Cryptocurrency Exchange Compliance

When dealing with cryptocurrency exchange compliance, the set of rules and processes that keep a crypto platform legal and trustworthy. It’s also called exchange regulatory compliance. This field sits at the crossroads of crypto regulations, government rules that define what digital assets can do in a country, AML/KYC requirements, procedures that verify user identity and prevent money‑laundering, and exchange licensing, the official permission a platform needs to operate legally. In Europe, the new MiCA framework EU MiCA, a comprehensive set of rules for crypto assets is reshaping how compliance looks. Put simply, cryptocurrency exchange compliance means making sure a platform follows the law, protects users, and stays out of trouble.

Why compliance matters for traders and investors

Compliance isn’t just a legal checkbox; it directly impacts the safety of your funds. When an exchange meets AML/KYC standards, it reduces the risk of fraud and keeps illicit money out of the system. Licensing gives users confidence that the platform has passed a regulator’s audit, which often translates into better security measures and insurance options. Meanwhile, staying aligned with crypto regulations—whether it’s China’s strict ban, India’s 30% tax, or Taiwan’s banking restrictions—helps traders avoid sudden shutdowns or fines. For example, a recent report showed that exchanges adhering to MiCA saw a 15% increase in user trust scores within six months. These semantic connections show that “cryptocurrency exchange compliance encompasses AML/KYC procedures,” “regulatory frameworks such as MiCA influence compliance requirements,” and “exchange licensing requires adherence to local crypto regulations.”

Our curated collection below pulls together real‑world guides, country‑specific breakdowns, and platform reviews that illustrate compliance in action. You’ll find detailed looks at how China’s 2025 crypto ban affects exchange operations, a step‑by‑step Indian tax guide, and hands‑on reviews of OpenSwap, SuperEx, and Coinext that rate each platform’s security and licensing status. There’s also a practical utility‑token compliance checklist for 2025, a deep dive into EU MiCA, and tips on avoiding non‑compliant exchanges in India. Whether you’re a trader needing to pick a safe venue, a developer building a new DEX, or an investor evaluating risk, the posts ahead give you the tools and insights to stay compliant and protect your assets.

A 2025 guide to Taiwan's FSC crypto regulations for exchanges, covering registration, AML rules, security token limits, ETF access, compliance checklist, and upcoming law changes.

Categories

Archives

Recent-posts

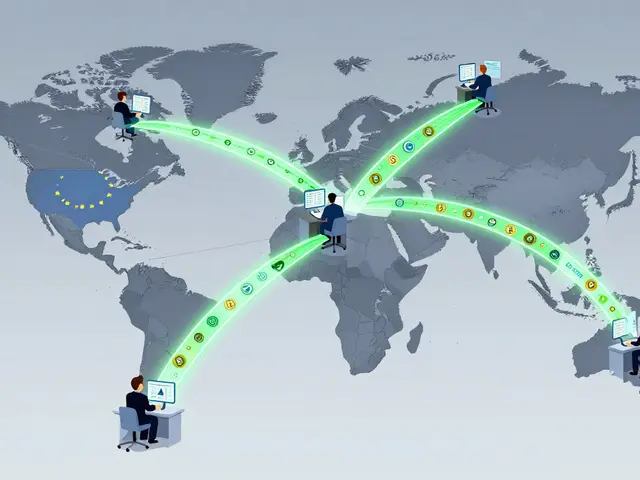

Automatic Exchange of Crypto Tax Information Between Countries: What You Need to Know in 2026

Jan, 2 2026

Finance

Finance