification-has saved me from countless scams. Stick to that, and you’ll navigate the Biswap ecosystem safely.

Darren R.

June 5, 2025 AT 10:01Oh, the tragedy of trusting whispered promises! How many wallets have been emptied under the veil of a “free BSW” mirage, how many dreams shattered by a single malicious contract, and how the noble pursuit of decentralisation is tarnished by such deceitful charlatans! Let us rise, let us educate, and let us demand transparency, for the future of crypto depends on our vigilance!!!

Hardik Kanzariya

June 7, 2025 AT 12:01Friends, if you’re hesitant, start small-add a modest amount of BNB‑BSW to a V3 farm and watch the rewards accrue. It’s a gentle introduction that builds confidence without exposing you to large impermanent loss.

Shanthan Jogavajjala

June 9, 2025 AT 14:01While your cautious approach is commendable, many users overlook the necessity of periodically rebalancing their positions to mitigate impermanent loss; consider setting alerts for pool performance.