FIU Compliance – What It Means for Crypto Businesses

When working with FIU compliance, the set of rules that force crypto firms to fight money laundering and report suspicious activity. Also known as Financial Intelligence Unit compliance, it sits at the core of any legit crypto operation. Anti‑money‑laundering (AML), a framework that requires monitoring, reporting and risk assessment of financial transactions is the backbone of FIU compliance, while Know Your Customer (KYC), the process of verifying a user’s identity before allowing access to services supplies the data needed for AML checks. In practice, FIU compliance requires firms to set up transaction monitoring systems, file suspicious activity reports, and keep records for the statutory period. The goal is simple: stop illicit funds from flowing through crypto platforms and give regulators a clear paper trail.

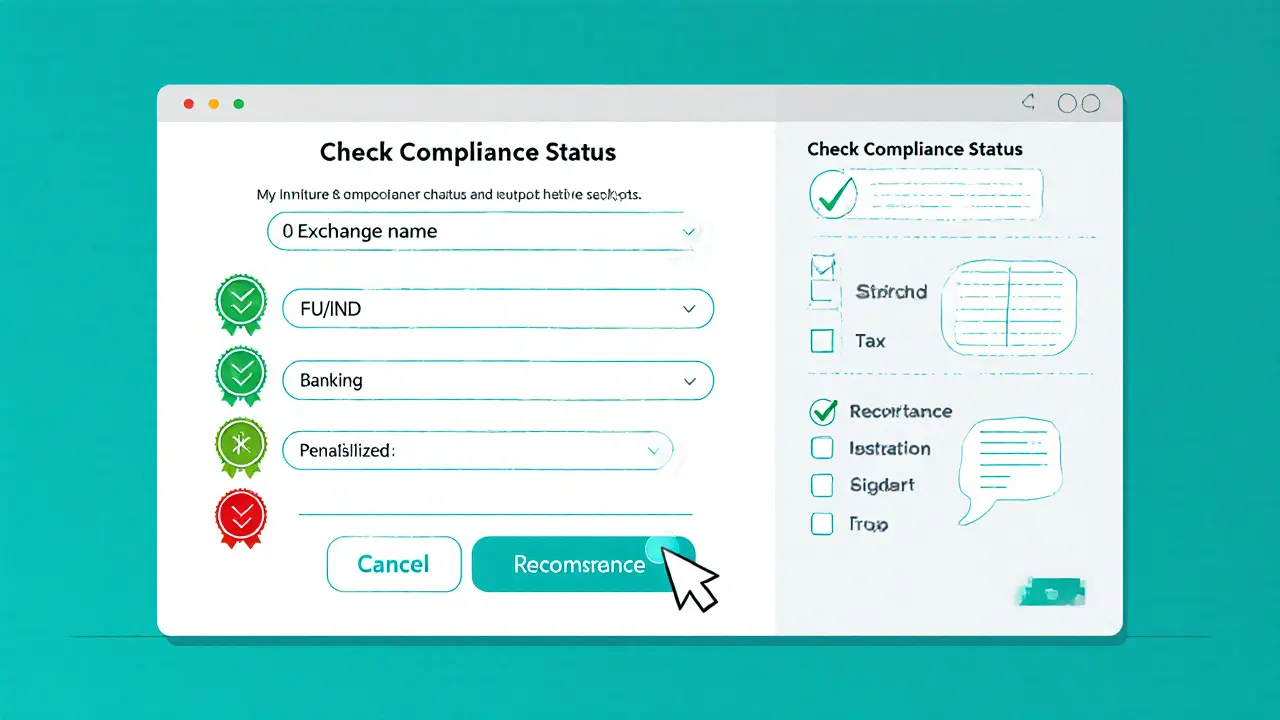

The regulatory landscape pushes FIU compliance beyond AML and KYC. The European Union’s Markets in Crypto‑Assets (MiCA), a comprehensive legal framework that standardizes crypto rules across member states forces exchanges to embed FIU‑related controls directly into their licensing process. Likewise, national tax codes, such as the cryptocurrency tax, rules that define how digital asset gains are reported and taxed, rely on the same data gathered for AML/KYC to calculate liabilities. When a firm meets FIU compliance, it simultaneously satisfies many of the requirements from MiCA and tax authorities, creating a smoother path to obtain exchange licenses and avoid costly penalties.

Key Pillars of FIU Compliance

First, FIU compliance demands a risk‑based AML program that identifies high‑risk customers, monitors transaction patterns, and triggers alerts for anomalies. Second, a solid KYC workflow must capture accurate identity documents, verify source‑of‑funds information, and store records securely. Third, reporting obligations include filing suspicious activity reports (SARs) with the local FIU, maintaining audit logs, and providing regulators with periodic compliance summaries. Fourth, tax alignment means syncing transaction data with tax reporting tools so that gains, losses, and capital‑allocation events can be accurately declared. Finally, ongoing training keeps staff aware of evolving regulations, ensuring that the compliance culture stays current and effective.

All of these pieces interact. For example, a robust KYC process feeds clean customer data into AML monitoring, which then produces reliable SARs that satisfy both FIU and tax reporting duties. MiCA’s licensing checklist mirrors this flow, asking exchanges to prove they have AML/KYC controls, transaction monitoring, and reporting mechanisms in place. By mastering FIU compliance, a crypto business not only avoids fines but also builds trust with users, partners, and regulators—an advantage that shows up across the articles below, from tax guides in India to exchange reviews in Brazil and Taiwan.

Below you’ll find a curated set of articles that explore each facet of FIU compliance in depth. Whether you’re a trader trying to understand India’s 30% crypto tax, an exchange looking to meet Taiwan’s FSC regulations, or a developer curious about how Merkle trees support data integrity for reporting, this collection gives you practical steps, real‑world examples, and actionable checklists. Dive in and see how FIU compliance ties together AML, KYC, tax, and global regulatory frameworks.

Learn which crypto exchanges Indian traders should avoid in 2025, why compliance matters, and how to pick safe platforms with practical checks and a handy checklist.

Finance

Finance