All About Stablecoins: How They Work, Risks, and What’s Next

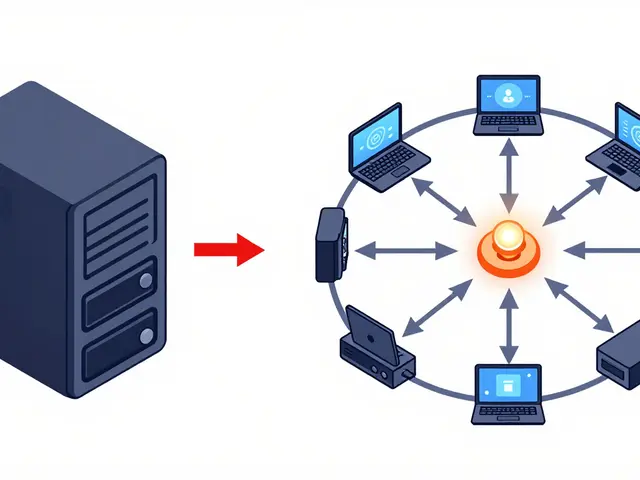

If you’ve ever wondered why stablecoins matter, you’re not alone. When working with stablecoins, digital assets that aim to keep a steady value by pegging to a fiat currency, commodity, or algorithmic rule. Also known as crypto stablecoins, they try to bring the predictability of traditional money into the fast‑moving world of crypto. Algorithmic stablecoins, coins that maintain their peg through smart‑contract‑driven supply changes rather than reserves are a newer branch that relies on code, not banks. Meanwhile, stablecoin regulation, the set of rules governments and watchdogs apply to keep the market transparent and protect users shapes how quickly these assets can be adopted. Together with the rise of DeFi, decentralized finance platforms that let you lend, borrow, and earn without a traditional bank, stablecoins have become the bridge between volatile crypto and everyday transactions.

Stablecoins come in three main flavors. Fiat‑collateralized variants lock up dollars, euros, or other government money in a bank or trusted custodian, so each token is backed 1:1 by a real asset. Crypto‑collateralized models use other digital coins like Ether as security, often over‑collateralizing to cover price swings. Algorithmic designs, as mentioned, adjust supply automatically, aiming for a self‑balancing system. Each type brings its own set of risks: fiat‑backed coins depend on the custodian’s honesty, crypto‑backed ones inherit the volatility of their collateral, and algorithmic versions can fail if the underlying math or market confidence breaks down. These risks matter most on crypto exchanges, platforms where users buy, sell, and trade digital assets that list stablecoins. An exchange might halt withdrawals if a regulator steps in, or it could suffer a hack that puts the peg in jeopardy. Understanding the mechanics helps you decide whether to hold a stablecoin for payments, as a low‑volatility store of value, or as liquidity in a DeFi protocol.

Why Tracking Stablecoins Is Essential Today

The stablecoin market moves faster than most traditional finance sectors. New listings appear weekly, regulators publish fresh guidance, and algorithmic experiments launch on testnets. Because stablecoins act as the backbone for many DeFi services—providing the stable unit for lending pools, yield farms, and cross‑chain bridges—any change in their stability or legal status ripples across the entire crypto ecosystem. This tag page gathers the latest insights on how different stablecoin models function, the newest regulatory developments, and practical tips for using them safely on exchanges and DeFi apps. By the time you finish reading, you’ll have a clear picture of which stablecoins fit your strategy, what to watch for in upcoming policy shifts, and how to protect yourself from the most common pitfalls. Dive into the articles below to get actionable guidance, real‑world examples, and up‑to‑date analysis that keep you ahead of the curve.

Cryptocurrency trading is pulling billions out of Nigeria's economy, devaluing the naira and reshaping remittances. This article explains the scale, drivers, regulatory shifts, and what it means for everyday Nigerians.

Categories

Archives

Recent-posts

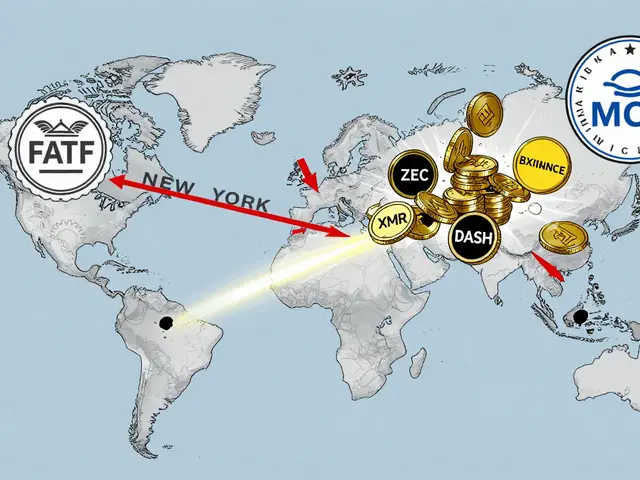

Privacy Coin Delisting Wave from Crypto Exchanges: Why Major Platforms Are Dropping XMR, ZEC, and DASH

Dec, 4 2025

Finance

Finance