TRUF token – everything you need to know

When working with TRUF token, a utility token built on a public blockchain that aims to reward community participation and enable fee‑free transactions. Also known as TRUF, it blends reward mechanics with smart‑contract automation, so users can earn by holding, staking, or completing simple tasks. The token lives on a decentralized ledger, which means every transfer is transparent and cannot be altered after confirmation.

Key aspects of TRUF token

One of the core features is its tokenomics, the economic model that defines supply limits, distribution phases, and incentive structures. The tokenomics design caps total supply at 100 million units, allocates 40% to community rewards, 30% to a strategic reserve, and the remaining 30% to development and partnerships. Because the supply is finite, price movements often react to demand spikes from airdrops or exchange listings.

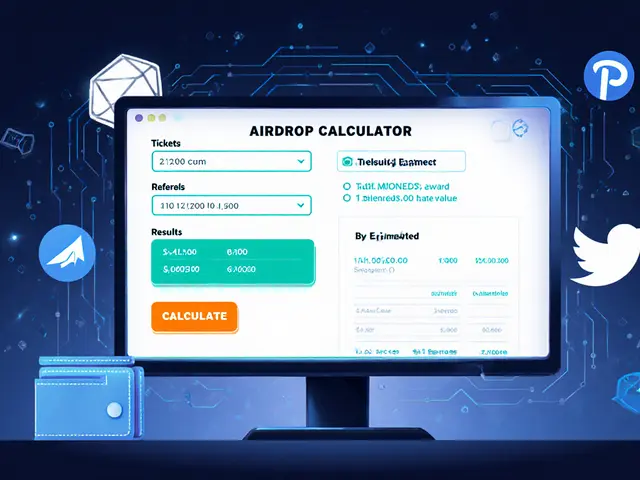

Speaking of airdrops, the crypto airdrop, a promotional distribution where free TRUF tokens are sent to eligible wallets has become a popular driver for rapid user growth. A successful airdrop usually requires participants to hold a minimum amount of another token, join the official Discord, or complete a short KYC process. When the airdrop lands, traders flood the market, pushing volume and creating short‑term price volatility – a classic case of "TRUF token influences airdrop impact".

After the airdrop, most holders look for places to trade. Major crypto exchanges, platforms that list digital assets and provide order‑book liquidity have started adding TRUF to their spot markets. Listings on reputable exchanges not only improve liquidity but also signal legitimacy, which can attract institutional interest. In practice, the relationship "crypto exchanges list TRUF token" helps bridge the gap between community enthusiasm and real‑world trading activity.

Beyond these three pillars, the TRUF ecosystem also touches regulation, security audits, and community governance. Regulators in several jurisdictions are beginning to classify utility tokens like TRUF under emerging crypto‑law frameworks, which means projects must stay compliant to avoid penalties. Regular smart‑contract audits add another layer of safety, ensuring that reward calculations and token transfers work as intended. All of these pieces—tokenomics, airdrops, exchange listings, compliance, and audits—form an interconnected network that defines the TRUF token's real‑world value. With this overview in mind, you’ll find below a curated set of articles that dive deeper into each area: tokenomics breakdowns, step‑by‑step airdrop guides, exchange review comparisons, and regulatory insights. Use the collection to sharpen your strategy, spot opportunities, and avoid common pitfalls as you navigate the TRUF token landscape.

Learn what TRUF.Network is, how the TRUF crypto coin works, its tokenomics, key products, market data, and how it stacks up against other oracle solutions.

Finance

Finance