Crypto Regulations: Global Rules Shaping the Market

When working with Crypto Regulations, government rules that define how digital assets can be created, traded, and taxed. Also known as digital asset regulation, it sets the legal framework that every trader, project, and investor must follow. Understanding crypto regulations means knowing who enforces the rules, what penalties exist, and how compliance can protect your portfolio. The landscape mixes tax codes, licensing requirements, and anti‑money‑laundering standards, creating a web of obligations that differ country by country.

Why Crypto Regulations Matter

One major subtopic is Utility Token Regulation, the set of compliance criteria that govern tokens used for accessing a platform’s services rather than as financial securities. This area often invokes the Howey test, which decides if a token counts as a security, and aligns with the EU’s MiCA framework. Another key entity is the China Crypto Ban, the 2025 policy that completely prohibits cryptocurrency trading, mining, and related services. The ban reshapes global market sentiment and pushes traders to seek compliant jurisdictions. In contrast, India Crypto Tax, a flat 30% tax on cryptocurrency gains, plus TDS and GST obligations for traders creates a clear fiscal burden but also offers a defined reporting path. Meanwhile, Taiwan Crypto Regulations, selective banking rules that require virtual asset service providers to register and adhere to AML standards illustrate how smaller economies balance innovation with oversight. Together these entities show that crypto regulations encompass tax policies, licensing, and security classifications, while also requiring projects to adapt to shifting legal environments.

What this means for you is simple: each regulation forms a piece of a larger compliance puzzle. If you’re launching a token, you’ll need to check utility token rules and possibly the Howey test; if you’re trading, you must account for jurisdiction‑specific taxes like India’s 30% rate; if you’re mining, China’s ban signals you should avoid that market, while Pakistan’s power grants hint at new opportunities. Our collection below covers everything from country‑specific bans to tax calculation guides, so you can see real‑world examples, discover actionable checklists, and stay ahead of regulatory changes. Dive into the articles to see how regulators shape the crypto world and how you can stay compliant.

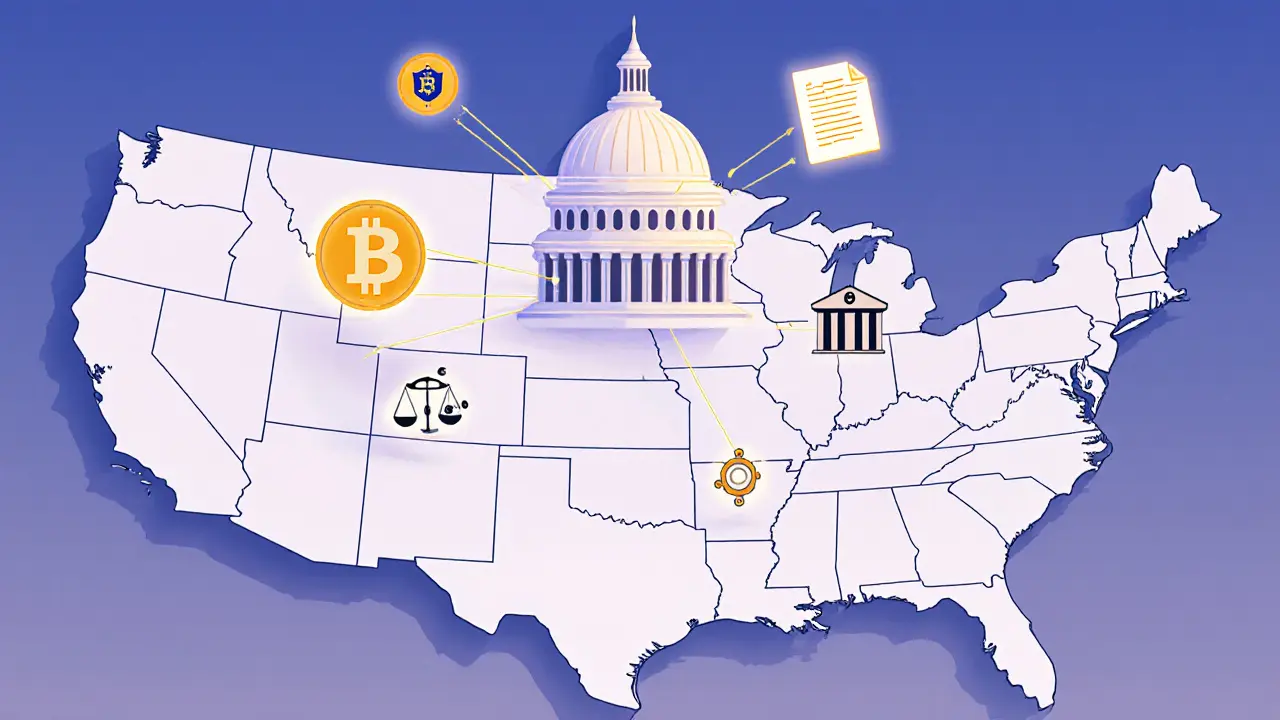

A 2025 guide that breaks down US crypto regulation state by state, covering federal laws, New York's BitLicense, California's DFPI, other key states, compliance steps, and future outlook.

Finance

Finance