Cryptocurrency Regulation in China

When working with cryptocurrency regulation in China, the set of laws and policies that govern digital assets, exchanges, and mining activities within the People’s Republic of China. Also known as China crypto policy, it determines how companies can list tokens, how miners can operate, and how the state‑issued digital yuan fits into the broader financial system.

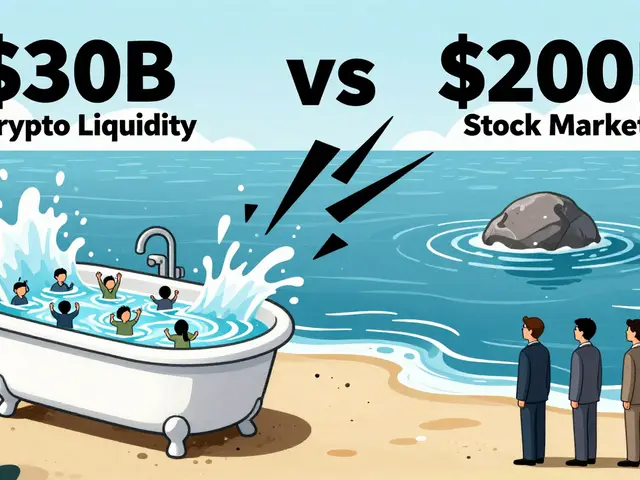

One of the most visible parts of this framework is the exchange licensing, which requires every crypto platform to obtain a special permit from the Ministry of Industry and Information Technology. Without that license, exchanges cannot legally offer spot trading or custody services. The rule directly affects foreign and domestic traders, forcing many platforms to relocate or shut down. At the same time, the government pushes the digital yuan, a central‑bank digital currency that runs parallel to traditional fiat. The digital yuan influences regulation because it gives authorities a sandbox to test transaction monitoring tools that later get applied to private cryptocurrencies. Another pillar of the policy is the strict crypto mining restrictions, which limit energy‑intensive mining farms to specific regions and require them to use state‑approved power sources. These three elements—exchange licensing, the digital yuan, and mining restrictions—form a triple that shapes the market: exchange licensing governs who can trade, the digital yuan sets the monetary backdrop, and mining restrictions control supply‑side dynamics.

Why This Matters for You

The impact of China’s approach reverberates far beyond its borders. Investors watching the market need to understand how exchange licensing can cause sudden delistings, how the digital yuan may bring new compliance requirements, and how mining restrictions can shift hash‑rate distribution globally. Our collection below dives into real‑world examples: tax guides for Indian traders, airdrop safety tips, and detailed reviews of crypto exchanges that operate under or outside Chinese jurisdiction. By grasping the core entities—exchange licensing, digital yuan, and mining restrictions—you’ll be better equipped to navigate the shifting regulatory landscape and make informed decisions.

China has fully banned cryptocurrency activities as of June 2025. Learn the legal framework, enforcement agencies, penalties, and why the state still promotes its digital yuan.

Finance

Finance