Exchange Comparison: Fees, Security, Features & Regulations Explained

When working with exchange comparison, the process of evaluating crypto exchanges side‑by‑side to find the best fit for your trading style. Also known as exchange review, it helps you weigh costs, safety measures, and legal standing before committing funds.

A solid crypto exchange, platform where users buy, sell, and trade digital assets isn’t just a marketplace; it’s a toolbox. It provides market data, order types, and wallet services. When you start an exchange fees, the transaction costs, withdrawal charges, and hidden spreads applied by the platform become a major decision factor because they can eat into profits over time.

Security is another pillar. An exchange security, the set of measures like cold storage, two‑factor authentication, and insurance that protect user assets determines whether you can trust the platform with large balances. Look for regular audits, bug bounty programs, and a transparent incident‑response plan. Without strong security, even the lowest fees lose their appeal.

Key Factors to Compare

First, line up the fee structure. Some exchanges charge a flat rate, others use a maker‑taker model that rewards liquidity providers. Compare spot‑trading fees, futures fees, and any tiered discounts for high‑volume traders. Next, assess security protocols. Does the exchange employ multi‑signature wallets? How many assets stay in cold storage? Then, examine regulatory compliance. An exchange regulation, the legal framework governing an exchange’s operations, licensing, and AML/KYC obligations can affect your ability to withdraw funds in certain jurisdictions and protect you from sudden shutdowns.

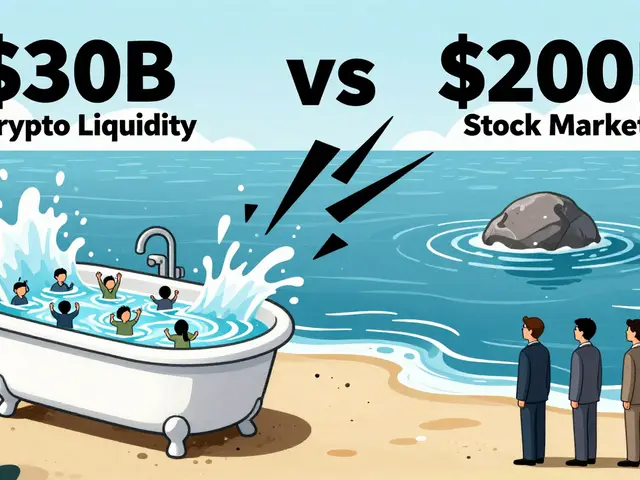

Liquidity is the hidden engine. High‑volume markets ensure you can enter and exit positions without slippage. Check the order book depth for major pairs like BTC/USDT and ETH/USDT. A platform with deep liquidity often pairs with multiple market makers, which also boosts price stability. Finally, consider the user experience. Intuitive UI, fast order execution, and responsive customer support turn a good exchange into a great one.

Putting these pieces together forms a semantic triple: exchange comparison encompasses fee analysis, security assessment, and regulatory review. Another triple: exchange security requires cold storage and multi‑factor authentication. And a third: exchange regulation influences user accessibility and legal risk. These connections guide you toward a data‑driven decision.

Our curated collection below reflects these themes. You’ll find detailed reviews of platforms like SuperEx, Coinext, and WoofSwap, each broken down by fees, security features, and compliance status. There are also deep dives into margin‑trading styles, power‑grant impacts on mining, and regional tax rules that affect exchange choice. Whether you’re a beginner sorting out the basics or an experienced trader fine‑tuning your stack, the articles ahead give you practical insight to power your next exchange comparison.

Ready to see the specifics? Scroll down to explore each review, compare the numbers, and pick the exchange that aligns with your strategy.

A practical review of OpenSwap crypto exchange covering features, security, fees, liquidity and how it compares to top DEXs and CEXs.

Finance

Finance