FEAR Token – All You Need to Know

When exploring FEAR token, a community‑driven crypto asset that blends meme culture with utility features. Also known as FearCoin, it aims to reward holders through regular airdrops and staking incentives.

One of the biggest hooks for FEAR token is its airdrop, a distribution method that sends free tokens to active community members. The airdrop model feeds a loop: more holders mean wider reach, which fuels demand, which in turn makes future airdrops more valuable. That loop creates a tangible link between token utility and community growth.

Regulation, Tax, and Real‑World Use

Global crypto regulation, government rules that dictate how digital assets can be issued and traded plays a crucial role in FEAR token’s market access. In jurisdictions with clear guidance, exchanges list FEAR faster, giving traders easier entry points. Where regulation stays vague, projects often face listing delays or higher compliance costs.

Alongside regulation, crypto tax considerations shape how investors handle FEAR token. Countries like India levy a flat 30% rate, while others treat gains as capital income. Knowing the tax framework helps users decide when to claim airdrops, sell, or hold, directly affecting net returns.

Beyond airdrops and compliance, FEAR token’s utility layer includes staking, governance voting, and access to exclusive DeFi pools. These features transform the token from a simple meme asset into a functional tool for earning yields and influencing protocol decisions.

Below you’ll find a curated set of articles that break down every angle: from step‑by‑step airdrop guides to deep dives on regulatory impacts, tax strategies, and utility use cases. Dive in to get the full picture before you make your next move with FEAR token.

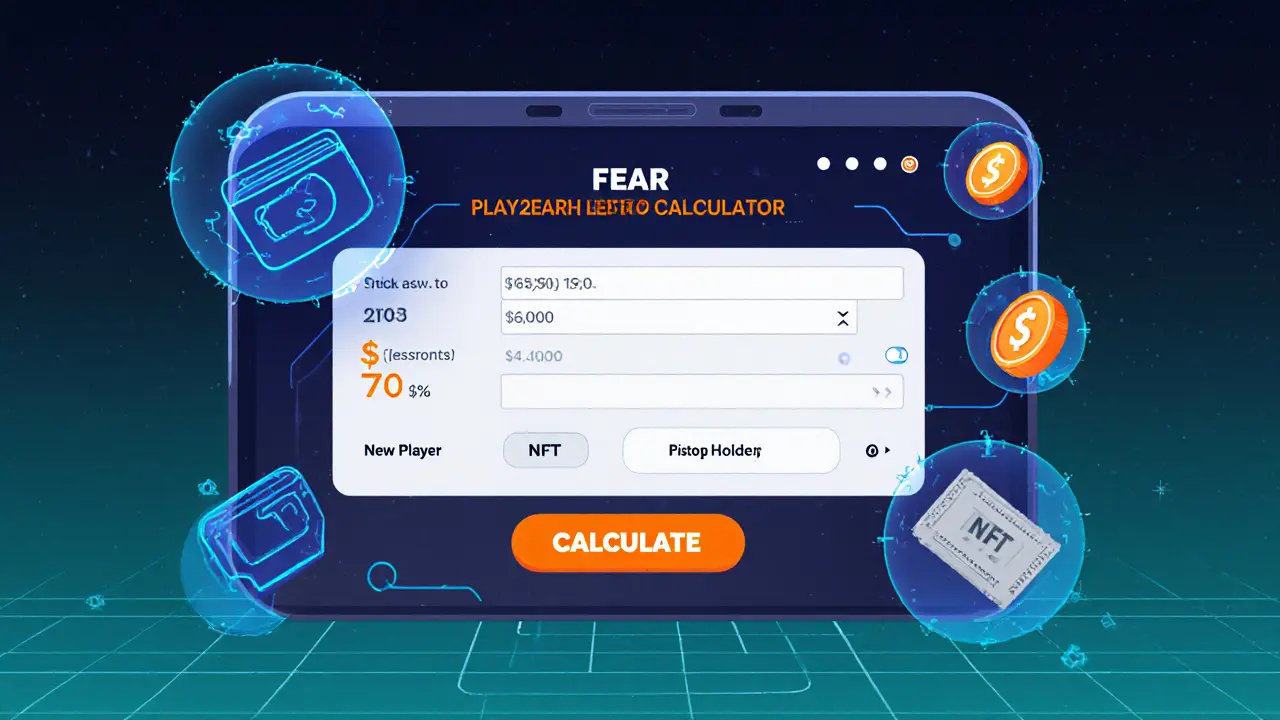

Learn the full details of FEAR's Play2Earn NFT tickets airdrop, from token values and distribution dates to how it boosted community growth and what to watch for in future drops.

Finance

Finance