Most crypto traders know the pain: you place a trade, wait for confirmation, and by the time it executes, the price has already moved. On Ethereum-based DEXs, that delay can cost you hundreds - or thousands - of dollars. Drift Protocol was built to fix that. It’s not another clone of Uniswap or dYdX. It’s a high-speed, Solana-native derivatives exchange designed for traders who need speed, efficiency, and control - not just another token swap.

What Makes Drift Protocol Different?

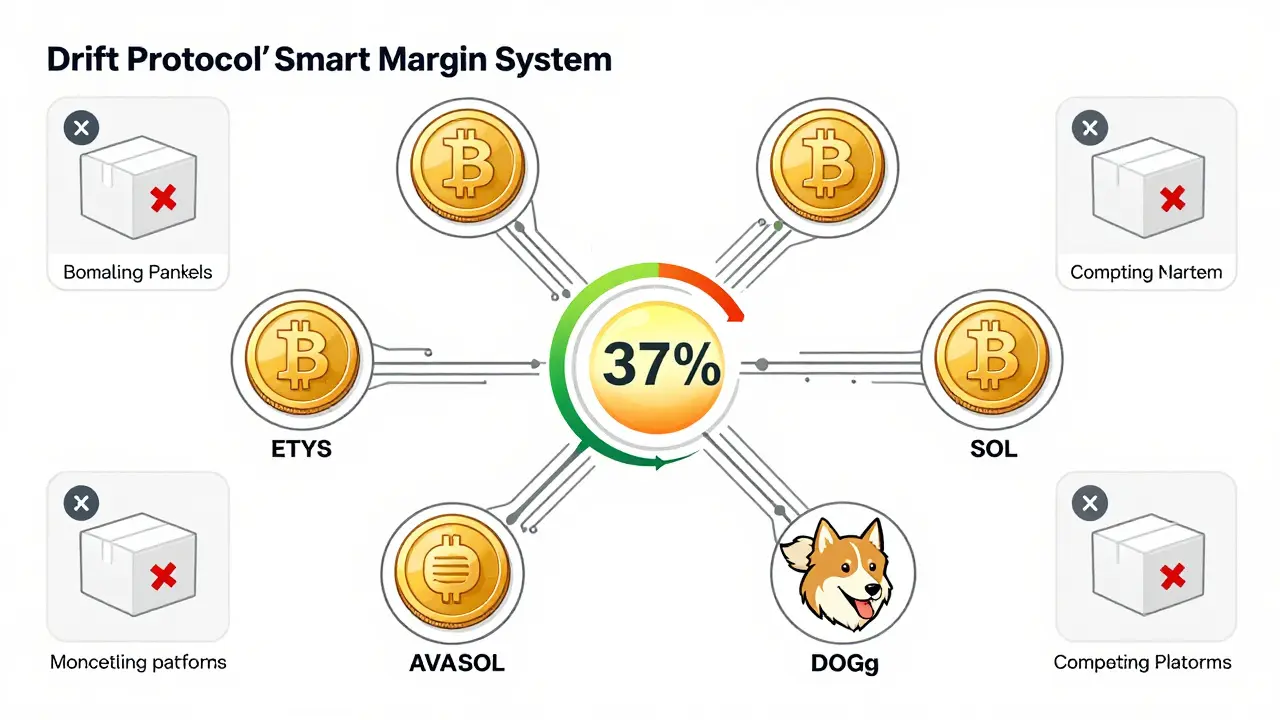

Drift Protocol isn’t a spot exchange. It’s a decentralized perpetual futures platform. That means you can go long or short on assets like SOL, BTC, and ETH with up to 50x leverage - without needing a centralized broker. The real breakthrough? Its Smart Margin system. Unlike other DEXs that lock your collateral per trade (isolated margin), Drift lets you use one unified account for all your positions. If you’re long BTC and short ETH, your margin is shared across both. That means 37% more capital efficiency, according to their internal tests. You’re not tying up cash in separate pots. You’re using it where it matters.

This isn’t just a nice feature - it’s a game-changer for active traders. Imagine running a strategy across five correlated markets. On dYdX or Hyperliquid, you’d need to manage five separate margin accounts. On Drift, you manage one. That cuts complexity, reduces idle capital, and lets you react faster when the market moves.

Speed That Actually Matters

Drift runs on Solana. That’s not marketing fluff - it’s the core reason it works. Solana’s architecture allows for sub-600 millisecond trade execution. That’s faster than most centralized exchanges. In backtests during volatile periods, 92% of stop-loss orders filled within one second. Compare that to Ethereum-based DEXs, where 63% of orders took longer than two seconds. That difference isn’t theoretical. It’s profit or loss.

The Just-In-Time (JIT) liquidity system is what makes this possible. Instead of relying on static order books, Drift matches orders in real time using a dynamic pool of liquidity providers. Even large orders - say, 10 BTC - execute with minimal slippage. That’s why quant firms and professional traders are moving here. They don’t care about UI polish. They care about execution quality. Drift delivers.

Liquidity: Strengths and Limits

But here’s the catch: Drift doesn’t have the depth of Binance or Bybit. At its peak, the average order book depth for BTC is around 1.2 BTC at 0.1% slippage. On Binance Futures, it’s 8.7 BTC. That means if you’re trying to enter a 50 ETH position during a CPI release, you might only get 32 filled before the price shifts. This isn’t a bug - it’s a trade-off. Drift prioritizes speed and capital efficiency over massive order book depth.

That makes Drift perfect for retail traders and small institutions. Not for hedge funds moving $10M+ in a single trade. If you’re trading under $500K per position, you’ll rarely hit liquidity walls. But if you’re scaling up, you’ll need to split orders or wait for calmer markets.

Security and Risk Management

Drift takes security seriously. The protocol has undergone 14 audits - by Trail of Bits, Neodyme, and OtterSec - with zero critical vulnerabilities found in the latest review. The code is open-source, and the bug bounty program has paid out $1.7 million since launch. That’s rare for a DEX.

Its Safety Module (DSM) is its insurance layer. Users stake DRIFT tokens to backstop the protocol. As of September 2025, the DSM held $23.7 million and covered $867,000 in bad debt across 12 liquidation events. That’s a solid track record. But it’s not perfect. During the March 2025 BTC flash crash, Drift’s liquidation engine handled 78% of positions safely. Hyperliquid hit 91%. That gap shows there’s still room for improvement in extreme scenarios.

Price feeds come from Pyth Network, updated every 15 seconds. That’s fast enough for most cases, but Trail of Bits flagged a medium-risk issue: oracle manipulation during low-liquidity hours. It’s not a showstopper - but it’s something to watch if you’re trading during Asian session lows or weekend dips.

The DRIFT Token: More Than Just a Fee Token

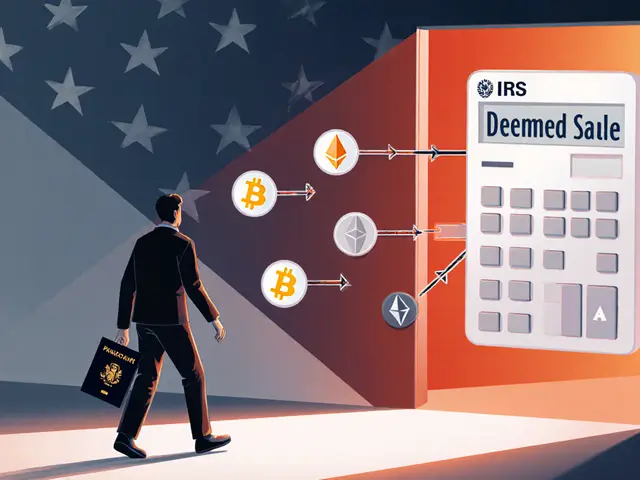

Drift’s token, DRIFT, used to be a simple fee distributor. Now, it’s the backbone of the protocol’s governance and risk system. Since October 2025, the token governs three key functions: setting risk parameters (like max leverage per asset), determining insurance coverage limits, and incentivizing liquidity providers. This shift from passive fee-sharing to active protocol control is a big step toward true decentralization.

Price predictions are split. TradingBeast forecasts $1.02 by December 2025. WalletInvestor says it’ll drop to $0.38. The truth? It’s tied to Solana’s health. If Solana stays stable, DRIFT has upside. If Solana has another major outage, the token will feel the pressure. As of December 2025, DRIFT trades around $0.75, consolidating after 220 days of sideways movement. Technical analysts see key targets at $0.95, $1.26, and $1.72 - but those depend on adoption, not speculation.

Who Is This For? (And Who Should Stay Away)

Drift Protocol is ideal for:

- Traders with 2+ years of crypto experience

- Those using 10x-25x leverage regularly

- People who hate paying gas fees (Drift is gasless for orders and cancellations)

- Users already in the Solana ecosystem with Phantom or Backpack wallets

It’s not for:

- Complete beginners - the interface assumes you know what a liquidation price is

- Those trading $1M+ positions - liquidity won’t support it

- People who want 24/7 customer service - support is Discord-based, not phone or email

- Users in restricted jurisdictions - Drift geo-blocks 32 countries after the SEC’s July 2025 crackdown

Getting Started: What You Need

You can’t use MetaMask here. Drift runs on Solana. You need a Solana wallet: Phantom, Backpack, or Slope. Connect it, deposit USDC or SOL, and you’re ready to trade. The onboarding is smooth - but mastering advanced features takes time. Reddit’s r/Drift101 has 1,200+ daily posts. The GitHub docs include 37 tutorial videos and 12 interactive walkthroughs. Expect to spend 8-12 hours learning how to optimize cross-margin, provide JIT liquidity, and use the prediction markets.

Common issues? Wallet connection drops (23% of users report this) and price feed delays during Solana congestion (18%). Both are usually fixed by switching networks or waiting 30 seconds. The Discord support channel has a 92% satisfaction rate - fast, no bots, real humans.

What’s New? Social Trading and Beyond

In September 2025, Drift launched Social Trading. You can now copy the trades of the top 100 traders on the platform. Over 12,000 users have followed accounts, allocating $47 million in copied positions. It’s not as polished as eToro’s version, but it’s the first of its kind on a DEX.

The Earn system lets you stake 20+ assets - from SOL to mSOL to ETH - and earn yield. It’s popular, but with caveats. 78% of users rate it good for passive income, but warn about impermanent loss during sideways markets. If you’re not actively trading, this is a decent side hustle. Just don’t expect Bitcoin-level returns.

The Bigger Picture

Drift holds 19% of the Solana derivatives market - up from 5% in 2023. It’s the second-largest DEX for perps on Solana, behind only Raydium. The entire decentralized derivatives sector is growing at 34% a year. Drift isn’t just riding that wave - it’s helping build it.

But its future depends on two things: Solana’s reliability and its ability to keep attracting professional traders. If Solana has another 12-hour outage like in Q2 2025, Drift’s $4.2 million in unrealized PnL discrepancies will scare off users. If it keeps improving its risk engine and adds more markets (it’s already at 43), it could become the go-to for retail derivatives trading.

Right now, Drift isn’t the biggest DEX. But it’s the fastest, most capital-efficient, and most developer-friendly. If you’re serious about trading perpetuals on-chain - and you’re tired of waiting for your orders to fill - this is the platform to try.

Is Drift Protocol safe to use?

Yes, for experienced traders. Drift has undergone 14 security audits, including multiple checks by Trail of Bits and Neodyme. No critical vulnerabilities have been found since 2024. Its Safety Module holds $23.7 million in DRIFT tokens to cover losses, and it has already paid out $867,000 in bad debt without user losses. However, it’s not immune to Solana network outages - three pauses in Q2 2025 caused temporary pricing issues. Use it if you understand the risks of decentralized trading.

Can I trade BTC and ETH on Drift Protocol?

Yes. Drift supports 43 markets as of Q3 2025, including BTC, ETH, SOL, AVAX, and even meme coins like DOGE and SHIB. You can trade perpetual futures with up to 50x leverage on major assets. All trades are settled in USDC, and price feeds come from Pyth Network, updated every 15 seconds.

Do I need to know how to use a Solana wallet?

Absolutely. Drift only works with Solana wallets like Phantom, Backpack, or Slope. You can’t connect MetaMask or Coinbase Wallet. If you’re new to Solana, start by buying a small amount of SOL and USDC on a centralized exchange like Kraken, then transfer it to your Solana wallet. Drift’s documentation includes step-by-step setup guides, and the r/Drift101 subreddit has daily help threads.

Is Drift Protocol better than dYdX or Hyperliquid?

It depends. dYdX has deeper liquidity and more institutional users, but it’s slower and runs on Ethereum, meaning higher fees and delays. Hyperliquid is faster than dYdX but still uses isolated margin - you can’t share collateral across trades. Drift’s Smart Margin gives you 37% more capital efficiency. If speed and capital usage matter more than order book depth, Drift wins. If you’re trading $1M+ positions, stick with centralized exchanges.

What’s the minimum amount to start trading on Drift?

You can start with as little as $50 in USDC. But to make meaningful trades with leverage, $500-$1,000 is more practical. Drift doesn’t charge deposit fees, and gas is free for placing and canceling orders. The real cost is slippage and liquidation risk - so don’t over-leverage. Most active users trade with 10x-25x leverage and maintain at least 10% buffer in their margin.

Does Drift Protocol have a mobile app?

No. Drift is a web-based platform only. You access it through your browser on desktop or mobile. The interface is responsive and works well on phones, but there’s no native iOS or Android app. This keeps the platform lightweight and avoids app store restrictions. Most users use their Solana wallet’s mobile app (like Phantom) to connect to the Drift website.

Are there any hidden fees on Drift?

No hidden fees. Drift charges a 0.05% maker fee and 0.1% taker fee - lower than most centralized exchanges. There are no deposit or withdrawal fees. Gas fees for placing or canceling orders are covered by the protocol. The only cost is slippage during low liquidity, and liquidation risk if your position moves against you. Always check the fee schedule on the platform - it’s transparent and updated in real time.

Can I earn passive income on Drift?

Yes, through the Earn system. You can stake 20+ assets - including SOL, mSOL, ETH, and USDC - to earn yield. Rewards come from protocol fees and liquidity incentives. Users report 5-12% APY depending on the asset. But be warned: some assets, especially liquid staking tokens, carry impermanent loss risk during sideways markets. Don’t stake more than you’re comfortable losing. It’s not a guaranteed return - it’s a risk-adjusted yield.

Finance

Finance

Sammy Tam

December 16, 2025 AT 16:26Drift’s Smart Margin is straight-up genius. I was stuck on dYdX for months, juggling five separate margin accounts like a circus performer. Now I just throw everything into one pool and let it breathe. 37% more capital efficiency? Yeah, I’ve seen it. My trades don’t sit idle anymore.

Also, Solana’s speed isn’t hype - I’ve had orders fill before my coffee cooled. That’s not a feature, that’s a lifestyle upgrade.

Abby Daguindal

December 18, 2025 AT 09:52It’s cool that you think this is revolutionary, but let’s be real - it’s just another Solana gamble with a fancy UI. You’re trading liquidity for speed, and that’s a gamble most retail traders shouldn’t even be allowed to take.

Patricia Amarante

December 18, 2025 AT 11:07I tried it last week and honestly? It felt like switching from a flip phone to a smartphone. No more waiting. No more gas fees. Just trade and go.

SeTSUnA Kevin

December 18, 2025 AT 11:45While Drift’s architecture is undeniably elegant, one must acknowledge the inherent fragility of relying on a single L1. Solana’s 12-hour outage in Q2 2025 was not an anomaly - it was a systemic vulnerability dressed in marketing jargon.

Rebecca Kotnik

December 19, 2025 AT 11:16It's important to recognize that Drift Protocol represents a significant evolutionary step in decentralized finance, particularly in the realm of derivatives trading. The shift from isolated margin to unified capital efficiency fundamentally restructures how traders allocate risk and liquidity. This isn't merely an incremental improvement - it's a paradigmatic realignment of capital deployment within on-chain markets.

Furthermore, the integration of the DRIFT token into governance and risk parameters introduces a novel mechanism for community-driven protocol stewardship. While the current liquidity constraints may deter institutional actors, they simultaneously create a more equitable environment for retail participants who prioritize capital efficiency over raw order book depth.

The Safety Module’s $23.7 million buffer, backed by staked DRIFT, represents a pragmatic and transparent risk-mitigation strategy that surpasses many centralized alternatives. While oracle manipulation during low-liquidity windows remains a medium-risk exposure, the transparency of the audit trail and the active bug bounty program indicate a commitment to long-term resilience.

Moreover, the introduction of social trading on a DEX is a landmark development. It democratizes access to sophisticated strategies previously reserved for quant funds. While the interface may lack polish compared to eToro, its decentralized nature ensures no single entity controls the copy-trading ecosystem.

Ultimately, Drift doesn't aim to be everything to everyone. It's a precision instrument for a specific class of trader - those who value speed, efficiency, and autonomy over convenience and liquidity depth. For that niche, it's arguably the most compelling option on-chain today.

Kayla Murphy

December 19, 2025 AT 13:13If you’ve been waiting for a DEX that actually feels fast, this is it. Stop doubting. Start trading. Your wallet will thank you. 💪

Dionne Wilkinson

December 19, 2025 AT 21:32I wonder if speed is really the goal, or just a distraction. What are we trading for? Profit? Freedom? Or just the thrill of clicking faster?

Florence Maail

December 20, 2025 AT 05:53Of course it's 'secure' - they paid auditors to say so. 😏

And the 'Safety Module'? That's just a fancy way of saying 'we're betting your money against our token holders.'

Also, Solana's been down 3 times this year. You think that's coincidence? I call it a pattern. 🤫

Chevy Guy

December 21, 2025 AT 07:16Drift runs on Solana so it's fast right? Lol

Wait till the next network crash and see how fast your 50x leveraged BTC position disappears

Also why do you think they call it 'Smart Margin'? Sounds like something a broker would say before stealing your crypto

Kelsey Stephens

December 21, 2025 AT 14:06I started with $200 and didn’t know what I was doing. Took me two weeks to get comfortable, but now I’m actually making consistent trades. Drift doesn’t hold your hand, but the community on r/Drift101 does. Don’t give up if it feels overwhelming at first.

Tom Joyner

December 22, 2025 AT 14:30Anyone who thinks this is better than Hyperliquid hasn’t traded real volume. This is a toy for weekend warriors with $500 accounts. Don’t mistake speed for sophistication.

Amy Copeland

December 24, 2025 AT 08:57Oh wow, you actually believe this isn’t just a pump-and-dump scheme wrapped in whitepapers? The DRIFT token is clearly designed to inflate before the next Solana crash. And don’t get me started on ‘social trading’ - it’s just herd behavior with a blockchain sticker on it.

Timothy Slazyk

December 25, 2025 AT 05:40Let me break this down for the people still stuck on Ethereum. Drift isn’t just faster - it’s architecturally superior. The JIT liquidity model isn’t a gimmick; it’s how you build a true order-matching engine on-chain. No static order books means no front-running bots sitting in front of your limit orders.

And the Smart Margin? That’s the future. Every other DEX is still running on 2021 tech. Drift’s unified account system is like upgrading from a spreadsheet to a real trading terminal.

Yes, liquidity is thinner than Binance - but that’s because Drift doesn’t need to serve the 90% of traders who just HODL and hope. It’s built for people who actually understand risk management. If you’re trading $100K+ per position, you’re not the audience. You’re the noise.

The DRIFT token’s governance shift is huge too. It’s no longer a passive fee distributor - it’s the protocol’s nervous system. That’s decentralization with teeth.

And yes, Solana outages hurt. But the fact that they’re still growing from 5% to 19% market share on Solana derivatives despite those outages? That’s adoption speaking louder than any audit report.

Madhavi Shyam

December 26, 2025 AT 15:21Smart Margin = collateral optimization via cross-margin algorithmic pooling. JIT liquidity = dynamic order matching without order book depth. DRIFT token = governance + risk layer. All standard DeFi primitives, just optimized for Solana. Not groundbreaking, just well-executed.

Mark Cook

December 28, 2025 AT 04:30They say it’s faster than CEXs… but did anyone check if the price feeds are manipulated during low-volume hours? 🤔

Also, why does everyone ignore the fact that Drift’s biggest users are bots? Not humans. Bots.

Jack Daniels

December 28, 2025 AT 14:52I lost everything on Drift during the BTC flash crash. The liquidations were too fast. The support didn’t reply. Now I just trade on Binance. At least they have a phone line.

Bradley Cassidy

December 28, 2025 AT 15:08drift is fire 🚀 honestly i was skeptical but the smart margin thing is a game changer - i was holding so much cash idle before now i’m using every dollar and my trades feel way more fluid. solana speed is no joke, i’ve seen fills in like 300ms. also no gas fees = pure joy. only thing? the ui sometimes glitches if you have 12 tabs open. but still, 10/10 would recommend to anyone who’s tired of waiting for their trades

Samantha West

December 30, 2025 AT 13:18It is imperative to interrogate the foundational assumptions underpinning the Drift Protocol’s claim to superiority. While the assertion of capital efficiency through unified margin is mathematically sound, one must question whether this efficiency is being purchased at the expense of systemic resilience.

By concentrating risk within a single margin pool, Drift effectively creates a single point of failure - a vulnerability that, when exploited during periods of extreme volatility, could trigger cascading liquidations across the entire platform.

Furthermore, the reliance on Pyth Network for price feeds introduces an external dependency that, despite its 15-second update frequency, remains susceptible to oracle manipulation - particularly during low-liquidity windows, which, as noted, occur with alarming regularity.

While the social trading feature may appear democratizing, it is, in essence, a form of algorithmic herd behavior, wherein novice traders delegate decision-making to a select group of ‘top traders’ - many of whom are likely operating with significant leverage and hidden short positions.

Drift Protocol is not a revolution - it is a refinement. And like all refinements, it must be approached with the utmost caution, not enthusiasm.