Crypto.com Review: What You Need to Know Before You Trade

When you hear Crypto.com, a major cryptocurrency exchange and wallet platform that offers trading, staking, and a branded debit card. Also known as Crypto.com Exchange, it started as a simple trading site but grew into a full financial ecosystem with its own token, app, and global payment tools. Most people use it because it promises low fees, cashback in crypto, and a card that lets you spend Bitcoin like cash. But behind the glossy ads, there are real trade-offs — especially if you’re not just speculating but actually using crypto in daily life.

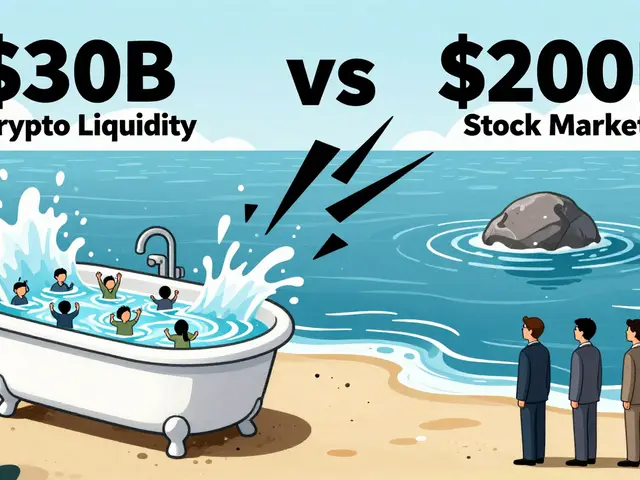

One big reason people pick Crypto.com is the CRO token, the native cryptocurrency used for fee discounts, staking rewards, and card tier upgrades. If you hold enough CRO, you can slash trading fees by up to 50% and unlock higher cashback rates on the debit card. But here’s the catch: CRO’s value is tied directly to how much you use the platform. If you stop trading or staking, the token’s perks fade fast. Compare that to Binance’s BNB, which works across dozens of decentralized apps — not just one company’s ecosystem. Then there’s the crypto exchange comparison, the process of evaluating platforms based on fees, supported coins, security, and user experience. Crypto.com supports over 250 coins, which sounds impressive, but many are low-volume tokens with no real demand. You won’t find the same depth in altcoins as you do on KuCoin or Bybit.

Security is another layer. Crypto.com claims to store 95% of assets in cold storage and offers insurance. That’s standard for big exchanges. But they also require KYC — full identity verification — which means your data is stored centrally. If you’re looking for privacy or non-custodial control, you’re better off with a wallet like Phantom or Ledger. And while the app is slick and easy for beginners, advanced traders miss features like limit orders on mobile or advanced charting tools that platforms like TradingView offer for free.

What you’ll find in the posts below are real user experiences and deep dives into Crypto.com’s actual performance — not the marketing hype. You’ll see how the CRO token behaves under pressure, what fees really cost over time, and why some users walked away after a year. There are comparisons with other exchanges, breakdowns of the card rewards system, and warnings about hidden restrictions. This isn’t a list of pros and cons from a press release. These are the kinds of details that matter when your money is on the line.

Cronus Finance is a scam crypto exchange using a misspelled name to trick users. Learn how to spot fake platforms, avoid losing money, and safely trade CRO on legitimate exchanges like Crypto.com.

Categories

Archives

Recent-posts

BiKing Crypto Exchange Review: Risks, Security Issues, and Why It’s Not for Most Traders

Nov, 28 2025

Finance

Finance