Chivo Wallet Fee Calculator

Compare Transfer Costs

Estimate how much you could save using the Chivo wallet versus traditional remittance services.

Estimated Transfer Costs

When ElSalvador announced that Bitcoin would become legal tender in September2021, the world watched a tiny CentralAmerican nation attempt something no other country had ever tried: launch a government‑backed cryptocurrency wallet for every citizen. The Chivo wallet is a digital app that lets Salvadorans send and receive Bitcoin and U.S. dollars without fees, backed by the state.

Quick Take

- Launched Sep72021 alongside Bitcoin’s legal‑tender status.

- Built by AlphaPoint to handle millions of users.

- Initial adoption: ~46% of the population downloaded the app.

- Major hurdles: technical glitches, identity theft, Bitcoin volatility.

- January2025: Bitcoin removed as legal tender after IMF pressure, but the wallet remains for crypto services.

Why the Government Went All‑In

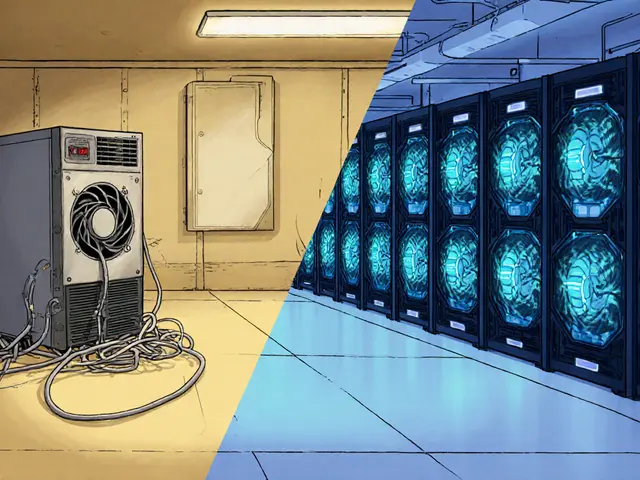

ElSalvador relies on a remittance economy that contributes up to 20% of its GDP. Traditional channels like Western Union charge 5‑10% per transfer, draining household income. By letting people move money with Bitcoin’s borderless network, the government hoped to cut fees to zero and boost financial inclusion for the 70% of citizens without bank accounts.

To sweeten the deal, each new user received a $30 credit directly into their Chivo account. The move signaled a serious fiscal commitment and gave people a risk‑free reason to try the app.

How the Wallet Works

At its core, Chivo is a dual‑currency app. Users can hold both Bitcoin (BTC) and U.S. dollars (USD) and switch between them with a single tap. All Bitcoin transfers are fee‑free because the state covers the network cost. The app’s backend, designed by AlphaPoint, uses a high‑availability architecture meant to scale to millions of simultaneous users.

Key technical specs:

- Supports Android5.0+ and iOS11+.

- Requires an internet connection (Wi‑Fi or 4G).

- Identity verification via national ID and selfie.

- Cold‑storage vaults for government‑owned Bitcoin, managed by the National Commission of Digital Assets (CNAD).

Early Adoption Numbers and the Reality Behind the Downloads

Within weeks of launch, government reports claimed that 46% of the population had installed the app - a remarkable figure for a brand‑new fintech product. However, installation does not equal active usage. A 2024 survey showed that eight out of ten Salvadorans still rarely or never used Bitcoin, even if they had Chivo on their phone. The $30 incentive sparked curiosity but did not create lasting habits.

Most active users were migrants sending money home. They saved an average of $12 per transaction compared with legacy providers, according to a study by the Central Bank of ElSalvador. For everyday purchases, volatility made many people revert to cash or USD.

Technical Glitches and Security Headaches

Launching a national‑scale crypto wallet is a massive engineering challenge. Within the first month, users reported:

- App crashes that locked wallets for hours.

- Incorrect balance displays after a Bitcoin price swing.

- Instances of identity theft where fraudsters accessed a user’s account after weak password policies.

AlphaPoint’s engineers later explained that the platform was built for “high throughput but low latency,” a balance that proved difficult when the national network surged with simultaneous onboarding requests.

Volatility: The Double‑Edged Sword

Bitcoin’s price plummeted from $69,000 in late2021 to under $16,000 by the end of2022. For someone who received $30 in Bitcoin, that drop meant the balance shrank to roughly $7 in purchasing power. The International Monetary Fund (IMF) repeatedly warned that such swings could destabilize the economy, and its 2025 staff‑level agreement forced the removal of Bitcoin as legal tender.

Nevertheless, the government’s Strategic Bitcoin Reserve Fund grew to 6,102 coins (about $500million) in March2025, showing that policymakers still see Bitcoin as a long‑term store of value despite short‑term turbulence.

Comparison with Traditional Remittance Services

| Metric | Chivo Wallet | Western Union | MoneyGram |

|---|---|---|---|

| Average fee per $100 transfer | $0 (zero‑fee) | $5‑$8 | $4‑$7 |

| Transfer speed | Minutes (blockchain confirmation) | Minutes‑hours (cash pickup) | Minutes‑hours (cash pickup) |

| Currency options | BTC & USD | USD, local fiat | USD, local fiat |

| Regulatory oversight | Government‑backed, CNAD | Private, regulated by host country | Private, regulated by host country |

The table makes it clear why cross‑border migrants liked Chivo: it erased fees and moved money instantly. But the trade‑off was exposure to Bitcoin’s price swings and occasional service outages.

Policy Shifts After the IMF Intervention

In January2025, the IMF conditioned a $1.4billion assistance package on ElSalvador dropping Bitcoin’s legal‑tender status. The government complied, but the Chivo app remained operational for crypto transactions, now classified as a “digital‑asset service” rather than a legal‑tender conduit.

The Digital Assets Issuance Act (LEAD) of 2023, which birthed the CNAD, continues to regulate private crypto businesses. This regulatory scaffolding kept the ecosystem alive even after the legal‑tender experiment ended.

What Users Need to Know Today

If you’re a Salvadoran considering Chivo now, the onboarding steps are unchanged:

- Download the app from Google Play or the App Store.

- Complete identity verification (national ID + selfie).

- Receive any remaining government‑funded credits (if applicable).

- Choose to hold BTC or USD, remembering that BTC value can swing dramatically.

Best‑practice tips:

- Enable two‑factor authentication to protect against theft.

- Only convert the amount you need for immediate expenses; keep the rest in USD to avoid volatility loss.

- Use the wallet primarily for remittances where the fee advantage outweighs price risk.

Lessons Learned and Future Outlook

ElSalvador’s experiment proved that a government can deploy a national cryptocurrency wallet at scale, but it also showed the limits of mandating a volatile asset as legal tender. Key takeaways for other countries eyeing similar moves:

- Financial inclusion works best when the technology complements existing fiat systems, not replaces them.

- Robust cybersecurity and user education are non‑negotiable for mass adoption.

- Policy flexibility matters; being able to pivot after IMF or other external pressure saved the nation from a deeper crisis.

Looking ahead, ElSalvador plans to host the PLANB Forum2025 and keep the CNAD active, positioning the country as a regional hub for crypto innovation even without mandatory Bitcoin usage.

Frequently Asked Questions

Is the Chivo wallet still free to use?

Yes, Bitcoin transfers within the app remain fee‑free. The government no longer deposits a $30 credit for new users, but there are no transaction fees on the blockchain side.

Can I convert Bitcoin to USD inside Chivo?

The app includes an internal exchange that lets you swap BTC for USD at the market rate. Keep in mind the conversion fee hidden in the spread, which is typically 1‑2%.

What security measures protect my funds?

Chivo implements two‑factor authentication, encrypted private keys stored in a secure enclave on the device, and a cold‑storage vault for the government’s Bitcoin holdings managed by the CNAD.

How does the IMF influence Bitcoin policy in ElSalvador?

The IMF linked its $1.4billion assistance to the removal of Bitcoin as legal tender. While the wallet stays active, the government can no longer require merchants to accept BTC for taxes or salaries.

Will the Strategic Bitcoin Reserve Fund affect my personal wallet?

The fund holds Bitcoin in state‑controlled cold storage and is not directly linked to individual Chivo balances. Its value can influence national policy, but personal holdings remain under the user’s control.

Finance

Finance

Ayaz Mudarris

August 10, 2025 AT 05:34The implementation of the Chivo wallet represents a pivotal moment in the evolution of state‑level digital currency initiatives.

By integrating Bitcoin as legal tender, El Salvador has positioned itself at the forefront of monetary innovation.

This policy facilitates instantaneous cross‑border transactions, which traditionally incur substantial fees and latency.

Moreover, the wallet’s fee‑free structure for domestic transfers incentivizes adoption among merchants and consumers alike.

The underlying blockchain offers immutability, thereby enhancing transparency in governmental financial operations.

Such transparency can foster public trust, provided that robust regulatory frameworks accompany the rollout.

The government’s commitment to educational campaigns is essential to mitigate user‑experience challenges.

User onboarding must address wallet security, private‑key management, and network volatility awareness.

Empirical data from early adopters suggests a modest increase in remittance inflows, though longitudinal studies are required.

Infrastructure development, including widespread point‑of‑sale terminals, remains a critical determinant of success.

Collaborations with international exchanges could streamline fiat conversion processes.

Nonetheless, the concentration of mining power and potential exposure to market speculation present systemic risks.

Policymakers should therefore consider diversification mechanisms, such as reserve assets, to buffer volatility.

Continuous monitoring of macro‑economic indicators will inform prudent adjustments to the national monetary policy.

In sum, the Chivo wallet’s trajectory will hinge upon coordinated efforts across technological, educational, and regulatory domains.

Irene Tien MD MSc

August 15, 2025 AT 18:54Oh, sure, let’s all hand over our hard‑earned cash to a government‑backed Bitcoin experiment, because nothing says "financial stability" like a cryptocurrency that was invented by a mysterious group of cypher‑punks in a basement.

El Salvador’s Chivo wallet is just the latest stage in the grand theater of "let’s see what breaks first"-be it the economy, the people’s trust, or the planet’s climate.

One can only imagine the shadowy cabals cheering from the sidelines as the state rolls out a fintech solution that doubles as a surveillance tool, tracking every transaction with the subtlety of a neon billboard.

The official narrative praises fee‑free transfers, yet the hidden costs manifest as data harvested for future control mechanisms.

And while the government proudly touts “financial inclusion,” the reality is a digital divide widened by the necessity of smartphones, stable internet, and a basic understanding of cryptographic keys.

Meanwhile, the global elite watch with amusement, preparing their next wave of speculative bubbles to profit from the inevitable crash.

In short, the Chivo wallet is less a benevolent innovation and more a glittering façade for deeper systemic manipulation.

Vaishnavi Singh

August 21, 2025 AT 08:14The wallet’s existence forces a reevaluation of what sovereignty means in a digitized world.

Peter Johansson

August 26, 2025 AT 21:34Hey folks, I think it’s great to see a country taking bold steps toward financial tech, and the community vibe around Chivo is really growing! 😊

It’s important we keep encouraging users to protect their private keys and stay savvy about market swings.

Let’s keep the conversation positive and help each other navigate the learning curve together.

Cindy Hernandez

September 1, 2025 AT 10:54From a cultural perspective, the Chivo wallet introduces a new layer of digital identity that aligns with El Salvador’s diaspora needs.

Remittance fees have historically eroded a significant portion of transferred funds; eliminating those fees could boost household income.

Effective rollout will depend on merchant adoption, reliable internet access, and clear guidance on tax implications.

Government‑run educational workshops are already being piloted in several municipalities to address these gaps.

Karl Livingston

September 7, 2025 AT 00:14I’ve been following the Chivo rollout and, honestly, it feels like a mixed bag.

On one hand, the promise of fee‑free transfers is a lifeline for families sending money home.

On the other, the volatility of Bitcoin can turn a modest remittance into a roller‑coaster of gains and losses.

People need solid education on how to hedge or convert to stablecoins if they want to protect their earnings.

Let’s hope the government backs that up with proper tools.

Kyle Hidding

September 12, 2025 AT 13:34Analyzing the Chivo deployment reveals a glaring oversight: the lack of a robust risk mitigation framework.

The systemic exposure to Bitcoin’s price cycles is a textbook case of financial engineering gone rogue.

Without hedging strategies, the sovereign balance sheet is essentially betting on speculative market sentiment.

This is a textbook example of policy captured by technocratic hype.

Andrea Tan

September 18, 2025 AT 02:54Just wanted to say I’m impressed by how quickly the community has adapted to the new wallet.

It’s cool to see people sharing tips on security and best practices.

Keep it up, everyone!

Gaurav Gautam

September 23, 2025 AT 16:14Seeing the energy around Chivo reminds me why collaboration matters.

When developers, merchants, and users come together, adoption rates can skyrocket.

Let’s keep the momentum, share success stories, and address pain points as a united front.

Robert Eliason

September 29, 2025 AT 05:34i think this is a big mistake. the govntn cant control btc price and people will lose money fast. its a scam!

Cody Harrington

October 4, 2025 AT 18:54The fee‑free domestic transfers could indeed stimulate micro‑entrepreneurship, especially in rural markets where banking services are sparse.

Chris Hayes

October 10, 2025 AT 08:14While the optimism is commendable, the underlying technology still suffers from scalability bottlenecks that could hinder transaction throughput during peak periods.

victor white

October 15, 2025 AT 21:34One must wonder whether the Chivo initiative is merely a veneer for deeper geopolitical maneuvers, the kind that elite think‑tanks love to orchestrate behind the curtains of public policy.

Samuel Wilson

October 21, 2025 AT 10:54Indeed, the potential for micro‑enterprise growth is real, provided that the infrastructure for point‑of‑sale acceptance is sufficiently widespread and supported by reliable internet connectivity.

Rae Harris

October 26, 2025 AT 23:14Honestly, these hype cycles always ignore the friction users face; you need better UI/UX, not just flashy slogans about “free transfers.”

Danny Locher

November 1, 2025 AT 12:34Nice points, but let’s remember that a friendly approach can ease adoption for less tech‑savvy users.

Emily Pelton

November 7, 2025 AT 01:54It is absolutely critical-!!!-that policymakers implement comprehensive consumer‑protection statutes; otherwise, the entire ecosystem is vulnerable to exploitation, fraud, and systemic collapse; this cannot be overstated.

sandi khardani

November 12, 2025 AT 15:14Delving deeper into the Chivo architecture reveals several layers of technical debt that could manifest as security vulnerabilities over time.

The reliance on a single‑signature wallet model introduces points of failure where private‑key leakage could result in irreversible loss of assets.

Furthermore, the integration with legacy banking APIs lacks end‑to‑end encryption, raising concerns about data interception.

From a compliance standpoint, the absence of Know‑Your‑Customer (KYC) rigor for certain transaction thresholds may expose the system to illicit activity.

In addition, the platform’s current monitoring tools are insufficient for real‑time fraud detection, which is essential given the pseudonymous nature of Bitcoin transactions.

These shortcomings highlight the necessity for a multi‑phase upgrade roadmap that prioritizes hardened cryptographic standards, decentralized identity verification, and robust analytics dashboards.

Only through such systematic improvements can the Chivo wallet achieve sustainable trust among its user base.

Donald Barrett

November 18, 2025 AT 04:34The whole thing is a disaster waiting to happen; without proper safeguards, users will be burned.

Angela Yeager

November 23, 2025 AT 17:54Balancing innovation with responsibility is key.

The Chivo wallet can unlock new economic opportunities, but it must be paired with clear guidelines, consumer education, and rigorous oversight to protect vulnerable populations.

vipin kumar

November 29, 2025 AT 07:14There are hidden agendas at play; the push for Bitcoin adoption aligns with shadow banking interests that thrive on regulatory gray zones.

Lara Cocchetti

December 4, 2025 AT 20:34From an ethical standpoint, championing a volatile cryptocurrency as legal tender undermines the moral responsibility governments have to safeguard their citizens’ financial well‑being.