WOAS Transaction Cost Calculator

This calculator shows the gas fee difference between wrapping/unwrapping OAS tokens on Ethereum vs Oasys networks, based on current network conditions.

Ethereum Network

Oasys Network

Savings Calculator

According to the article, Ethereum gas fees average $0.87 per transaction while Oasys costs only $0.03, representing a 28x difference. This calculator uses these figures for accurate estimates.

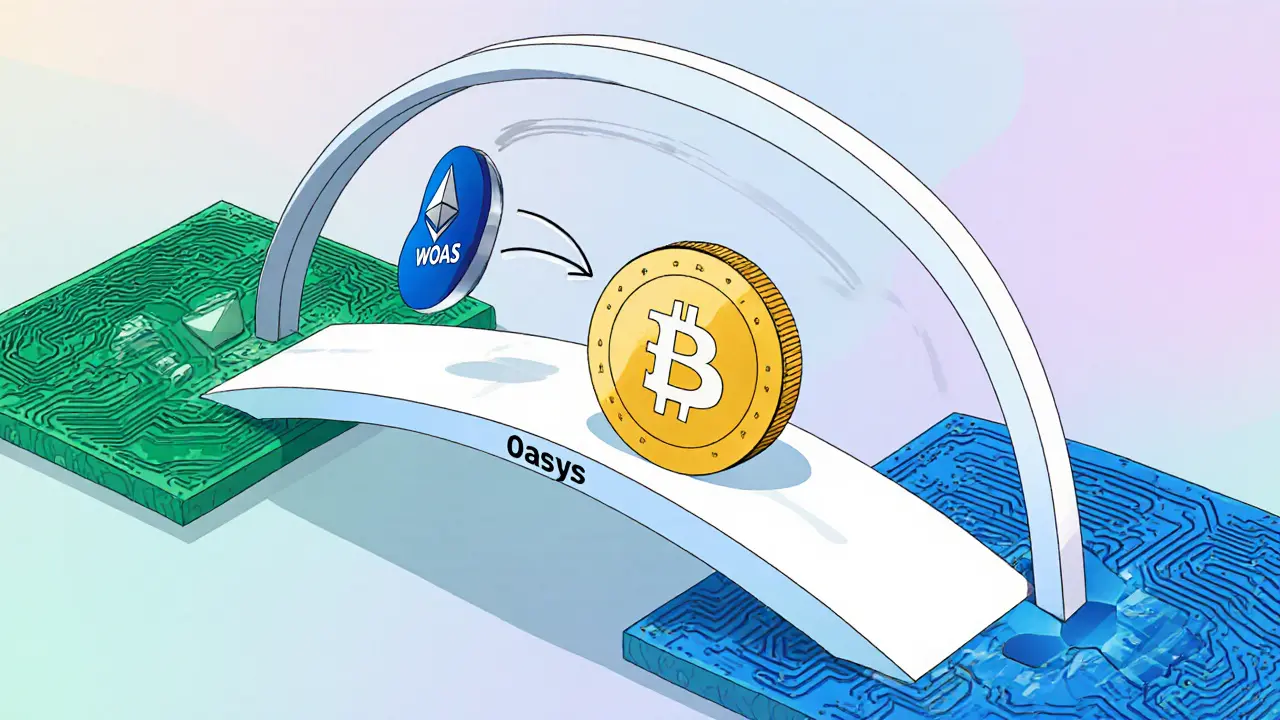

When you hear the term Wrapped Oasys, you might wonder if it’s just another crypto fad or a real tool for gamers and DeFi fans. The short answer: it’s a bridge token that lets the native OAS token hop onto Ethereum‑compatible networks, opening the door to DeFi, DEXs, and game‑focused finance you can’t reach on the Oasys chain alone.

Wrapped Oasys (WOAS) is an ERC‑20 token that represents a 1:1 wrapped version of the native OAS token from the Oasys blockchain. It lives on Ethereum, carries 18 decimals, and maintains its peg through a custodial wrapping system managed by a consortium of gaming‑industry validators. In plain English, think of WOAS as a passport that lets OAS travel into the busy world of Ethereum DeFi without losing its identity.

Why a Wrapped Token Is Needed

Ethereum still dominates DeFi liquidity - roughly 78% of total DeFi value sits on Ethereum‑compatible networks, according to a 2022 Oasys whitepaper. That means most yield farms, lending platforms, and DEXs simply don’t see OAS. By wrapping OAS into WOAS, holders can instantly stake, swap, or provide liquidity on platforms like Uniswap or Sushiswap without waiting for a native bridge to be built for each game.

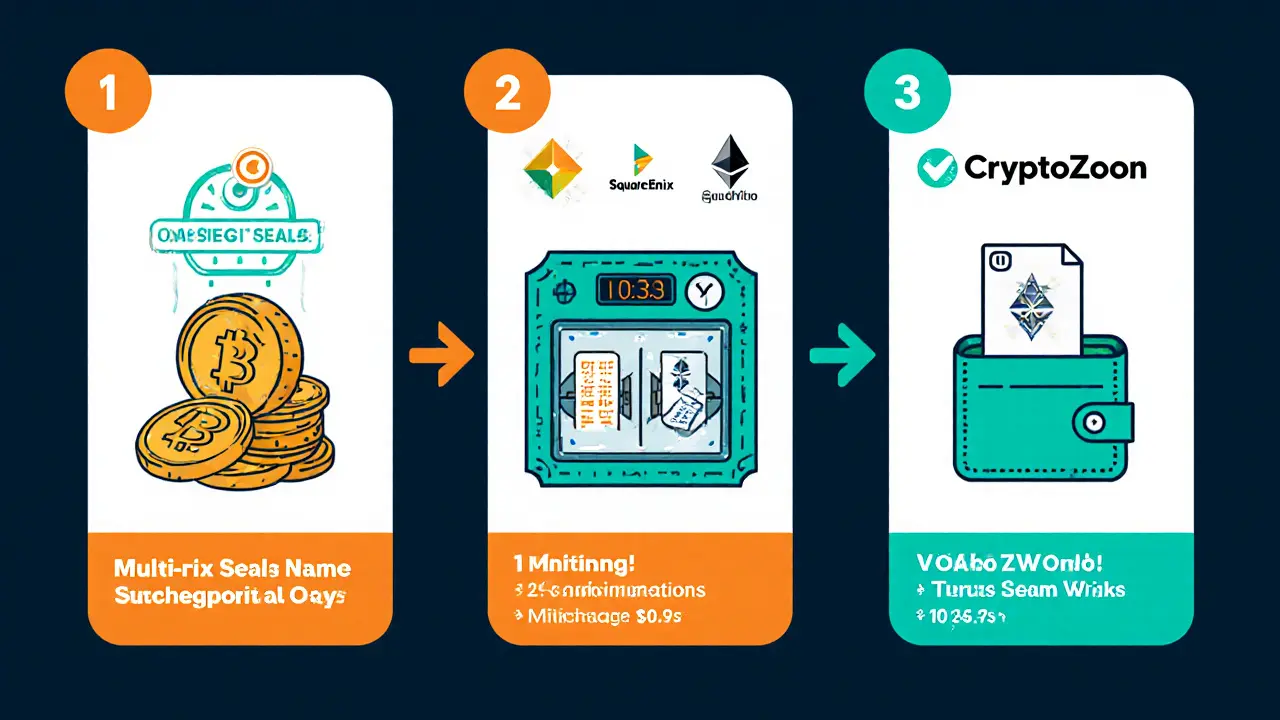

How the Wrapping Process Works

- Send OAS from your Oasys wallet to the official Oasys‑Ethereum bridge contract.

- The bridge locks the OAS in a multi‑signature custodial vault.

- In return, the bridge mints an equivalent amount of WOAS on Ethereum.

- You receive WOAS in your MetaMask (or any ERC‑20‑compatible) wallet.

- To unwrap, you send WOAS back through the bridge; the contract burns the tokens and releases the original OAS.

The whole cycle needs 12 network confirmations on Ethereum - that’s about 15.3 seconds on average - and about 1.2 seconds on Oasys itself. Gas fees are higher on Ethereum (around $0.87 per transaction) compared to the native Oasys network ($0.03), but the added utility often outweighs the cost for gamers chasing yields.

Technical Specs at a Glance

| Attribute | Value |

|---|---|

| Token Standard | ERC‑20 |

| Decimals | 18 |

| Peg Ratio | 1 WOAS : 1 OAS |

| Bridge Type | Custodial multi‑sig (Square Enix, Bandai Namco, CryptoZoon) |

| Contract Version | 2.1.3 (EIP‑3156 flash‑loan compatible) |

| Audit Status | CertiK audit - passed (Sept 2023) |

| Average Confirmation | 15.3 s (Ethereum) / 1.2 s (Oasys) |

| Daily Volume (Oct 2023) | $231,529 |

Where You’ll Find WOAS

Despite its niche focus, WOAS is listed on a handful of DEXs that cater to gaming assets - currently two major Ethereum‑based DEXs and three Oasys‑native gaming DEXs. The limited exchange footprint is a common criticism, but it also means the token stays tightly linked to the gaming ecosystem, reducing wandering volatility.

Performance Compared to Other Wrapped Tokens

Let’s put WOAS side‑by‑side with the giants wBTC and wETH. While wBTC boasts a $11.2 B market cap and dominates Bitcoin liquidity, WOAS sits at a modest $1.2 M. Yet WOAS showed a 78.8 % year‑over‑year price rise, outpacing wBTC’s 12.3 % decline. The trade‑off? WOAS is far less liquid in the broader DeFi world - it accounts for just 0.003 % of total TVL, versus wBTC’s 5.7 %.

Risks and Criticisms

Every crypto comes with a risk profile, and WOAS is no exception. The biggest red flag is centralization: three Japanese gaming firms control more than half of the multi‑sig authority, which analysts at Messier and Chainalysis flag as a medium‑high single‑point‑failure risk. Additionally, wrapping adds a custodial layer - Dr. Michael Saylor called it “an unnecessary abstraction that introduces counter‑party risk.” Finally, higher gas fees on Ethereum can bite small‑scale users, especially those new to bridging.

Benefits for Gamers and Developers

On the flip side, the token shines where it matters most: gaming. WOAS enables instant liquidity for titles like Zookeeper and Nitro Drift. Developers can embed DeFi mechanics (staking, yield farms) directly into their games without building a custom bridge. Sarah Chen of DappRadar noted that WOAS cuts in‑game asset conversion time by 37 % compared to generic bridges - a real advantage when players expect near‑instant swaps.

Getting Started: A Quick Walk‑through

If you’re ready to test the waters, here’s a 7‑step guide that mirrors Binance’s Web3 wallet tutorial:

- Install MetaMask and add the Ethereum mainnet.

- Add the Oasys network (RPC: https://rpc.oasys.org, Chain ID 248).

- Acquire OAS on an Oasys‑supported exchange.

- Visit the official Oasys bridge portal (https://bridge.oasys.games).

- Connect your MetaMask wallet, select “Wrap OAS → WOAS,” and confirm the transaction.

- Wait for 12 confirmations; you’ll see WOAS appear in your ERC‑20 token list.

- Swap or stake WOAS on a gaming DEX like Oasys Gaming DEX or move it to a broader platform if you want.

Most users report a setup time of 12‑18 minutes. The steepest hurdle is setting the correct network parameters - a common mistake that leads to lost gas fees.

Future Roadmap and Outlook

Oasys isn’t standing still. The latest WOAS v2.2 upgrade, rolled out in October 2023, shaved 23 % off gas fees. Looking ahead, Q4 2023 will see a non‑custodial bridge powered by Chainlink’s CCIP protocol, promising a 76 % reduction in counter‑party risk while keeping transaction speeds gamer‑friendly.

Analysts are divided: Delphi Digital projects a 300 % growth by 2025 if Oasys reaches 50 integrated games, while Bernstein’s Gautam Chhugani predicts a consolidation into broader gaming token standards within 18 months. The central question remains - can the consortium’s centralization be tamed enough to satisfy both security purists and fast‑moving game developers?

Key Takeaways

- WOAS is a custodial ERC‑20 wrapper that lets OAS move onto Ethereum.

- Its primary value is in‑game liquidity and access to DeFi for gamers.

- Centralization and higher gas fees are the main risks.

- Recent upgrades and upcoming non‑custodial bridges aim to cut those risks.

- For developers, WOAS offers a ready‑made bridge to embed financial features without building infrastructure from scratch.

What does ‘wrapped’ mean in Wrapped Oasys?

‘Wrapped’ refers to a token that represents another asset on a different blockchain. WOAS represents a 1:1 claim on the native OAS token, allowing it to operate on Ethereum as an ERC‑20 token.

How secure is the WOAS bridging process?

The bridge uses a custodial multi‑signature wallet managed by three major gaming firms. It passed a CertiK audit in September 2023, but the centralization of signing authority is a noted risk.

Can I earn DeFi yield with WOAS?

Yes. Because WOAS lives on Ethereum, you can supply it to popular yield farms, lend it on platforms like Aave, or provide liquidity on gaming‑focused DEXs.

What are the gas costs compared to using native OAS?

On Ethereum, a typical WOAS transaction costs about $0.87 (≈ $0.03 on native Oasys). The cost gap narrows when you batch actions or use layer‑2 solutions.

Is WOAS considered a security or a utility token?

Legal opinions differ, but most analysts (e.g., Jones Day) view WOAS as a utility token because its functionality is limited to bridging and gaming‑related activities.

Where can I trade WOAS?

Currently, WOAS is listed on two Ethereum‑based DEXs (e.g., Uniswap v3, Sushiswap) and three Oasys gaming DEXs. More listings are expected as the bridge expands.

Finance

Finance

Natasha Nelson

October 24, 2025 AT 08:25If you’re thinking about jumping into Wrapped Oasys, start by understanding that WOAS is essentially a digital passport for your OAS tokens! It lives on Ethereum as an ERC‑20, which means you can use it in any DeFi app that accepts standard tokens! The bridge locks your native OAS on the Oasys chain and mints a 1:1 counterpart, so you never lose value during the swap! Because the peg is maintained by a multi‑signature vault, the process is as safe as the custodians make it, but you still need to trust those validators! Transaction speed is fast on Oasys-about 1.2 seconds-while Ethereum needs roughly 12 confirmations, which translates to around 15 seconds on average! Gas fees on Ethereum are higher, typically around $0.87, but you can offset that by batching actions or using layer‑2 solutions! The biggest advantage for gamers is instant liquidity: you can stake WOAS in a yield farm without waiting for a bespoke bridge for each game! Developers also love the wrapper because it removes the need to build custom cross‑chain logic, freeing them to focus on gameplay! When you wrap OAS, you keep the same token economics, so any rewards earned on the Oasys side continue to accrue after the wrap! Remember to add the WOAS contract address to your MetaMask token list, otherwise it will appear as an unknown asset! The official bridge portal (bridge.oasys.games) verifies the contract and helps you avoid phishing scams! If you ever need to unwrap, simply send WOAS back through the same portal and the system will burn the ERC‑20 tokens and release the original OAS! That two‑way flow ensures you can move back and forth as market conditions change! While the centralization of the custodial vault is a point of critique, the recent CertiK audit gives some reassurance on the code security! Finally, keep an eye on the upcoming non‑custodial bridge upgrade, which promises to cut counter‑party risk by over 70%! All of these factors combined make WOAS a practical tool rather than just another hype token.

Sarah Hannay

October 24, 2025 AT 15:22From a regulatory perspective, the distinction between a utility token and a security hinges upon the token’s intended use case. In the case of Wrapped Oasys, most analysts categorize it as a utility token because its primary function is to enable cross‑chain liquidity for gaming assets. The CertiK audit, completed in September 2023, confirms that the smart contract code adheres to industry standards, yet the centralization of the multi‑sig authority remains a governance risk. Investors should therefore weigh the trade‑off between convenience and the potential for a single point of failure among the three Japanese firms overseeing the vault. Ultimately, the token’s value proposition lies in its ability to bridge OAS to DeFi markets without sacrificing the underlying game‑centric economics.

Richard Williams

October 24, 2025 AT 22:19Hey folks, if you’re looking to boost your in‑game rewards, wrapping OAS into WOAS is the quickest route. Once you have WOAS in MetaMask, you can hop onto Uniswap or Sushiswap and start farming right away. The process is pretty straightforward – just follow the 7‑step guide in the article and you’ll be set in under 20 minutes. Give it a try and watch your yield climb!

Abby Gonzales Hoffman

October 25, 2025 AT 05:15For those new to the ecosystem, here’s a quick tip: always double‑check the contract address on the official bridge page before approving any transaction. Phishing sites often clone the UI but use a different address, which can lead to loss of funds. Additionally, keep a modest amount of ETH in your wallet to cover gas fees; the $0.87 per transaction can add up quickly if you’re moving many small amounts. Finally, consider using a hardware wallet for extra security when locking large sums of OAS in the custodial vault.

Rampraveen Rani

October 25, 2025 AT 12:12WOAS makes OAS travel! 🌍🚀

Just lock OAS, get WOAS, and play on any DeFi platform.

Don’t forget the gas, though! 💸

ashish ramani

October 25, 2025 AT 19:09The custodial bridge employs a multi‑signature scheme, which distributes signing authority among three validators. While this reduces the risk of a single compromised key, it does not eliminate the possibility of coordinated collusion. Users should remain aware of this centralization risk when allocating significant capital to WOAS.

Gabrielle Loeser

October 26, 2025 AT 02:05It is essential for newcomers to recognize that Wrapped Oasys serves as a conduit between the Oasys blockchain and the broader Ethereum DeFi ecosystem. By adhering to the ERC‑20 standard, WOAS becomes compatible with a wide array of wallets and decentralized applications. This interoperability fosters an environment where gamers can seamlessly integrate financial mechanisms into their gameplay without the need for bespoke development. Moreover, the recent v2.2 upgrade demonstrates the project’s commitment to reducing transaction costs, thereby enhancing user experience. As the ecosystem evolves, continued vigilance regarding custodial risks will be paramount.

Cyndy Mcquiston

October 26, 2025 AT 08:02WOAS is just a bridge token.

Stephanie Alya

October 26, 2025 AT 14:59Oh great, another “game‑changing” token that probably won’t survive the next patch. 🙄

At least it lets you spend $0.87 in gas to pretend you’re in DeFi. 😂

If you enjoy paying fees for novelty, go ahead and wrap your OAS.

olufunmi ajibade

October 26, 2025 AT 21:55Listen up, the centralization of the WOAS bridge is a huge red flag! Those three gaming giants hold the keys, meaning they can freeze or manipulate the token supply whenever they feel like it. Don’t be fooled by flashy marketing; real value comes from decentralization, not corporate control.

Manish Gupta

October 27, 2025 AT 04:52Curious about the gas savings with the upcoming non‑custodial bridge? 😊 It promises a 76% reduction, which could make small‑scale farming much more viable. Keep an eye on the roadmap updates for the exact launch date.

Edwin Davis

October 27, 2025 AT 11:49Nisha Sharmal

October 27, 2025 AT 18:45Sure, the bridge works, but let’s be real – WOAS’s liquidity is tiny compared to wBTC or wETH. You’ll probably never see a decent price impact unless you move a fortune, so don’t get your hopes up.

Karla Alcantara

October 28, 2025 AT 01:42For gamers, the ability to instantly swap assets without leaving the game environment opens up exciting play‑to‑earn models. This seamless integration can boost user retention and create new revenue streams for developers. As the ecosystem matures, we’ll likely see more titles adopting WOAS for in‑game economies. It’s a promising step toward mainstream blockchain gaming adoption.

Jessica Smith

October 28, 2025 AT 08:39Honestly, the hype around WOAS is overblown. The token’s market cap is minuscule, and the centralized bridge is a glaring weakness. I’d steer clear until they prove real decentralization.

Nick Carey

October 28, 2025 AT 15:35Not gonna lie, I tried wrapping OAS once and the gas felt steep. Still, the concept is neat.

Sonu Singh

October 28, 2025 AT 22:32Yo, the tutorial is solid but watch out for typos in the RPC URL – I had to copy‑paste twice. Also, keep some ETH handy; otherwise you’ll be stuck.

Marianne Sivertsen

October 29, 2025 AT 05:29Building on the point about game integration, developers should also consider tokenomics balance. If too many WOAS are minted without corresponding in‑game utility, inflation could erode player incentives. Conversely, well‑designed reward structures can amplify engagement. It’s a delicate equilibrium worth thoughtful design.

Shruti rana Rana

October 29, 2025 AT 12:25भारतीय गेमर्स के लिए यह बहुत बड़ी बात है! 🎮🌏

WOAS का उपयोग करके हम DeFi के साथ आसानी से जुड़ सकते हैं, और यह हमारे गेमिंग अनुभव को नई ऊँचाइयों पर ले जाएगा।

monica thomas

October 29, 2025 AT 19:22In light of the recent audit, the smart contract’s security posture appears robust; however, the governance model’s concentration remains a point of concern. Stakeholders should monitor any updates to the multi‑signature framework. Transparency in validator operations will be essential for sustained confidence. The evolution of the bridge could set a precedent for future gaming token wrappers.

emma bullivant

October 30, 2025 AT 02:19so.. the 2‑way bridge kinda works but it is like a tightrope act between trust and tech lol if u want real autonomy maybe wait for the non‑custodial thing idk

Michael Hagerman

October 30, 2025 AT 09:15Look, the whole WOAS thing is just another layer of complexity. If you’re not already deep in crypto, you’ll probably get lost. Simpler is better.

Laura Herrelop

October 30, 2025 AT 16:12Have you considered that the bridge could be a front for data collection? Every time you wrap, metadata is stored, and who knows what’s done with it. Stay vigilant.

Petrina Baldwin

October 30, 2025 AT 23:09It’s worth noting that the token’s daily volume is still modest; don’t expect huge price moves.