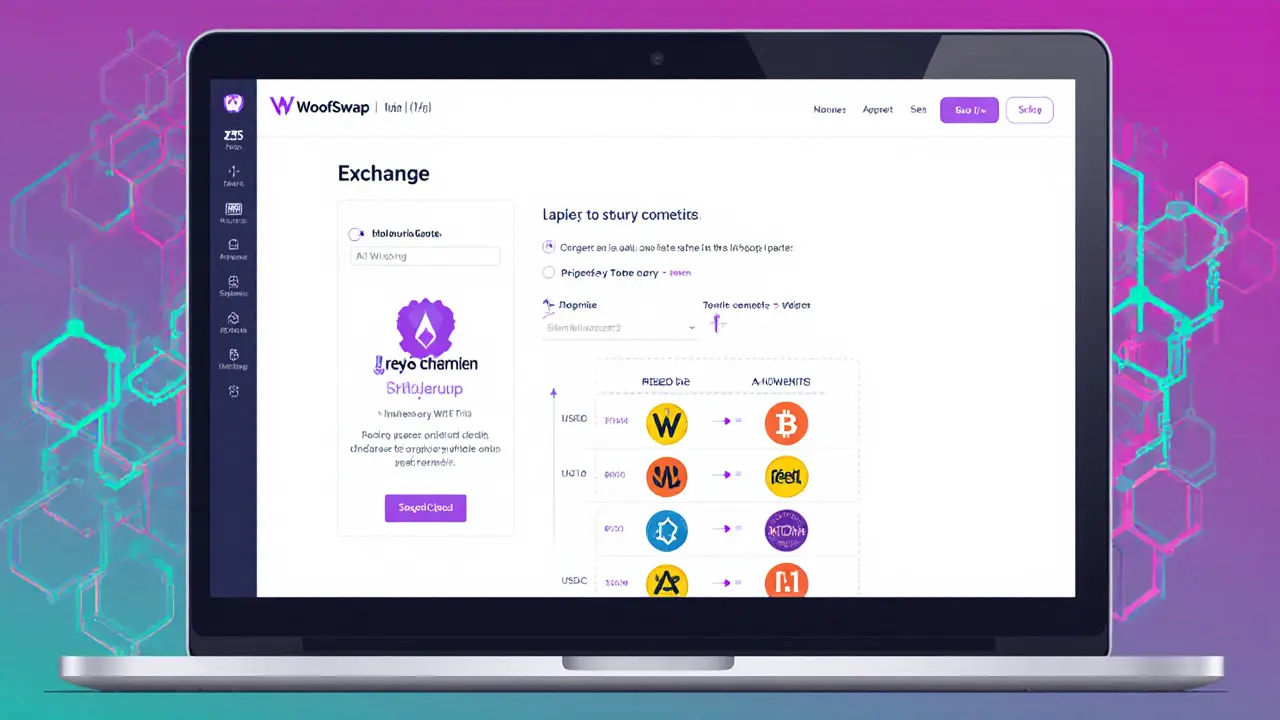

WoofSwap DEX – What It Is and Why It Matters

WoofSwap DEX, a community‑run decentralized exchange on Binance Smart Chain. Also known as WoofSwap, it provides automated market making and token swapping. Decentralized Exchange (DEX) enables peer‑to‑peer trading without a central order book. Automated Market Maker (AMM) powers the pricing algorithm that matches buys and sells instantly. Liquidity Pools hold token reserves that traders draw from and add to for fees. Together these pieces form a self‑contained trading ecosystem. WoofSwap DEX encompasses AMM functionality, requires liquidity pools, and facilitates token swapping—all without a custodian. The platform also supports yield farms, cross‑chain bridges, and community‑governed tokenomics. If you’ve ever wondered how a DEX can run without order books, the answer lies in the AMM‑liquidity pool relationship: the pool’s depth determines price slippage, and the AMM formula ensures trades execute at fair market rates.

Key Features, Risks, and Real‑World Use Cases

A DEX like WoofSwap relies on users to supply liquidity, so the health of its liquidity pools directly impacts trade quality. High‑volume pairs usually have deep pools, which keeps slippage low; niche tokens may suffer wider spreads but offer higher farming rewards. The AMM model also influences token emission schedules—many projects launch airdrops or yield incentives tied to pool participation, a pattern you’ll see in several of the articles below (e.g., Bull Finance airdrop, AST Unifarm airdrop). Regulation is another piece of the puzzle: while WoofSwap itself operates on a permission‑less blockchain, users must stay aware of jurisdictional rules such as India’s 30% crypto tax or China’s 2025 ban, because those affect how profits from swaps are reported. Security is a shared responsibility. Smart‑contract audits, timelock mechanisms, and community governance help mitigate exploits, but no system is immune. Understanding tokenomics, fee structures, and potential rug‑pull signals can save you from costly mistakes. For traders, choosing between isolated and cross margin (as explained in the “Isolated Margin vs Cross Margin” guide) determines risk exposure when leveraging DEX positions. Finally, WoofSwap’s ecosystem interacts with other DEXes—Azurswap, Pangea Swap, and even centralized platforms like Coinext—creating arbitrage opportunities that savvy users exploit. By comparing fee models, gas costs, and liquidity depth across these venues, you can optimize trade routes and improve net returns.

The posts collected on this page give you a complete toolkit: regulation overviews for China, India, Taiwan, and Bolivia; step‑by‑step airdrop claims for Bull Finance, AST Unifarm, SupremeX, and more; deep dives into competing exchanges such as OpenSwap, Azurswap, and Pangea Swap; and practical guides on margin types, token tax rules, and blockchain applications in energy. Whether you’re a beginner looking to understand how a DEX works, an experienced trader hunting arbitrage angles, or a developer planning to launch a new pool, the articles below provide concrete examples, data points, and actionable advice to help you navigate the WoofSwap landscape.

A detailed WoofSwap crypto exchange review covering fees, tokenomics, liquidity, controversy, and future outlook for traders and investors.

Finance

Finance