DEX Explained: What Decentralized Exchanges Are and Why They Matter

When you trade crypto on a DEX, a decentralized exchange that lets users trade directly from their wallets without a central authority. Also known as a decentralized crypto exchange, it removes banks, brokers, and middlemen from the equation—putting control back in your hands. That’s the core idea. No KYC. No deposits. No one holding your keys. You connect your wallet, pick a token, and swap—right on the blockchain.

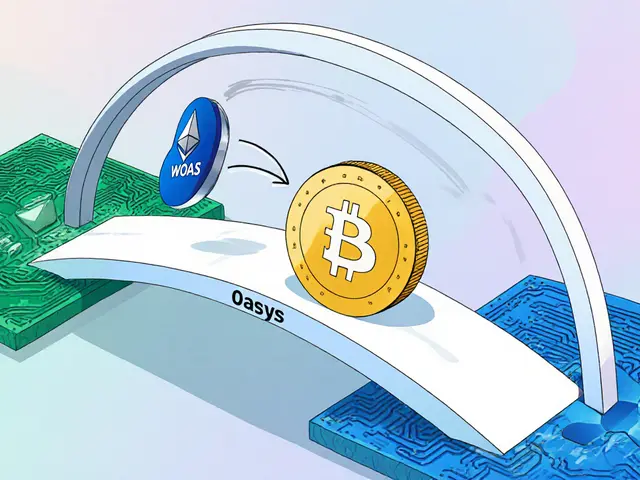

That’s different from places like Binance or BTCC, which act like digital banks. Those are centralized exchanges—they store your crypto, manage your trades, and can freeze your account. A DEX, a decentralized exchange that operates on smart contracts runs on code. If the code works, your trade executes. If it doesn’t, nothing happens. No one can cancel it. No one can delay it. That’s why DEXs like Minswap V2, a fast, low-fee decentralized exchange built on Cardano or Flamingo Finance, a multi-chain DeFi platform offering swaps and vaults without KYC are growing. They’re not trying to be banks. They’re trying to be infrastructure.

But DEXs aren’t perfect. They’re slower than centralized platforms. They’re harder to use if you’re new. And if you mess up a transaction, there’s no customer service to call. That’s why many traders use both: a DEX for control, a centralized exchange for speed. The real value of a DEX isn’t just in trading—it’s in access. It lets anyone with an internet connection join global markets without permission. You don’t need a bank account. You don’t need to prove who you are. You just need a wallet.

That’s why you’ll see so many posts here about DEXs on Cardano, Solana, and BNB Chain. They’re not just trading tools—they’re the backbone of DeFi. From swapping tokens on THENA FUSION, a DeFi SuperApp on BNB Chain with leveraged trading to spotting scams like fake airdrops tied to CoinMarketCap, the thread is the same: if you’re using crypto without a middleman, you’re using a DEX. And if you’re not careful, you’re also risking your funds.

Below, you’ll find real reviews, deep dives, and blunt warnings about the DEXs people are actually using—some good, some dangerous. No fluff. No hype. Just what’s working, what’s broken, and what to avoid before you send your next transaction.

Uniswap v2 is a leading decentralized exchange for swapping Ethereum tokens, while Plasma is a separate blockchain built only for free USDT transfers. Learn how they work, why they’re not the same, and which one to use.

Finance

Finance