Bitcoin Mining Hardware: What It Is and Why It Matters

When talking about Bitcoin mining hardware, the specialized equipment used to solve cryptographic puzzles and secure the Bitcoin network. Also known as mining rigs, it directly influences hash rate, power draw, and overall profitability.

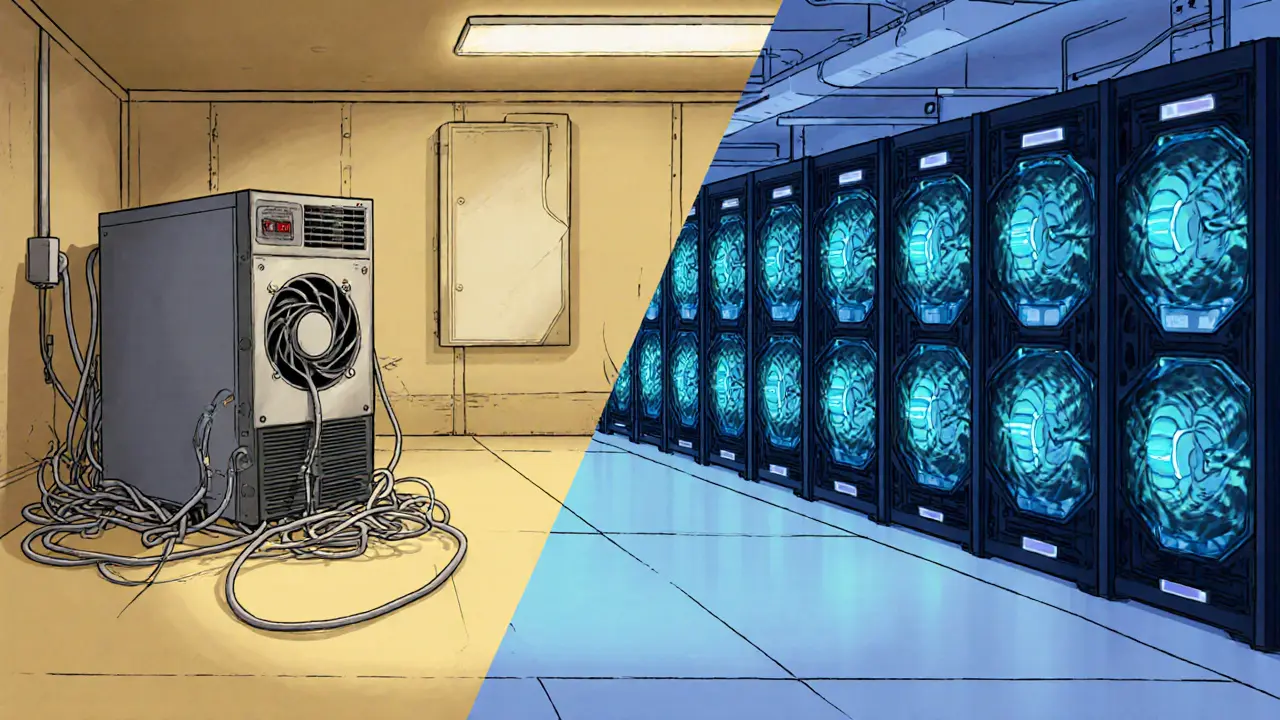

One of the most common forms is ASIC miners, application‑specific integrated circuits built solely for Bitcoin mining. These machines pack immense computational power into a single chip, making them far more efficient than general‑purpose hardware. By contrast, GPU rigs, graphics processing units repurposed for mining, are versatile but less efficient for Bitcoin’s SHA‑256 algorithm. Understanding the difference helps you choose the right tool for your budget and goals.

Key Factors That Shape Your Mining Setup

Every miner watches three core metrics: hash rate, energy consumption, and profitability. The hash rate measures how many hashes a device can calculate per second; higher rates mean a better chance of earning block rewards. Energy consumption, expressed in watts per terahash, tells you how much electricity you’ll need to keep the hardware running. Finally, profitability ties the first two together with Bitcoin’s price and network difficulty, answering the question "Is this hardware worth the investment?"

Bitcoin mining hardware encompasses ASIC miners, but it also includes supporting components such as power supplies, cooling systems, and firmware that optimizes performance. Efficient hardware requires low energy consumption, so many miners invest in immersion cooling or custom liquid loops to keep temperatures down and electricity bills manageable. The choice of cooling method often determines the overall footprint of a mining farm.

Mining profitability influences hardware choice in a very practical way. When Bitcoin’s price spikes, older miners can still break even because the reward per hash rises. During bear markets, only the most efficient devices survive, pushing operators toward newer ASIC models with better hash‑per‑watt ratios. This dynamic creates a constant cycle of upgrade, resale, and recycling within the industry.

Location matters, too. In regions where electricity costs are below $0.05 per kWh, even less efficient rigs can turn a profit. Some countries offer renewable‑energy incentives, allowing miners to offset carbon footprints while cutting costs. Understanding local regulations—such as permits for large‑scale mining farms—helps avoid legal hiccups and keeps operations running smoothly.

Beyond the machines themselves, the Bitcoin network difficulty acts as a backdrop for every decision. Difficulty adjusts roughly every two weeks to keep block times around ten minutes, regardless of total hash power. When difficulty climbs, miners need more hash rate or lower energy costs to stay competitive. This feedback loop means hardware performance, electricity pricing, and network difficulty are tightly intertwined.

Choosing the right Bitcoin mining hardware starts with assessing your goals: are you aiming for short‑term gains, long‑term stability, or a mix of both? By weighing ASIC efficiency, power consumption, cooling options, and local electricity rates, you can build a setup that matches your risk tolerance. Below, you’ll find a curated selection of articles covering everything from the latest ASIC releases to strategies for maximizing profit in volatile markets. Dive in to get the practical insights you need to make informed mining decisions.

A clear, conversational guide explains what ASIC miners are, how they differ from GPUs/CPUs, key manufacturers, setup steps, cost factors, and future trends for cryptocurrency mining.

Categories

Archives

Recent-posts

What is Children Of The Sky (COTS) crypto coin? Real risks, no game, and why it's fading fast

Jan, 31 2026

Finance

Finance