SecretSky.finance (SSF) Airdrop Checker

Use this tool to verify if a claimed SecretSky.finance airdrop is legitimate by checking key indicators:

| Category | Allocation | Notes |

|---|---|---|

| Total Supply | 1,000,000,000 SSF | Fixed |

| Presale (Unicrypt) | 30% | Available via Unicrypt launchpad |

| Initial Liquidity Pool | 20% | Locked at launch |

| Team & Advisors | 10% | Vesting schedule not disclosed |

| Staking & Rewards | 25% | Feeds the high-APY promises |

| Community & Marketing | 15% | Includes potential airdrop pool |

- ✓ Check official URLs (secretsky.finance)

- ✓ Verify contract address on BscScan

- ✓ Never share your seed phrase

- ✓ Avoid third-party sites requesting fees

- ✗ Be wary of extreme APY claims (>1000%)

- ✗ Don't trust unverified social media posts

- ✗ Watch out for phishing domains

There’s a lot of buzz around the SecretSky.finance airdrop lately, but the official information is thin. Before you click any link or share your wallet address, it helps to understand what the project actually is, how its token is structured, and which red flags you should watch for.

Quick Summary

- SecretSky.finance is a BEP‑20 messaging platform on BNB Smart Chain.

- The SSF token has a 1billion total supply; 30% was sold on Unicrypt, 20% reserved for liquidity.

- No verifiable airdrop announcement, snapshot date, or eligibility list is publicly available.

- Staking promos claim over 400,000% APY - a figure that is mathematically unsustainable.

- Proceed with extreme caution: verify official channels, avoid sharing private keys, and treat any “airdrop” claim as speculative until the team posts a clear statement.

What Is SecretSky.finance?

When you hear about SecretSky.finance, it is a decentralized communication platform that lets users exchange messages without phone numbers or email verification. The service runs on the BNB Smart Chain, a blockchain that supports BEP‑20 tokens and offers low transaction fees.

Users interact through an address‑only chat called SSF:Chat. You can decide whether to accept messages from anyone or only from whitelisted addresses, and the app includes anti‑screenshot and auto‑destruct features to protect privacy.

SSF Token Basics and Distribution

The native token, SSF, is a BEP‑20 utility token that powers governance, staking, and future platform fees. The total supply is fixed at 1billion tokens.

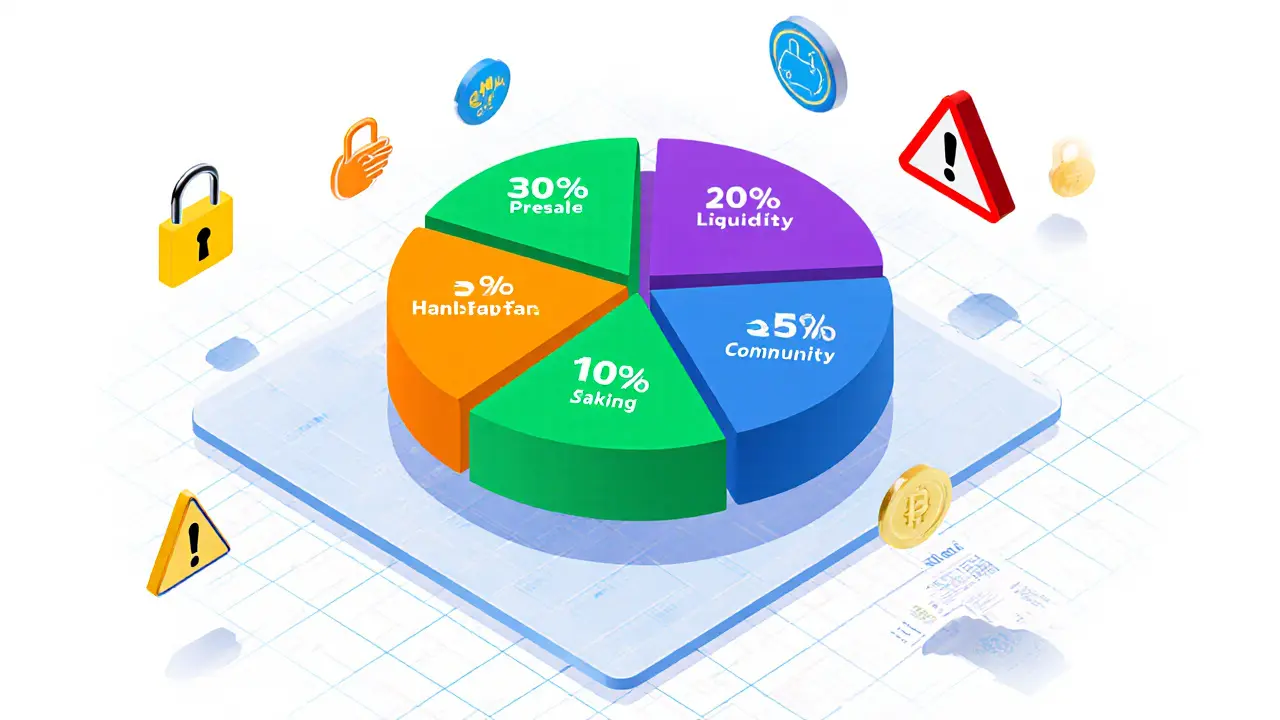

According to the published tokenomics:

| Category | Allocation | Notes |

|---|---|---|

| Total Supply | 1,000,000,000 SSF | Fixed |

| Presale (Unicrypt) | 30% | Available via Unicrypt launchpad |

| Initial Liquidity Pool | 20% | Locked at launch |

| Team & Advisors | 10% | Vesting schedule not disclosed |

| Staking & Rewards | 25% | Feeds the high‑APY promises |

| Community & Marketing | 15% | Includes potential airdrop pool |

CoinMarketCap still shows a circulating supply of 0SSF, which suggests that the token has not been officially released to public markets yet.

Official Airdrop Signals - What to Expect

Legitimate airdrops usually come with a clear set of data points:

- A public announcement on the project’s official Twitter, Discord, or Medium.

- A snapshot date that records wallet balances for eligibility.

- Specific criteria - such as holding a minimum amount of SSF, interacting with the platform, or completing a KYC‑free form.

- Details on distribution timeline and any vesting period.

At the moment, none of those elements have been posted by SecretSky.finance. The only references found are speculative YouTube videos that mention “hidden crypto airdrops” without naming SSF directly.

How to Evaluate Eligibility and Avoid Scams

Because the project’s communication channels are still sparse, it’s easy for scammers to copy the brand and ask for private keys. Here’s a quick way to tell a genuine request from a fake:

- Check the URL - the official site ends with

secretsky.finance. Any variation like.comor misspelled domains is a red flag. - Look for a verified Twitter badge or a Discord server with a high member count and a consistent posting schedule.

- Never share your seed phrase. The project only requires a wallet address to receive tokens.

- If a third‑party site asks for a fee to “unlock” your airdrop, walk away.

Use a block‑explorer (e.g., BscScan) to verify that the contract address 0x6836…ab7ffa matches the one listed on the official site.

Staking Promises and Tokenomics Red Flags

The marketing material boasts an APY of 405,555.56% and a DPY of 1,111.11% on the staking platform, which is a smart‑contract module that rewards users for locking SSF tokens. Those numbers are not just high; they are mathematically impossible to sustain without massive token inflation.

To illustrate, a 400,000% APY would require the token supply to increase by a factor of 4,000 in a single year. Even with a 1billion total supply, the rewards would quickly exceed the entire token pool, leading to a sudden collapse in price.

Projects that advertise such yields often rely on early participants' deposits to pay later users - a classic Ponzi‑style structure. If you decide to stake, limit the amount to what you can afford to lose entirely.

Steps to Safely Monitor SecretSky.finance

- Subscribe to the official Twitter and join the verified Discord server.

- Bookmark the token’s BscScan page and set up an address watchlist for any token transfers.

- Set Google Alerts for “SecretSky.finance airdrop” to catch any new announcements instantly.

- Periodically review the token’s market data on CoinMarketCap or CoinGecko - a sudden appearance of a circulating supply usually signals the start of distribution.

- If an airdrop is announced, record the snapshot date, note the required holding amount, and prepare a fresh wallet that has never interacted with the platform before.

Quick Checklist Before You Engage

- Is the announcement posted on the official channels?

- Does the contract address match the one on the site?

- Are the required actions free (no fee, no private key request)?

- Do the reward numbers make economic sense?

- Do you understand the vesting or lock‑up terms, if any?

Frequently Asked Questions

Is there an official SecretSky.finance airdrop right now?

As of October2025, the team has not posted a formal airdrop announcement. Any claim that an airdrop is live should be treated as speculative until verified on the official Twitter or Discord.

What wallet should I use to receive a potential SSF airdrop?

A BEP‑20 compatible wallet such as Trust Wallet, MetaMask (configured for BNB Smart Chain), or Binance Chain Wallet works. Make sure the address is a fresh one that you control; never share your seed phrase.

How can I verify the contract address?

Visit the official website and compare the listed address with the one shown on BscScan. The correct contract address is 0x6836…ab7ffa. Any deviation indicates a fake token.

Are the advertised 400,000% APY staking rewards realistic?

No. Such yields would require exponential token inflation that cannot be sustained. Treat those promises as marketing hype and only stake what you can lose.

What should I do if I receive an unsolicited SSF token?

First, check the transaction on BscScan to see the source contract. If the token came from an unknown address and you never signed up for an airdrop, it’s likely a spam token. You can safely ignore or send it to a burn address.

Finance

Finance

Adetoyese Oluyomi-Deji Olugunna

November 21, 2024 AT 09:51Esteemed interlocutors, allow me to elucidate the intricacies of the SecretSky.finance airdrop with a perspicacious lens. The project's tokenomics, whilst ostensibly transparent, conceal a labyrinthine architecture that necessitates a discerning eye. Firstly, the absence of an official announcement is not merely an oversight but a strategic obfuscation designed to generate speculative fervor. Secondly, the purported 400,000% APY constitutes a mathematical anomaly that defies the laws of exponential growth. Moreover, the allocation of twenty percent to liquidity, albeit ostensibly prudent, remains unverifiable without a public audit. The vesting schedule for the team, shrouded in inscrutability, further aggravates concerns regarding governance. In addition, the contract address 0x6836…ab7ffa, though listed on the site, must be cross‑referenced against BscScan to preclude impostor contracts. Equally, the requirement for users to provide a wallet address, but not a private key, aligns with best practises, yet the allure of fee‑based “unlock” portals is a red flag. The community allocation, albeit modest at 15%, could be a vehicle for airdrop distribution, but only if the team issues a verifiable snapshot. Historically, similar projects have succumbed to Ponzi‑like structures, wherein early participants' stakes fund later entrants. Consequently, prospective participants ought to approach with circumspection and allocate only capital they are prepared to forfeit. In synthesis, the amalgamation of opaque communications, hyperbolic yields, and unverified contracts renders this a venture fraught with peril. Prudence, therefore, dictates vigilant monitoring of official channels. Should an unequivocal announcement materialise, reassess the risk calculus accordingly. Until such moment, exercise due diligence and eschew any demand for seed phrases. Lastly, retain the wisdom that if it sounds too good to be true, it most likely is.

mark gray

November 23, 2024 AT 08:21I think the safest move is to double‑check the official Twitter and Discord for any real announcement. If the snapshot date isn’t posted, treat the airdrop as unconfirmed. Keep your seed phrase private and never pay a fee to claim tokens.

Karl Livingston

November 25, 2024 AT 06:51Reading through the SSF whitepaper feels like strolling through a technicolor maze of promises. The project paints a picture of a decentralized chat realm, yet the token distribution chart looks more like a painter’s splash of bright red‑flag colors. While the idea of privacy‑first messaging is appealing, the 400,000% APY is a siren song that could capsize even seasoned investors. I’d recommend keeping a skeptical eye on the contract address and waiting for a concrete snapshot announcement. In the meantime, enjoy the community chats but stay grounded.

Kyle Hidding

November 27, 2024 AT 05:21The absence of a verifiable KYC‑free eligibility matrix signifies a classic pump‑and‑dump vector, rendering the airdrop structurally unsound. Moreover, the AI‑generated hype metrics lack any on‑chain validation, exposing a systemic vulnerability.

Andrea Tan

November 29, 2024 AT 03:51Just a heads‑up: any site asking for a fee to “unlock” your SSF is almost certainly a scam. Stick to the official secretsky.finance domain and you’ll stay safe.

Gaurav Gautam

December 1, 2024 AT 02:21Hey folks, stay upbeat but stay sharp! The community vibe around SSF is lively, and that’s great for networking. However, remember the golden rule: verify the contract on BscScan before you interact. A little caution now saves a lot of hassle later.

Robert Eliason

December 3, 2024 AT 00:51It’s no coincidence that the SSF team released a vague tokenomics sheet just as a wave of “secret airdrop” rumors surged across Telegram. The timing aligns with known patterns of coordinated pump schemes, where inflated APY promises lure unwary users. One should suspect that hidden bots are amplifying the hype to manipulate market perception. The lack of a transparent vesting schedule further fuels this narrative. Until a verifiable, time‑stamped snapshot appears, keep your assets out of the SSF pool.

Cody Harrington

December 4, 2024 AT 23:21Agreed, keep your wallet addresses separate for any potential airdrop.

Chris Hayes

December 6, 2024 AT 21:51The red‑flag checklist for SSF is practically a textbook case of crypto hype gone awry. No official announcement, no snapshot, and absurd APY numbers-all point to a likely scam. If you value your capital, steer clear until transparent details emerge.

Donald Barrett

December 8, 2024 AT 20:21Anyone buying into this hype is just feeding the fraudsters. Wake up and do your own research instead of following the herd.

vipin kumar

December 10, 2024 AT 18:51There’s a pattern here that the mainstream media won’t cover: every time a new “secret” airdrop is whispered, the developers vanish after a short burst of token price. The SSF project fits this mold perfectly, with its fleeting social media presence and massive APY claims. It’s almost as if the entire thing is engineered to extract funds from unsuspecting participants. Keep an eye on the contract creator’s history for any red flags.

Lara Cocchetti

December 12, 2024 AT 17:21From an ethical standpoint, promoting a token with 400,000% returns is nothing short of irresponsible. The developers have a duty to provide clear, truthful information, yet they hide behind vague language. Users deserve honesty, not gilded promises that inevitably collapse. Exposing such schemes protects the broader crypto community from exploitation. Therefore, I urge all readers to demand full disclosure before committing any capital.

Mark Briggs

December 14, 2024 AT 15:51Sure, because 400k% APY works in real life.

mannu kumar rajpoot

December 16, 2024 AT 14:21Looking at the transaction logs, you can see a flurry of bot activity funneling tiny amounts into the SSF contract right after each “announcement”. This pattern mirrors previous rug‑pull operations where the scammer pumps the price then exits. The lack of a lock‑up period for the team’s 10% allocation is another glaring omission. Until the team posts a transparent roadmap, skepticism is the only rational stance.

Tilly Fluf

December 18, 2024 AT 12:51Dear community members, I wish to emphasize the importance of adhering to established security protocols when engaging with nascent projects such as SecretSky.finance. Verifying the contract address on reputable block explorers, consulting official communications, and refraining from divulging private keys constitute fundamental safeguards. Moreover, the extraordinarily high APY figures advertised are inconsistent with sustainable tokenomics. It is advisable to allocate only discretionary funds that you can afford to lose. I remain hopeful that the development team will provide clearer guidance in the near future.

Hardik Kanzariya

December 20, 2024 AT 11:21Hey everyone, I get why the hype around SSF is exciting, but let’s keep our feet on the ground. The community channel can be a great place to learn, yet it’s also fertile ground for misinformation. Check the BscScan contract address yourself; copy‑paste errors are common and can lead to scams. If you decide to stake, consider a modest amount and set a stop‑loss to protect yourself. Encourage friends to do the same-knowledge sharing is our best defense. Remember, the goal is long‑term growth, not a quick flash in the pan.

Shanthan Jogavajjala

December 22, 2024 AT 09:51Also, don’t forget to whitelist the official Discord bot; it will automatically flag any suspicious links you might encounter. Your vigilance helps the whole group stay safe. Let’s keep the conversation respectful and fact‑based.