Privacy Coin Delisting: Why Exchanges Are Banning Them and What It Means for You

When an exchange removes a privacy coin, a cryptocurrency designed to hide transaction details like sender, receiver, and amount. Also known as anonymous coins, it enables financial privacy by default—something most blockchains avoid for regulatory reasons. This isn’t just a technical change. It’s a legal and economic shift that’s reshaping who can trade what, and why.

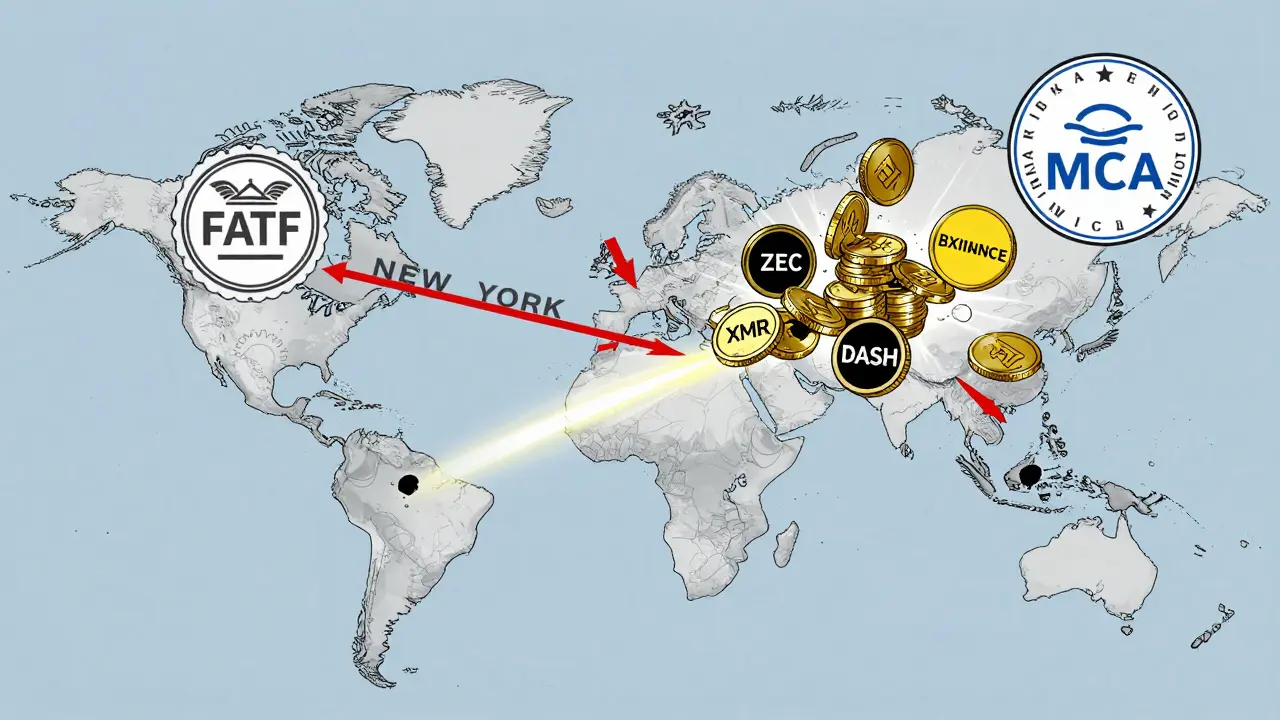

Exchanges like Bitfinex, a major crypto trading platform known for advanced tools and deep liquidity and BiKing, an unregulated exchange flagged for security breaches and delisting privacy coins without warning have quietly pulled support for coins like Monero and Zcash. Why? Because regulators in the U.S., EU, and elsewhere are pressuring exchanges to cut off services that can’t comply with AML (anti-money laundering) rules. Privacy coins make it impossible to trace funds—something banks and financial authorities see as a red flag, even if most users aren’t doing anything illegal.

This isn’t about banning privacy—it’s about control. When an exchange delists a privacy coin, it doesn’t mean the coin disappears. It just means you can’t easily trade it on big platforms anymore. You might still buy it on a decentralized exchange, use a peer-to-peer marketplace, or hold it in your own wallet. But the convenience is gone. And that’s the point. Regulators want you to trade on platforms where every transaction is visible, logged, and reportable.

Some users still rely on privacy coins to protect their finances from surveillance, inflation, or censorship—especially in countries like Iran, where crypto restrictions are tight. But for most traders, the move away from privacy coins means one thing: fewer options. And with exchanges like CEEX, a fake platform mimicking CEX.IO and others disappearing overnight, the space is getting riskier, not safer.

What you’ll find below are real stories from traders who lost access to their privacy coins, exchanges that got shut down for ignoring compliance, and scams that popped up after privacy coins vanished from major platforms. Some posts expose fake airdrops pretending to be tied to Monero or Zcash. Others break down why exchanges like BiKing got flagged for delisting coins without notice. You’ll see how this trend connects to broader issues—like the rise of surveillance-friendly stablecoins, the decline of truly anonymous crypto, and what happens when privacy becomes a liability instead of a feature.

Major crypto exchanges are removing privacy coins like Monero and Zcash due to new global regulations. Here's why it's happening, where you can still trade them, and what it means for your crypto holdings in 2025.

Finance

Finance