AMM Pools: The Backbone of Decentralized Trading

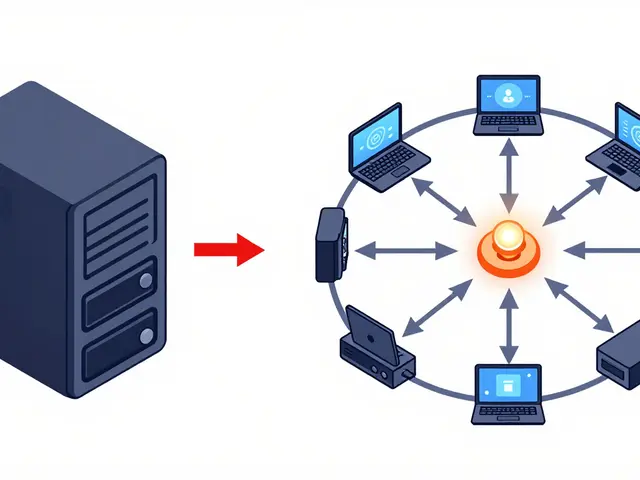

When working with AMM pools, automated market maker pools that enable on‑chain token swaps without order books. Also known as Automated Market Maker pools, they provide the liquid backbone for many DeFi services.

One of the core building blocks feeding an AMM pool is the Liquidity Pool, a reserve of two or more tokens supplied by users to facilitate trades. Those pools lock up capital, earn fees, and let anyone swap assets instantly. In turn, a Decentralized Exchange, a platform that runs on smart contracts to match trades without a central authority relies on multiple AMM pools to offer a full market. The relationship can be summed up in a simple triple: AMM pools enable token swaps. Another triple links the ecosystem: Liquidity pools provide capital for AMM pools. And because capital efficiency matters, many modern AMMs adopt Concentrated Liquidity, a technique that lets providers focus funds around specific price ranges, boosting depth while reducing slippage.

Why AMM Pools Matter for Traders and Builders

If you’ve ever tried to trade on a DEX like Uniswap or Raydium, you’ve already interacted with an AMM pool. The pool’s algorithm constantly adjusts prices based on the ratio of tokens inside, so you never need a counter‑party waiting on the other side. That simplicity fuels rapid growth: developers can launch new tokens, attach them to an existing pool, and instantly gain market access. For liquidity providers, the pool acts like a shared bank account that pays a slice of every trade. The risk‑reward balance hinges on factors such as pool size, fee tier, and whether the pool uses concentrated liquidity. Smaller pools often exhibit higher price impact, while larger, well‑balanced pools keep trades smooth.

Beyond pure trading, AMM pools power a range of DeFi primitives. Yield farms stake LP (liquidity provider) tokens to earn extra rewards, while launchpads like Raydium LaunchLab funnel new projects into pre‑configured pools to bootstrap liquidity. Airdrop campaigns frequently target users who hold LP tokens, creating a feedback loop where more participation grows the pool’s depth. Even margin trading platforms may use AMM pools to source instant liquidity for leveraged positions, showing how the concept spreads across the ecosystem.

Regulators are starting to notice this infrastructure too. In jurisdictions such as China and Taiwan, the legal status of liquidity‑providing activities can affect how AMM pools operate. Understanding the compliance landscape helps creators design pools that can survive regulatory shifts while still delivering value to users.

All of these angles—trading, farming, launching, and compliance—show why a solid grasp of AMM pools is essential for anyone navigating DeFi. Below you’ll find a curated set of articles that dive into specific coins, airdrop strategies, exchange reviews, tax guidance, and regulatory updates, all tied back to the core idea of automated market making. Whether you’re a trader looking for the next high‑yield pool or a developer planning a new token launch, the insights ahead will give you practical steps and deeper context to make informed decisions.

Learn how to earn fees by providing liquidity to AMM pools, avoid impermanent loss, and use advanced strategies for better DeFi returns.

Finance

Finance