Bitcoin sits on its own blockchain-simple, secure, and slow to change. But what if you could use Bitcoin inside Ethereum’s world of lending, trading, and earning interest? That’s where Wrapped Bitcoin (WBTC) comes in. It’s not Bitcoin itself, but a digital twin that acts like Bitcoin on Ethereum. For every WBTC token you hold, there’s one real Bitcoin locked away in a secure vault. It’s a bridge. And it’s how billions of dollars in Bitcoin value ended up in DeFi protocols like Aave and Uniswap.

What Exactly Is Wrapped Bitcoin?

Wrapped Bitcoin (WBTC) is an ERC-20 token built on Ethereum that represents Bitcoin on a 1:1 basis. It doesn’t replace Bitcoin. It just lets you use Bitcoin’s value inside Ethereum’s smart contract ecosystem. You can lend WBTC to earn interest, use it as collateral for loans, or swap it for other tokens-all without selling your actual Bitcoin.

Think of it like a warehouse receipt. If you deposit your car in a secure lot, you get a paper ticket that proves you own it. You can trade that ticket without moving the car. WBTC works the same way: your Bitcoin stays locked up, and you get a token that acts like it.

Launched in January 2019 by BitGo, Kyber Network, and Ren, WBTC was designed to solve a simple problem: Bitcoin’s blockchain can’t run smart contracts. Ethereum can. So WBTC lets Bitcoin holders tap into Ethereum’s DeFi tools without giving up their BTC.

How WBTC Is Created (Wrapping)

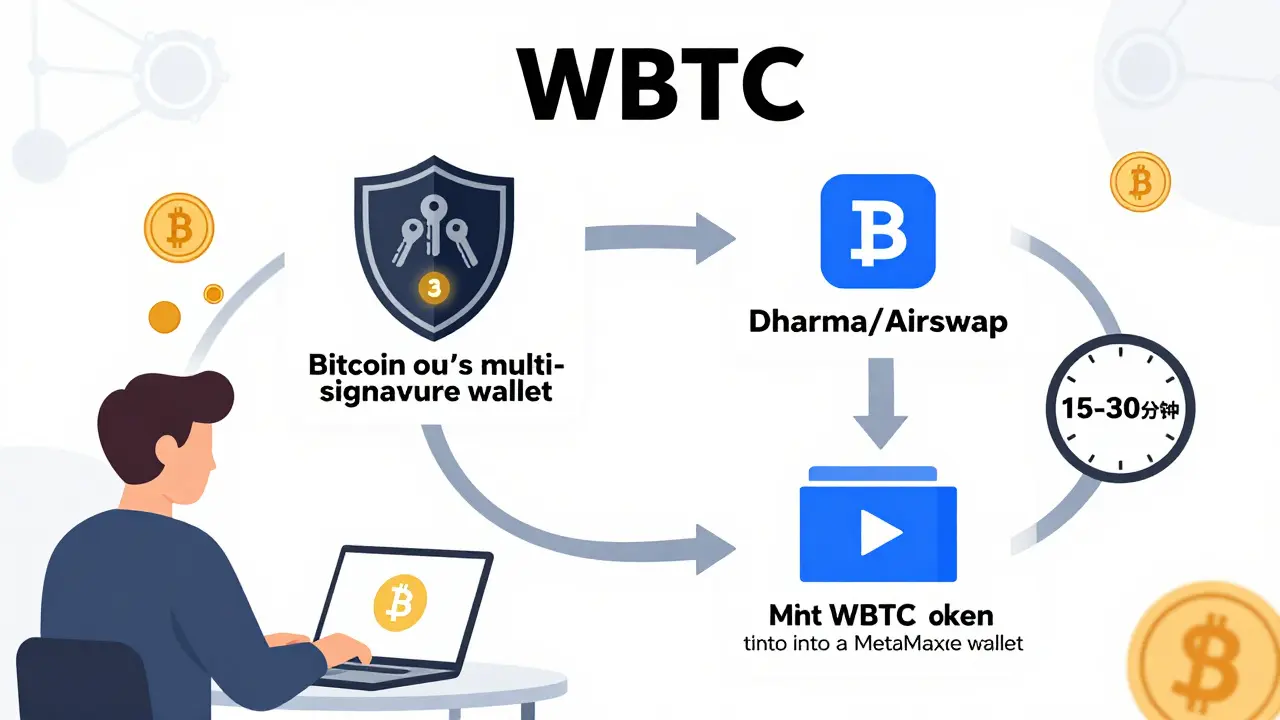

Getting WBTC isn’t as simple as clicking a button. It’s a multi-step process managed by a trusted system.

- You choose an approved merchant-like Dharma, AirSwap, or Kyber. These are the only entities allowed to initiate wrapping.

- You complete KYC/AML checks. This usually takes 5-15 minutes, but sometimes stretches to 3 days if documents are unclear.

- You send your Bitcoin to BitGo’s multisignature wallet. BitGo is the sole custodian. No one else holds the keys.

- Once BitGo confirms the deposit, the merchant sends a request to the WBTC smart contract on Ethereum.

- The contract mints the exact amount of WBTC and sends it to your Ethereum wallet. This takes 15-30 minutes.

The whole process is automated but requires trust in BitGo. That’s the trade-off. You get speed and reliability, but you’re relying on a centralized company to hold your Bitcoin.

How WBTC Is Returned to Bitcoin (Unwrapping)

Want your Bitcoin back? It’s the reverse.

- You send your WBTC to the merchant’s smart contract.

- The contract burns the WBTC tokens-permanently removing them from circulation.

- The merchant requests BitGo to release the equivalent amount of Bitcoin.

- BitGo sends the BTC to your Bitcoin address.

This takes longer-30 to 60 minutes-because Bitcoin’s network is slower. You also pay Ethereum gas fees to burn the WBTC, and Bitcoin network fees to receive the coins. There’s no way around that.

Who Runs WBTC? The Custodian-Merchant-DAO Model

WBTC isn’t fully decentralized. It’s a hybrid system with three parts:

- Custodian (BitGo): Holds all the Bitcoin. Uses cold storage and a 3-of-5 multi-signature setup. Only BitGo can unlock the funds.

- Merchants (17 approved): Act as intermediaries. They handle user onboarding, collect Bitcoin, and request minting. You can’t wrap WBTC without one.

- WBTC DAO: A group of token holders who vote on system changes-like adding new merchants, updating security rules, or expanding to other blockchains.

BitGo doesn’t control the DAO. The DAO doesn’t control BitGo. They check each other. It’s a balance of power designed to reduce risk.

Security and Transparency

Trust is the biggest concern with WBTC. What if BitGo disappears? What if they get hacked?

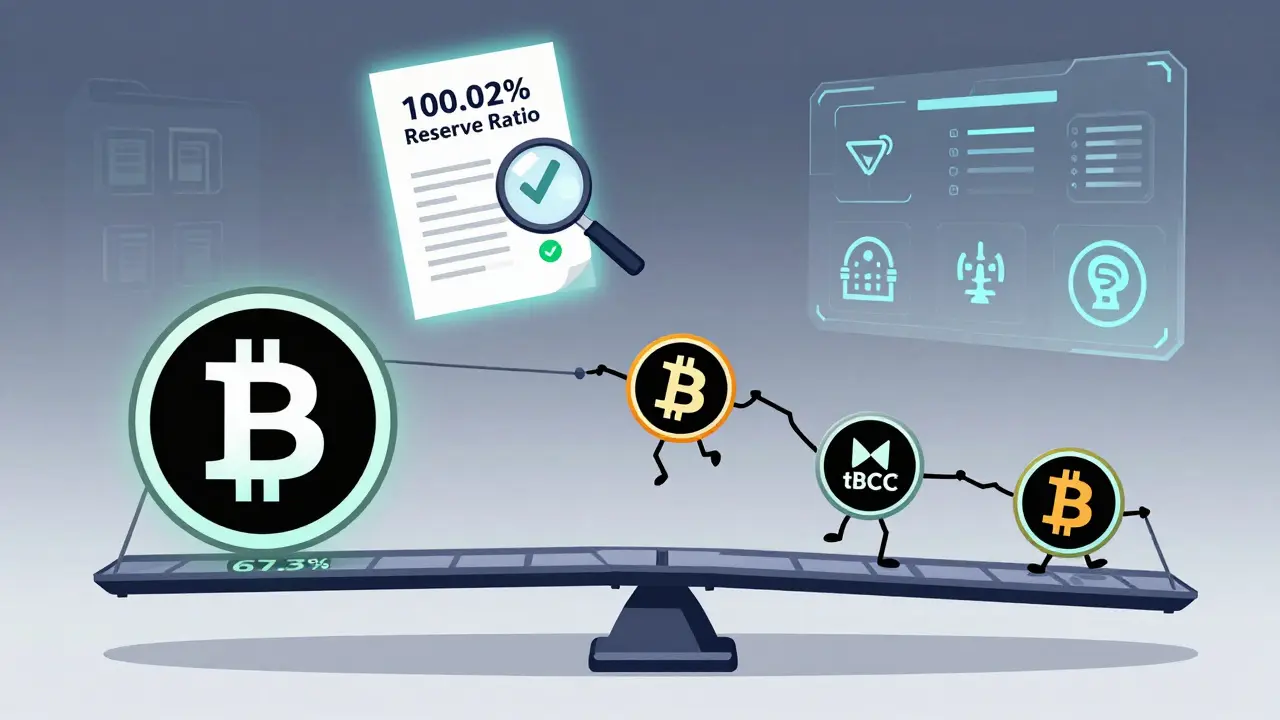

That’s why transparency is built in. Every month, BitGo publishes a Proof of Reserves report. It’s a cryptographic audit showing that the total WBTC in circulation matches the Bitcoin held in custody. As of April 2024, the reserve ratio was 100.02%-meaning there’s even slightly more Bitcoin than WBTC tokens.

The audit is done on-chain. You can verify it yourself at the wallet address: 0xbf5a887057200b88aa1d0b84c3099a83266a9bb3. No third-party reports. Just raw data.

BitGo’s security is also top-tier. They use threshold signature schemes (TSS), which split private keys across multiple machines. No single person or system can access the funds. This is why WBTC has never been hacked-unlike some decentralized alternatives.

How WBTC Compares to Other Wrapped Bitcoin Tokens

WBTC isn’t the only way to use Bitcoin on Ethereum. But it’s by far the most popular.

| Token | Market Share | Custody Model | Total Value Locked (TVL) | Key Risk |

|---|---|---|---|---|

| WBTC | 67.3% | Centralized (BitGo) | $1.2 billion | Single custodian failure |

| renBTC | 14.2% | Decentralized (network of nodes) | $254 million | Smart contract exploit (lost $1.4M in 2022) |

| sBTC | 8.7% | Decentralized (Synthetix) | $287 million | Over-collateralization needed |

| tBTC | 5.1% | Decentralized (Threshold Network) | $93 million | Slow minting (6-12 hours) |

WBTC dominates because of liquidity. DeFi protocols prefer it because it’s easy to integrate and has a proven track record. renBTC tried to be more decentralized but got hacked. tBTC is secure but too slow for most traders. sBTC requires locking up extra ETH as collateral, which makes it inefficient.

Who Uses WBTC and Why?

Most WBTC users are in DeFi. According to DappRadar, 92% of WBTC holders use it in protocols.

- 63% provide liquidity on exchanges like Uniswap to earn trading fees.

- 29% use it as collateral to borrow other assets (like ETH or stablecoins).

- 10% trade it for short-term gains.

Why bother? Because Bitcoin earns 0% interest. WBTC can earn up to 4.2% APY on Aave or 5.8% on Curve. That’s real yield. For Bitcoin holders who believe in long-term value but want to earn something now, WBTC is the easiest path.

Institutional adoption is growing too. Fidelity, Coinbase, and 12 Fortune 500 companies now hold WBTC as part of their treasury strategy. It’s a way to get Bitcoin exposure while participating in yield-generating DeFi.

Real User Experiences

Most users report smooth experiences. Reddit user u/EthereumTrader89 wrapped 2.5 BTC to WBTC in 22 minutes. Gas fees were $3.75. They used it to earn 4.2% on Uniswap. “Worth every second,” they said.

But problems happen. Some users complain about BitGo’s KYC taking longer than promised. Others lost money using fake merchants-scammers who pretend to be WBTC partners. The WBTC DAO lists only 17 approved merchants. Always double-check before sending Bitcoin.

Trustpilot reviews average 4.1 out of 5. The biggest complaints: slow KYC and lack of customer support from BitGo. The best-rated merchants? AirSwap and Dharma. They’re fast, clear, and responsive.

What You Need to Know Before Using WBTC

Using WBTC isn’t hard-but it’s not beginner-friendly either. Here’s what you need:

- An Ethereum wallet (MetaMask recommended).

- Ethereum (ETH) to pay gas fees-usually $1.50 to $5 per transaction.

- A verified identity for KYC.

- Access to one of the 17 approved merchants.

Don’t try to wrap WBTC directly through BitGo. You need a merchant. And never use a merchant not listed on the official WBTC DAO site.

Gas fees spike during network congestion. If your transaction fails, you still pay the fee. Always check Etherscan for current gas prices before starting.

Future of WBTC

WBTC isn’t standing still. In March 2024, the DAO approved expansion to Polygon, Arbitrum, and Optimism. WBTC is now available on multiple EVM chains.

By Q3 2024, the team plans to integrate Bitcoin’s Taproot upgrade. This will allow WBTC to use more advanced Bitcoin signatures, reducing reliance on BitGo’s custodial role.

By Q2 2025, they aim to replace BitGo’s multi-sig system with a decentralized oracle network. That means no single company controls the keys. It’s a step toward decentralization without sacrificing security.

But challenges remain. The SEC has flagged WBTC as a “security-adjacent instrument.” If new regulations force custodians to register as financial institutions, it could slow adoption.

Still, WBTC’s network effects are strong. It’s the most used, most audited, and most trusted wrapped Bitcoin. Until a truly decentralized alternative matches its liquidity and speed, WBTC will remain the default choice.

Final Thoughts

Wrapped Bitcoin isn’t perfect. It’s centralized. It relies on one company. It’s not as pure as holding Bitcoin directly. But it solves a real problem: Bitcoin’s isolation from DeFi.

If you want to earn yield on your Bitcoin without selling it, WBTC is the most straightforward way. If you’re okay with trusting a custodian for speed and reliability, it’s worth it. If you want full decentralization, you’ll need to wait-for now, the alternatives are either riskier or too slow.

WBTC isn’t the future of Bitcoin. It’s a bridge. And right now, it’s the best one we’ve got.

Is WBTC the same as Bitcoin?

No. WBTC is an ERC-20 token on Ethereum that represents Bitcoin on a 1:1 basis. Your actual Bitcoin is locked in BitGo’s custody. WBTC is a digital claim on that Bitcoin. You can trade or use WBTC on Ethereum, but you can’t spend it on Bitcoin’s network.

Can I lose my WBTC if BitGo gets hacked?

If BitGo’s security is breached, yes-your Bitcoin could be stolen, and your WBTC would become worthless. That’s the central risk. But BitGo has never been hacked. They use cold storage, multi-signature wallets, and threshold signatures to minimize risk. Monthly on-chain audits also help verify that your WBTC is fully backed.

How long does it take to wrap or unwrap WBTC?

Wrapping (converting BTC to WBTC) takes 15-30 minutes after your Bitcoin deposit is confirmed. Unwrapping (converting WBTC back to BTC) takes 30-60 minutes because Bitcoin’s network confirms slower. The delay isn’t from the smart contract-it’s from Bitcoin’s 10-minute block time.

Do I need ETH to use WBTC?

Yes. Every transaction on Ethereum-wrapping, unwrapping, trading, or lending WBTC-requires ETH to pay gas fees. You need a small amount of ETH in your wallet just to interact with WBTC contracts.

Can I use WBTC on networks other than Ethereum?

Yes. As of April 2024, WBTC is available on Polygon, Arbitrum, and Optimism-all Ethereum-compatible chains. The same WBTC token works across them. You can move it between chains using bridges, but you still need to go through an approved merchant to create or destroy WBTC.

Is WBTC regulated by the SEC?

The SEC hasn’t officially classified WBTC as a security, but it has called it a “security-adjacent instrument” due to its custodial structure. This means future regulations could require merchants or custodians to register as financial institutions, which might slow adoption or increase costs.

What happens if BitGo goes out of business?

The WBTC DAO has contingency plans. If BitGo fails, the DAO could vote to appoint a new custodian or transition to a decentralized model. But this would take time. Until then, your WBTC would be frozen. That’s why many users treat WBTC like a short-term DeFi tool-not a long-term Bitcoin storage solution.

Can I wrap Bitcoin without KYC?

No. All approved merchants require KYC/AML verification. This is a legal requirement tied to BitGo’s status as a regulated custodian. If you want to avoid KYC, you can’t use WBTC. Decentralized alternatives like tBTC also require identity checks in practice.

Finance

Finance

Mathew Finch

January 25, 2026 AT 06:27WBTC is just another Wall Street scam dressed up as blockchain innovation. Bitcoin was built to escape centralized control, and now we're handing our keys to a corporate custodian like it's a fucking bank account. This isn't progress-it's regression with a whitepaper.

And don't even get me started on the 'DAO' pretending it's decentralized. BitGo holds the keys, the merchants are vetted by BitGo, and the DAO has no power to remove them. It's theater. Pure theater.

Jessica Boling

January 26, 2026 AT 16:47So you’re telling me I can’t use my Bitcoin to earn interest unless I give it to a company that’s probably got a compliance officer named Greg who drinks kombucha and writes SEC filings in his sleep?

Cool. I’ll just keep my BTC in a cold wallet and watch my portfolio grow at 0% APY. At least I won’t have to explain to my grandma why her 1 BTC is now a ‘token’ on some blockchain she’s never heard of.

Andy Marsland

January 27, 2026 AT 17:06Let’s be clear: WBTC is not a technological breakthrough-it’s a legal and economic workaround engineered to circumvent Bitcoin’s inherent limitations while simultaneously violating the very philosophical principles that Bitcoin was founded upon. The fact that institutional players like Fidelity and Coinbase are now using it as treasury collateral speaks volumes about the erosion of ideological purity in crypto.

Moreover, the reliance on a single custodian introduces systemic risk that no amount of multi-sig or threshold signatures can fully mitigate. Cryptographic security is not the same as institutional trustworthiness. And while the monthly on-chain audits appear transparent, they are still subject to the discretion of the custodian’s internal audit team, which may not be independently verified by a third-party auditor with full access to the private keys. The 100.02% reserve ratio? That’s not a feature-it’s a red flag. Why would anyone hold more BTC than WBTC? It suggests either accounting errors or intentional over-collateralization to mask liquidity concerns. Either way, this is not the future of money-it’s a fragile, centralized ponzi built on the corpse of decentralization.

Jeffrey Dufoe

January 28, 2026 AT 09:06I just wrapped 0.5 BTC last week. Took 20 mins, paid $4 in gas, now I’m earning 4.5% on Aave. No drama. No stress. I didn’t sell my Bitcoin, I just used it better. Why make it harder than it needs to be?

Tselane Sebatane

January 28, 2026 AT 15:26Let me tell you something-this is why Africa needs to stop being a passive observer in this space. While Westerners debate whether WBTC is 'centralized enough,' people in Nigeria and Kenya are already using Bitcoin to bypass hyperinflation and remittance fees. WBTC might be convenient for traders in Brooklyn, but for millions, Bitcoin without wrappers is the only tool that keeps their families fed.

Don’t mistake convenience for liberation. The real innovation isn’t wrapping Bitcoin-it’s letting people use Bitcoin without permission. WBTC is a golden cage. And we’re all too happy to be fed inside it.

Jen Allanson

January 29, 2026 AT 17:40It is imperative to note that the structural integrity of Wrapped Bitcoin is predicated upon the unwavering fidelity of its custodial entity, BitGo, whose operational protocols, while ostensibly robust, remain susceptible to regulatory overreach, corporate dissolution, or existential threat from geopolitical forces. The invocation of a 'DAO' as a governance mechanism is, in this context, a performative illusion-a façade of decentralization that does not mitigate the existential dependency on a single, centralized, for-profit custodian.

Furthermore, the requirement of KYC/AML compliance inherently contradicts the pseudonymous ethos upon which Bitcoin was constructed. One cannot simultaneously champion financial sovereignty and surrender one’s identity to a regulated financial intermediary. The cognitive dissonance is palpable, and the ethical compromise, irreversible.

Dave Ellender

January 29, 2026 AT 22:19I’ve used WBTC for over two years now. It’s not perfect, but it’s the least bad option we’ve got. The alternatives are either slower, riskier, or less liquid. I respect the ideology behind full decentralization, but I also respect my time and my portfolio.

BitGo has never been hacked. The audits are public. The merchants are vetted. I’m not going to risk my Bitcoin on a protocol that lost $1.4M in 2022 just because it sounds ‘more pure.’

There’s a difference between principle and practicality. WBTC lets me have both.

Adam Lewkovitz

January 30, 2026 AT 03:44USA made Bitcoin. USA made Ethereum. Now we’re making WBTC. This is American innovation at its finest-take the best of both worlds and make them work together. The haters cry 'centralized!' but they’re the same people who use PayPal and Chase. You want freedom? Then stop complaining and use the tool that works.

And if you’re still holding BTC in a cold wallet while everyone else is earning 5%? You’re not a HODLer. You’re a loser.

Arnaud Landry

January 30, 2026 AT 05:46Let me ask you this: what happens when the SEC shuts down BitGo? What happens when the U.S. government decides that 'crypto custodians' must be federally licensed-and BitGo refuses to comply? Your WBTC becomes a digital ghost. A phantom asset.

And don’t tell me about 'contingency plans.' The DAO doesn’t have the power to move funds. It doesn’t have the legal authority to appoint a new custodian. It’s a glorified forum. The entire system is one regulatory action away from collapse.

I’m not paranoid. I’m just reading the tea leaves. And the tea says: this is a house of cards built on the hope that regulators won’t notice.

george haris

January 31, 2026 AT 22:27Just started learning about WBTC last week. I had no idea it was this straightforward. Thanks for breaking it down so clearly. I’ve been holding BTC for 5 years but never knew I could earn yield on it without selling. I’m going to try wrapping 0.1 BTC this weekend. Any tips on which merchant to use? I saw AirSwap and Dharma mentioned-any experience with either?

Athena Mantle

February 2, 2026 AT 18:26WBTC is basically Bitcoin’s therapy session 😔💸

It’s like your Bitcoin went to rehab to be ‘more social’ on Ethereum… and now it’s posting crypto memes and dating stablecoins. Meanwhile, real Bitcoin is chilling on its blockchain, sipping tea, and judging everyone.

Also, 100.02% reserve? That’s not a feature, that’s a typo. Or a secret stash for the BitGo CEO’s private island. 🏝️👑

Paru Somashekar

February 3, 2026 AT 17:36As a long-time participant in DeFi ecosystems, I must emphasize that WBTC remains the most reliable and audited bridge for Bitcoin interoperability. The custodial model, while not ideal from a theoretical standpoint, offers a pragmatic balance between security, speed, and liquidity that decentralized alternatives have yet to replicate.

Furthermore, the monthly on-chain reserve proofs are unprecedented in the crypto space and demonstrate a level of transparency that most DeFi protocols lack entirely. The requirement of KYC, though contrary to the pseudonymous ethos of Bitcoin, is a necessary compliance measure in today’s regulatory environment.

For institutional investors and retail users alike who seek yield without liquidating their BTC holdings, WBTC remains the gold standard. One must distinguish between ideological purity and operational viability.