VCT – Your Hub for Crypto Tax, Airdrops, Exchanges & Regulation

When you dive into VCT, a curated tag that bundles everything from tax rules to airdrop news and exchange analysis. Also known as Virtual Currency Topics, it acts like a shortcut for anyone who wants to keep up with the fast‑moving crypto world.

VCT isn’t just a label; it encompasses cryptocurrency tax, the set of rules that determine how governments treat digital assets for income and capital gains. From India’s 30% flat rate to China’s outright ban, the tax landscape shifts quickly, and understanding these changes can protect your portfolio from costly surprises. The tag also requires staying aware of filing deadlines, TDS mechanisms, and record‑keeping best practices – all of which we break down in clear, step‑by‑step guides.

Another pillar of VCT is the airdrop, a distribution method where projects give free tokens to eligible wallets to spark community growth. Airdrops can swing market sentiment, boost token liquidity, and sometimes expose scams. By following VCT you’ll learn how to spot legitimate drops, claim them safely, and evaluate the tokenomics that determine their long‑term value. In short, airdrops influence crypto market volatility and offer a low‑risk way to diversify your holdings.

Exchange reviews also sit at the heart of VCT. We cover platforms like OpenSwap, SuperEx, and Coinext, each marked as a crypto exchange, a service that lets you trade, deposit, or withdraw digital assets. Security features, fee structures, and compliance checks vary widely, so VCT helps you compare the pros and cons before you lock in funds. Knowing which exchanges meet local AML requirements or offer insurance can be the difference between a smooth trade and a painful loss.

Underlying all of these topics is the ever‑changing regulation, the legal framework that governs crypto activity in each jurisdiction. From Taiwan’s selective banking rules to Bolivia’s sudden policy flip, regulation shapes everything from token listings to mining subsidies. VCT connects you with the latest policy shifts, explains how they affect traders, and offers practical steps to stay compliant – whether you’re an individual investor or a crypto‑focused startup.

Put together, these entities create a network of knowledge: VCT encompasses tax guidance, airdrop alerts, exchange reviews, and regulation updates; tax rules influence how you claim airdrops; airdrops affect exchange liquidity; exchanges must adapt to regulation; and regulation drives the evolution of tax policies. This web of relationships means you get a 360° view of the crypto ecosystem without jumping between scattered sources.

Below you’ll find a hand‑picked collection of articles that dive deeper into each of these areas. Whether you’re looking for a step‑by‑step tax calculator, the latest airdrop checklist, an exchange safety audit, or a summary of new regulatory headlines, the VCT tag has you covered. Explore the posts to turn complex crypto topics into clear, actionable insight.

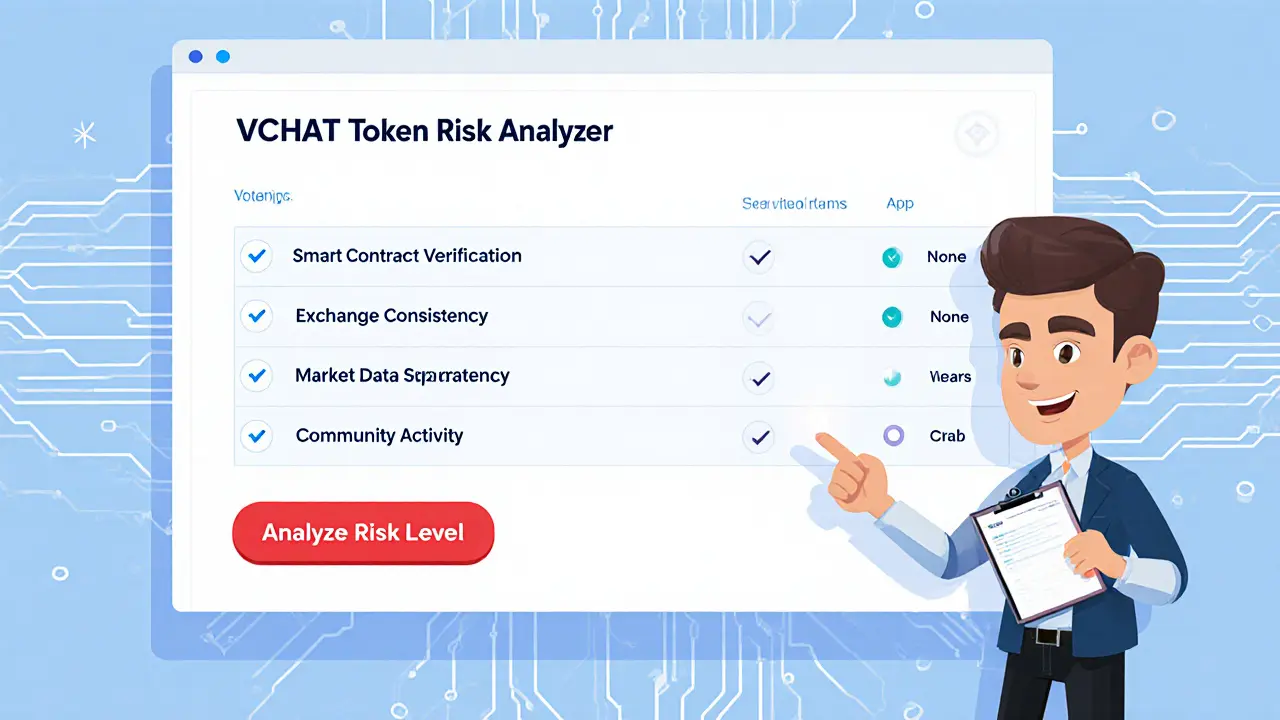

An in‑depth look at VCHAT Token (VCT), covering its vague tech claims, conflicting market data, exchange absence, and why it poses high risk for investors.

Finance

Finance