Uniswap v2 – Everything You Need to Know

When working with Uniswap v2, a decentralized exchange (DEX) built on Ethereum that uses an automated market maker (AMM) to enable direct token swaps. Also known as Uniswap V2, it offers fixed‑fee swaps for any ERC‑20 pair without relying on order books. Ethereum, the blockchain that hosts Uniswap v2 provides the smart‑contract layer that secures each trade. Automated Market Maker, the algorithm that balances token prices based on pool ratios is the core engine: it calculates the price of token A against token B by dividing the reserve of A by the reserve of B, then applying a 0.3% fee. This design means Uniswap v2 enables token swaps without order books, liquidity pools require users to deposit matching amounts of two ERC‑20 tokens, and prices are set by an AMM formula that reacts instantly to supply changes. Because every swap draws from the same pool, traders experience slippage that mirrors pool depth: larger orders shift the price more than smaller ones. The system also emits events on the blockchain, letting analytics tools track volume, fee revenue, and pool growth in real time. Users benefit from transparent pricing, instant settlement, and the ability to trade tokens that might not be listed on centralized platforms. That openness has led to thousands of pools, ranging from stablecoin pairs to niche meme tokens, each governed by the same simple rule set.

How Liquidity Providers and Swappers Interact

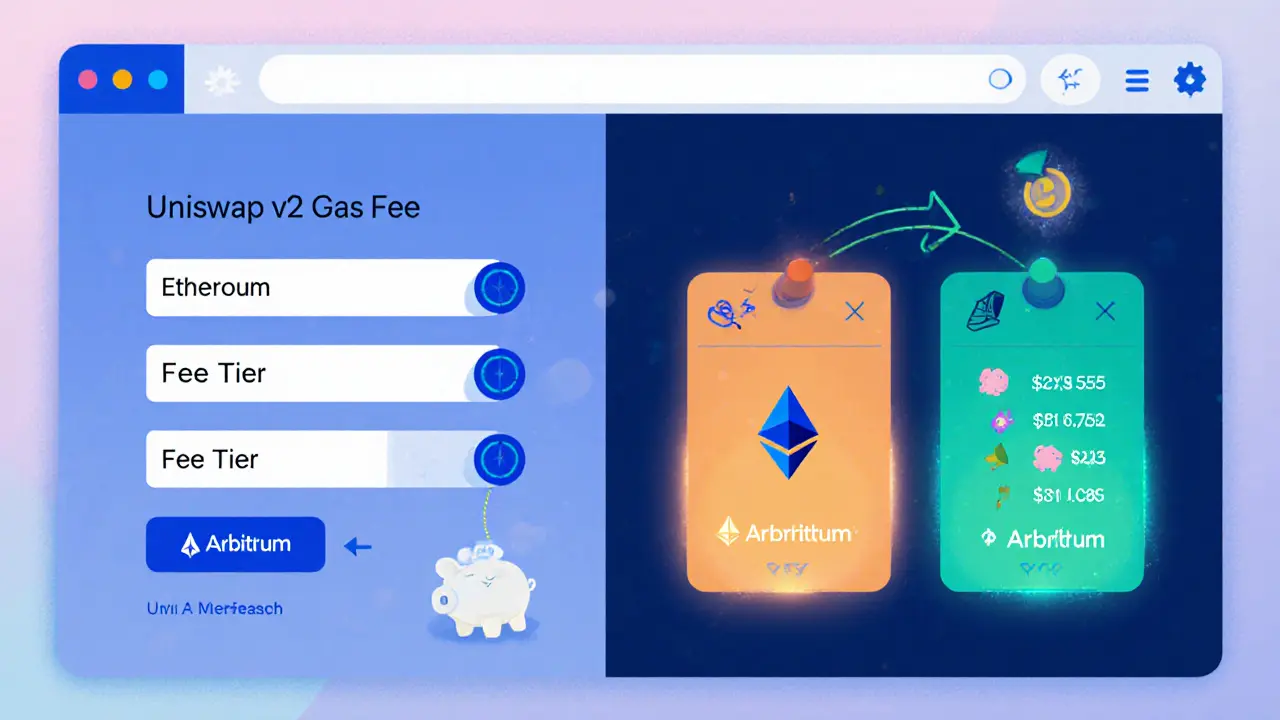

The next key player is the Liquidity Provider, any user who deposits an equal value of two tokens into a pool and earns a share of the swap fees. By adding capital, LPs create the depth that reduces slippage for traders, and in return they receive pool tokens representing their stake. Those pool tokens can be redeemed later, minus any impermanent loss that occurs when token prices diverge. Impermanent loss is a risk unique to AMM models: if one token’s price rises sharply, LPs may end up with less value than if they had simply held the assets. However, the 0.3% fee collected on every swap often compensates active LPs, especially in high‑volume pools. Swappers, on the other hand, look for the best price impact and lowest gas cost. Because each transaction runs on Ethereum, gas fees can spike during network congestion, so timing a trade can save significant dollars. Tools that estimate slippage and gas before confirming a swap help users avoid unexpected costs. Many traders also use price‑oracle integrations or layer‑2 solutions to lower fees while keeping the same AMM logic. The relationship between LPs and swappers is symbiotic: more liquidity attracts larger traders, and larger trades boost fee earnings for LPs.

Beyond the basic fee structure, Uniswap v2 supports advanced features like flash swaps, where users can borrow assets from a pool as long as they return them in the same transaction. This opens doors for arbitrage, debt refinancing, and collateral swaps without upfront capital. Developers can also build custom front‑ends that add UI‑level safeguards, such as setting maximum slippage thresholds or batching multiple swaps to reduce gas. When evaluating a pool, consider its total value locked (TVL), historical fee return, and token volatility. High TVL often means lower slippage but also lower fee yield, while volatile pairs can offer higher returns at the cost of impermanent loss. For newcomers, starting with stablecoin‑stablecoin pools provides a low‑risk way to understand fee accrual and gas dynamics. As the ecosystem evolves, bridges to other chains bring Uniswap‑style AMMs to layer‑2 networks, expanding liquidity without overloading Ethereum. The next wave of updates may tweak fee tiers or introduce concentrated liquidity, but the core principle remains: a simple, permissionless market where anyone can trade or provide capital.

Below you’ll find a curated set of articles that walk through Uniswap v2 strategies, fee calculations, LP risk management, and real‑world use cases. Whether you’re a trader hunting low‑slippage swaps or an LP seeking optimal pool placement, the collection offers practical steps you can apply right away.

Uniswap v2 is a leading decentralized exchange for swapping Ethereum tokens, while Plasma is a separate blockchain built only for free USDT transfers. Learn how they work, why they’re not the same, and which one to use.

A 2025 review of Uniswap v2 on Arbitrum covering fees, liquidity, security, user experience, and how it stacks up against v3.

Finance

Finance