AMM Explained: What Automated Market Makers Are and How They Power DeFi

When you trade crypto on a decentralized exchange like Uniswap or SushiSwap, you’re not dealing with a person or a central order book—you’re interacting with an AMM, an algorithm that automatically sets prices using math instead of buyers and sellers. Also known as automated market maker, it’s what makes decentralized trading possible without middlemen. Unlike traditional exchanges where someone places a buy or sell order, AMMs use liquidity pools, reserves of two tokens locked in a smart contract to match trades instantly. This is why you can swap ETH for USDC at 2 a.m. with no one on the other side—because the pool itself is the counterparty.

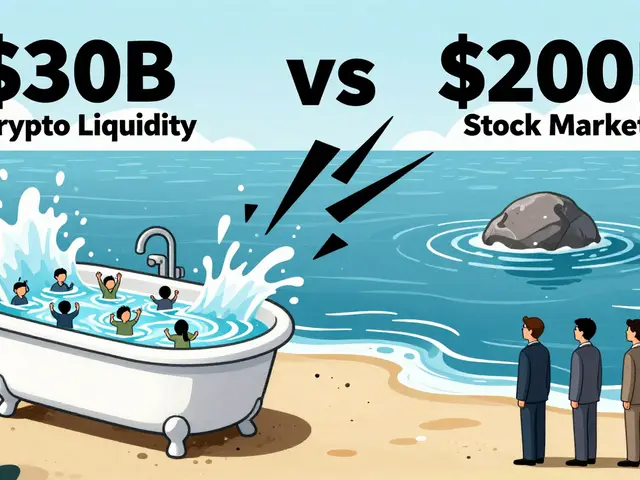

AMMs rely on formulas, most commonly the constant product market maker, a rule that keeps the product of two token reserves constant (x * y = k). If more people buy ETH from the pool, its price rises because the ETH reserve shrinks. This isn’t guesswork—it’s math in action. But this system has trade-offs. Slippage happens when large trades move the price. Impermanent loss hits liquidity providers when token prices swing wildly. And not all AMMs are built the same: some use weighted pools, others use stablecoin-optimized curves. The one thing they all share? They need people to deposit tokens into those pools. Without liquidity providers, AMMs don’t work.

What you’ll find in this collection isn’t theory—it’s real cases. You’ll see how a low-liquidity token like CRODEX (CRX) gets crushed by AMM mechanics, why Wrapped Oasys (WOAS) exists to bridge chains using AMM logic, and how platforms like AjuBit and 6x.com rely on these systems behind the scenes. You’ll also learn how mempool congestion affects AMM trade execution, why digital signatures matter for securing swaps, and what happens when a token like Launchium (LNCHM) has no real pool backing it. These aren’t abstract concepts—they’re the daily reality of trading on DeFi. Whether you’re providing liquidity, swapping tokens, or just trying to avoid losses, understanding AMMs isn’t optional. It’s the foundation.

Uniswap v2 is a leading decentralized exchange for swapping Ethereum tokens, while Plasma is a separate blockchain built only for free USDT transfers. Learn how they work, why they’re not the same, and which one to use.

Learn how to calculate impermanent loss in DeFi liquidity pools using simple formulas, real examples, and key insights on when fees offset losses. Avoid common mistakes and make smarter liquidity decisions.

Finance

Finance