Crypto Business Regulation Malta: What You Need to Know

When navigating crypto business regulation Malta, the collection of laws and supervisory standards that dictate how digital‑asset firms can operate on the island. Also known as Malta VFA framework, it encompasses licensing, AML/KYC duties, and reporting obligations. The Malta Financial Services Authority (MFSA), the regulator that grants licences and enforces compliance issues Virtual Asset Service Provider (VASP) licences, while the European Union’s Markets in Crypto‑Assets (MiCA) Regulation, a continent‑wide rulebook that shapes national crypto policies influences Malta’s approach, especially regarding consumer protection and stablecoin oversight. Meanwhile, Virtual Asset Service Provider (VASP), any entity offering crypto exchange, wallet or custodial services must meet strict AML/KYC standards, submit regular audits, and keep transparent records. Understanding how these pieces fit together helps you avoid costly licence rejections and keeps your business on the right side of regulators.

Core Pillars of Malta’s Crypto Compliance Landscape

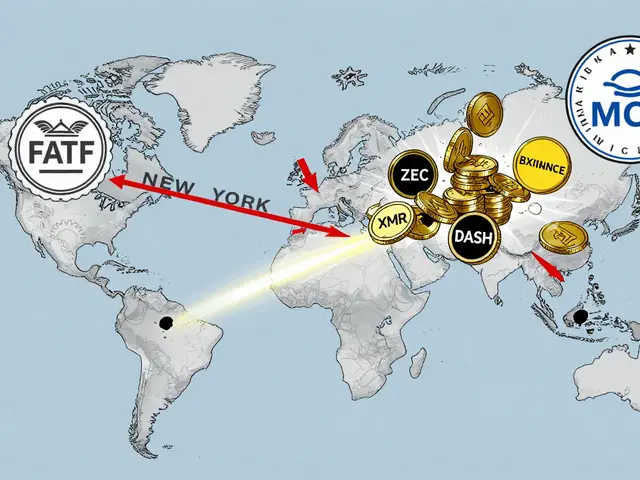

The first pillar is licensing. The MFSA classifies crypto firms into three tiers: (1) Virtual Asset Issuers, (2) Service Providers (VASP), and (3) Custodians. Each tier has distinct capital requirements, governance checks, and reporting frequencies. The second pillar covers AML/KYC procedures, processes to verify client identity and monitor suspicious transactions. Malta aligns its AML framework with the Financial Action Task Force (FATF) recommendations, meaning you’ll need to implement risk‑based customer due‑diligence, transaction monitoring tools, and periodic independent audits. The third pillar is consumer protection rules, guidelines that ensure transparent token disclosures and fair dispute resolution. Under MiCA, Malta must provide clear token white‑papers, segregation of client assets, and mandatory insurance for custodial services. By satisfying these three pillars—licensing, AML/KYC, and consumer safeguards—you create a compliance backbone that can adapt to future regulatory tweaks.

Beyond the core requirements, Malta offers practical incentives: a stable political climate, English‑language legal system, and a tax regime that treats many crypto‑related income streams favourably. However, you’ll still need to file annual compliance reports, maintain a local resident director, and keep a registered office on the island. The MFSA also runs a sandbox environment for innovative projects, letting you pilot new token models under relaxed conditions before full rollout. All these elements—MFSA oversight, VASP duties, EU MiCA alignment, AML/KYC rigor, and consumer protection—form a tightly knit ecosystem that makes Malta an attractive yet disciplined hub for crypto businesses. Below you’ll find a curated list of articles that break down each aspect, from step‑by‑step licence applications to detailed analyses of MiCA’s impact on Maltese token issuers.

Explore Malta's Blockchain Island Strategy, covering crypto regulations, tax perks, licensing steps, residency programs, and how it compares to other crypto-friendly jurisdictions.

Finance

Finance