2025 Crypto and Blockchain Updates: Exchange Shutdowns, Airdrops, and Regulations

When it comes to crypto exchanges, platforms where users buy, sell, or trade digital assets. Also known as cryptocurrency trading platforms, it has become clear in 2025 that not all exchanges survive long-term, even with institutional backing. VCC Exchange and others collapsed this month, not because of hacks, but because of poor design, tiny coin selections, and no real user demand. Meanwhile, AjuBit and 6x.com kept operating by focusing on fast fiat conversions and transparent fees—proving that utility beats hype every time.

Crypto airdrops, free token distributions meant to reward users or grow communities. Also known as token giveaways, it dominated headlines in October 2025. But most were noise. Launchium (LNCHM) and CRODEX (CRX) had no website, no team, and no future—yet people still chased them. Real opportunities like the Base Reward Token (BRW) and SHO token airdrops came with clear rules, eligibility steps, and actual utility. And if you’re looking at NFT airdrops like EPICHERO or Monad’s "1 Million Nads," you need to verify claims before spending time or gas fees.

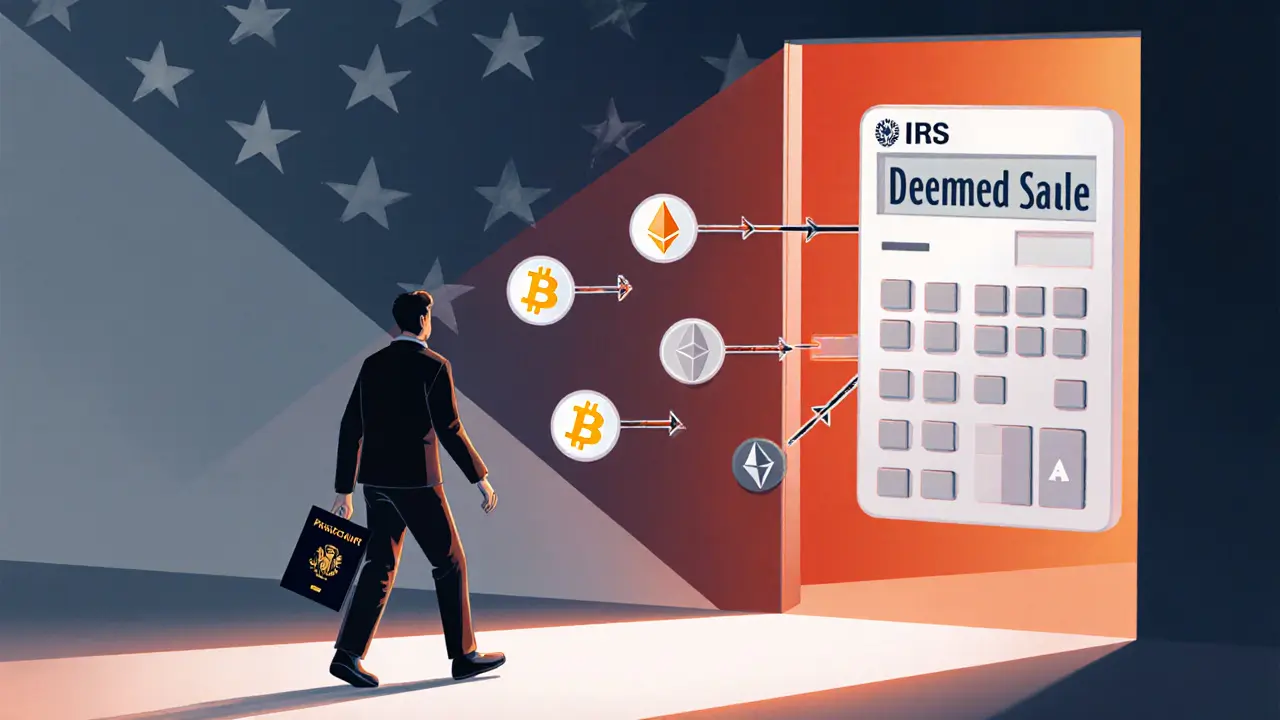

Blockchain regulation, government rules that shape how crypto is used, taxed, or banned. Also known as crypto legal frameworks, it took sharp turns worldwide this month. China made its crypto ban absolute—no trading, no mining, no exceptions. India doubled down on its 30% tax, forcing traders to track every transaction. And the U.S. introduced a new exit tax for expats holding crypto, turning offshore moves into a tax nightmare unless planned carefully. Meanwhile, Malta kept its "Blockchain Island" strategy alive, offering licenses and residency to crypto businesses that play by the rules.

Behind the scenes, technical foundations mattered too. Digital signature algorithms, the cryptographic methods that prove ownership on blockchains. Also known as crypto signing standards, it determined security and efficiency across Bitcoin, Ethereum, and Solana. ECDSA is still common, but Schnorr and EdDSA are gaining ground for better performance and privacy. And if you’ve ever waited hours for a transaction to confirm, you’ve felt the impact of mempools, the temporary holding areas where unconfirmed transactions wait for miners or validators. Also known as transaction queues, it varies wildly between blockchains—knowing how each handles it saves you money.

There’s no magic formula to win in crypto right now. It’s about spotting what’s real: a platform with users, a token with use, a regulation you can plan around. The posts below cover every shutdown, every airdrop, every tax rule, and every technical detail you need to cut through the noise. No fluff. Just what worked, what failed, and what’s still worth your attention in late 2025.

VCC Exchange was a region-focused crypto platform that shut down in 2025. Learn why it failed despite institutional backing, its limited coin selection, and what traders should look for instead.

Launchium (LNCHM) is a Solana-based token with no website, team, or platform. Despite claims of being a social token launchpad, it has zero functionality and extremely low liquidity. Avoid unless you're speculating.

Blockchain offers trust without intermediaries but comes with slow speeds, high costs, and complex implementation. Learn where it works, where it fails, and what real companies are doing with it today.

CRODEX (CRX) is a low-liquidity, un-audited DeFi token on the Cronos blockchain with extreme price volatility and no clear utility. Learn why most experts advise against investing.

AjuBit is a non-custodial crypto exchange focused on fast, low-fee crypto-to-fiat conversions for freelancers and international users. Supports 70+ currencies, 247 exchange pairs, and offers 30% referral commissions.

Learn how the 2025 U.S. exit tax treats cryptocurrency, who must pay, how to calculate the deemed sale, reporting requirements, and strategies to reduce liability.

Explore the main digital signature algorithms behind blockchain-ECDSA, EdDSA, Schnorr and more. Learn how they work, compare security, performance, and future quantum‑ready options.

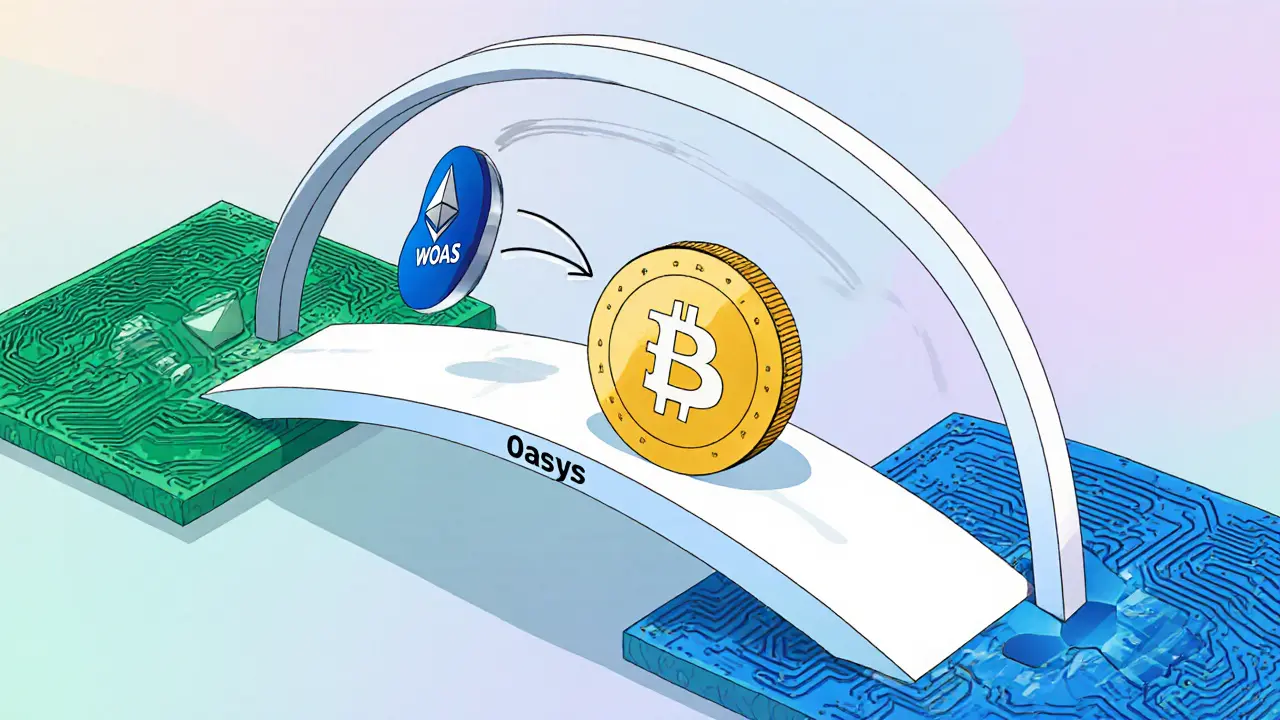

Learn what Wrapped Oasys (WOAS) is, how it works as an ERC‑20 bridge token, its benefits for gaming DeFi, risks, and future roadmap in a clear, friendly guide.

A 2025 review of 6x.com crypto exchange covering fees, security, user experience, and how it measures up against top platforms like Binance and Coinbase.

Mempools are the invisible queues where crypto transactions wait to be confirmed. Bitcoin, Ethereum, Solana, and others handle them differently-knowing how they work helps you avoid delays and save on fees.

Learn how EPICHERO rewards work, who qualifies, and how to start earning BNB through the EpicHero 3D NFT reflection system.

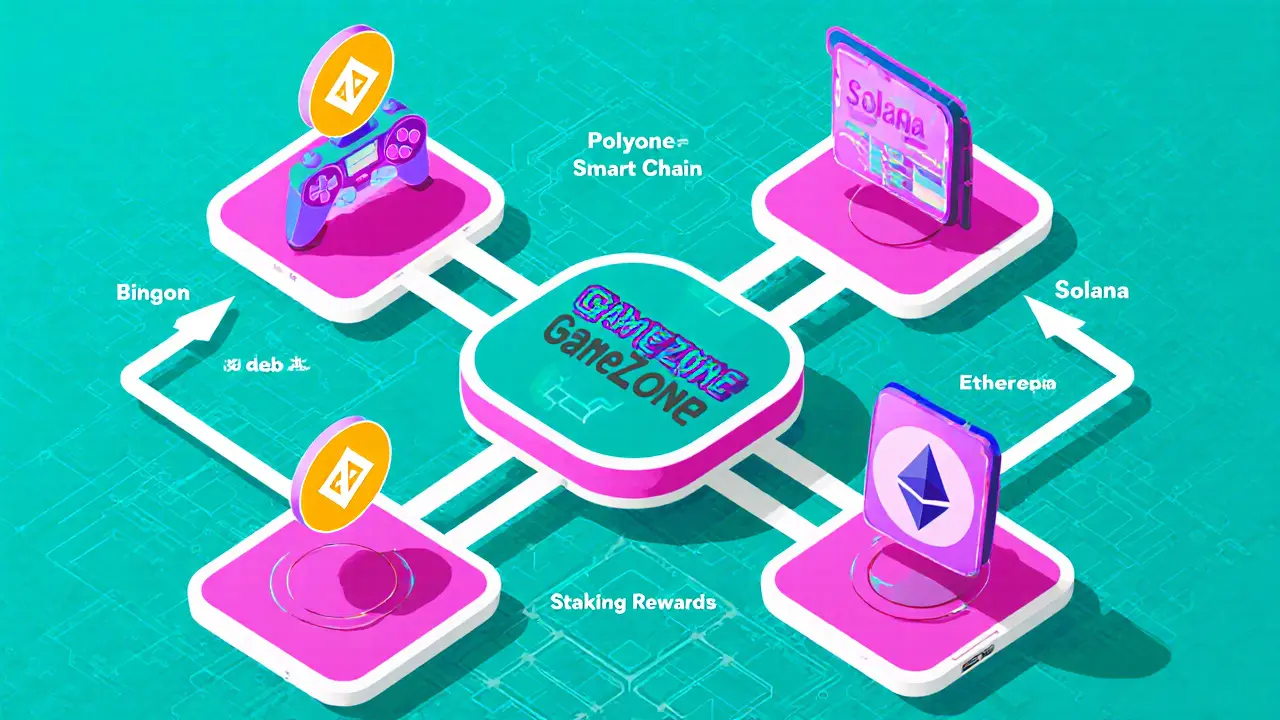

Explore the GameZone IDO launch, GZONE tokenomics, current market data, and everything you need to know about a possible GZONE airdrop.

Finance

Finance