inflation crypto: navigating price rises in digital assets

When talking about inflation crypto, the way rising consumer prices influence cryptocurrencies and how crypto projects respond to that pressure. Also known as crypto inflation, it sits at the crossroads of inflation, a sustained increase in the general price level of goods and services and cryptocurrency, digital assets that use cryptography to secure transactions. The concept also leans heavily on stablecoins, coins pegged to a stable asset like the US dollar to reduce volatility. Understanding inflation crypto means grasping how monetary policy, supply dynamics, and regulatory moves shape price behavior across the crypto ecosystem.

One of the core ideas here is that inflation crypto encompasses stablecoins. Stablecoins act as a hedge when fiat money loses purchasing power, but they also create feedback loops that can amplify or dampen crypto‑wide inflation. For example, when a country’s currency weakens, users flock to dollar‑pegged stablecoins, boosting demand and sometimes driving the underlying crypto market up. At the same time, inflation crypto requires understanding of monetary policy. Central banks’ interest‑rate decisions affect fiat inflation, which in turn influences how investors allocate capital between traditional assets and crypto. Those shifts ripple through token supply models, especially for algorithmic stablecoins that adjust supply algorithmically to maintain a peg.

Key factors to watch

First, keep an eye on crypto tax, the fiscal rules that determine how gains from digital assets are reported and taxed. Tax regimes often treat inflation gains differently, and many jurisdictions are drafting rules that specifically address crypto‑related inflation. Second, monitor crypto regulation, the legal framework governing crypto activities, from trading to issuance. New regulations can tighten or loosen the flow of capital, directly affecting inflation pressures within the crypto market. Third, watch algorithmic stablecoins like the ones discussed in our posts – they rely on supply‑adjustment mechanisms that are sensitive to macro‑economic shocks.

Another practical angle is the impact on everyday traders. When inflation spikes, purchasing power drops, prompting investors to seek stores of value. Bitcoin and other limited‑supply assets often see inflows, but the response varies by region. In places with aggressive crypto tax policies, traders may shift toward privacy‑focused coins or move assets offshore. Regulatory news, such as China’s 2025 crypto ban or India’s 30% crypto tax, also creates sudden inflation‑type shocks within the crypto market, reshaping price curves in minutes.

Finally, the technology side matters. Blockchain’s transparency lets analysts track real‑time supply changes, making it easier to spot inflation signals early. Tools that monitor token mint‑burn events, stablecoin reserve ratios, and on‑chain inflation metrics are becoming essential for anyone trying to stay ahead.

All these pieces – macro‑economic trends, tax policy, regulatory shifts, and on‑chain data – intertwine to form the bigger picture of inflation crypto. Below you’ll find a curated set of articles that break down each element, from stablecoin mechanics to country‑specific tax guides, so you can build a clearer strategy for navigating price rises in the digital asset world.

Explore how communities worldwide adopt cryptocurrency despite bans, with a focus on Nigeria's grassroots movement, drivers, risks, and future regulatory trends.

Categories

Archives

Recent-posts

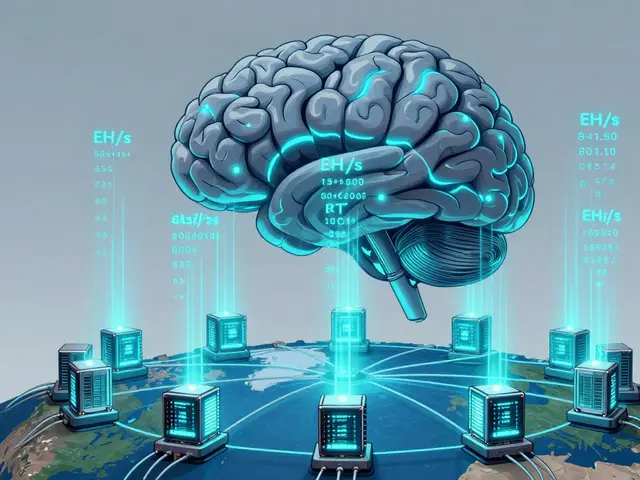

Understanding Bitcoin Network Hash Rate: How Computational Power Secures the Blockchain

Dec, 22 2025

State Control of Crypto Mining in Venezuela: How the Government Manages and Restricts Digital Mining

Jan, 30 2026

Finance

Finance