Arbitrum: Ethereum’s Fast‑Lane Scaling Solution

When working with Arbitrum, an Optimistic Rollup that boosts transaction speed while keeping Ethereum’s security guarantees. Also known as Arbitrum One, it lets developers run smart contracts faster and cheaper. Built on Ethereum, the world’s most popular programmable blockchain, Arbitrum inherits the same consensus rules, meaning anything that works on Ethereum can be ported with minimal changes. The platform adopts an Optimistic Rollup, a scalability design that assumes transactions are valid unless challenged, which lets it batch thousands of transfers into a single proof. This design encompasses the idea that rollup data is posted on‑chain, while execution happens off‑chain, creating the semantic triple: Arbitrum encompasses Optimistic Rollup technology.

Why Arbitrum Matters for DeFi and Developers

DeFi applications benefit, from lower gas fees and near‑instant finality when they run on Arbitrum because the rollup compresses transaction data before it hits the main chain. This requires a bridge that moves assets between Ethereum and Arbitrum, forming the triple: Token bridges connect Ethereum and Arbitrum. Users can swap ERC‑20 tokens, provide liquidity, and stake assets without paying the premium gas prices typical of Layer 1. Smart contracts deployed on Arbitrum inherit Ethereum’s security model, meaning the same audit standards and tooling apply, which reduces onboarding friction for developers. Moreover, the lowered transaction cost encourages experimental finance—like high‑frequency yield farming or complex order types—that would be prohibitive on the base chain.

Beyond DeFi, Arbitrum’s ecosystem supports NFTs, gaming, and enterprise use cases. Projects can launch on Arbitrum to reach a global audience while keeping latency low enough for real‑time interactions. The platform also offers a suite of developer tools—SDKs, testnets, and gas‑price estimators—that streamline deployment. As the community grows, governance proposals shape fee structures and upgrade paths, illustrating the triple: Arbitrum requires community governance to evolve. Whether you’re a trader looking for cheap swaps, a developer aiming to scale your dApp, or an investor tracking the latest layer‑2 trends, the articles below cover token listings, airdrop alerts, regulatory insights, and deep dives into related technologies. Dive in to see how Arbitrum is reshaping the Ethereum landscape.

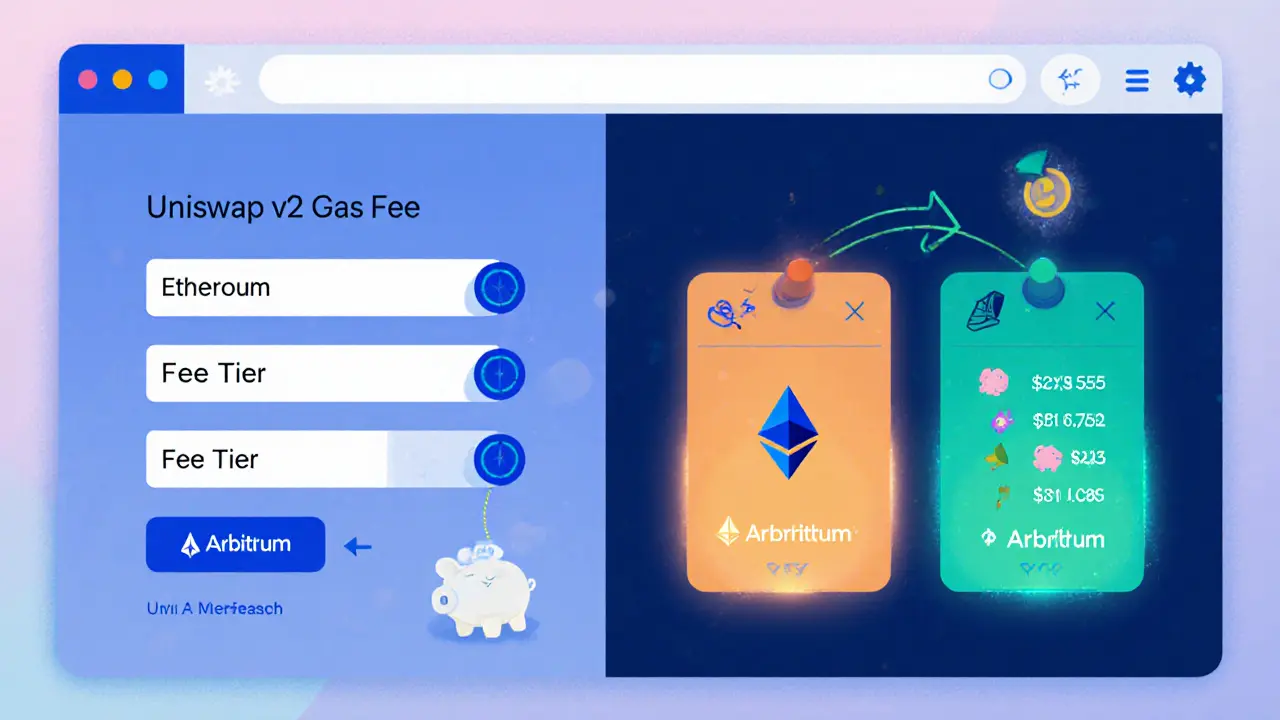

A 2025 review of Uniswap v2 on Arbitrum covering fees, liquidity, security, user experience, and how it stacks up against v3.

Finance

Finance