Zcash Exchange Ban: Why Privacy Coins Are Under Fire and What It Means for You

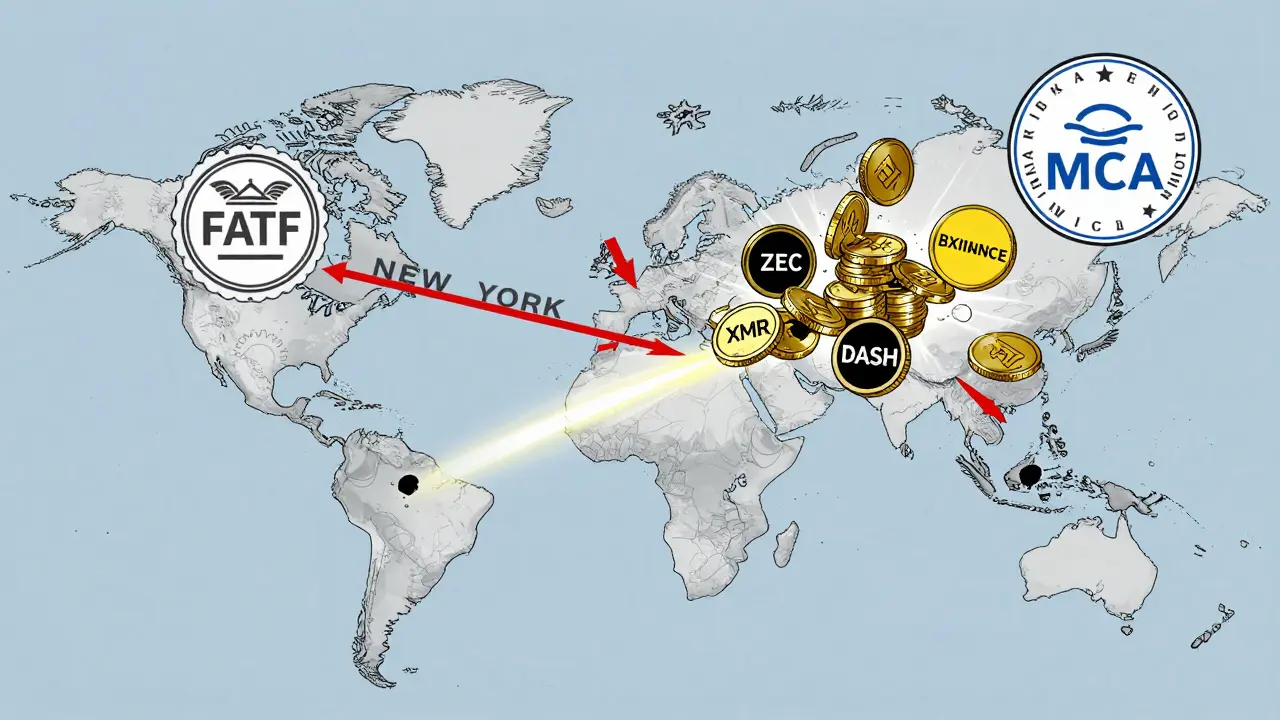

When exchanges start banning Zcash, a privacy-focused cryptocurrency that uses zero-knowledge proofs to hide transaction details. Also known as ZEC, it was built to give users real financial privacy—something most blockchains don’t offer. It’s not just about Zcash. It’s about the entire category of privacy coins, cryptocurrencies designed to obscure sender, receiver, and amount in transactions. Also known as anonymous coins, they include Monero, Dash, and others that prioritize confidentiality over public ledger transparency. These coins are under pressure because regulators see them as tools for money laundering, tax evasion, and illicit activity. But here’s the twist: most users aren’t hiding illegal deals—they’re just protecting their financial data from corporations, advertisers, and surveillance systems. The blockchain privacy, the ability to control who sees your transaction history on a public ledger. Also known as financial privacy, it’s a fundamental right in the digital age. conflict isn’t new. It’s been building since 2018, when major exchanges like Binance and Kraken started delisting privacy coins under regulatory pressure. But the Zcash exchange ban in 2024 hit harder. It wasn’t just one exchange. It was a wave. CoinBase, Gemini, and even some regional platforms pulled ZEC overnight. Why? Because regulators told them to. The FATF’s travel rule, which requires exchanges to share user data across borders, doesn’t play well with zero-knowledge proofs. You can’t track what you can’t see.

What does this mean for you? If you hold Zcash, your options are shrinking. You can’t trade it easily on big platforms anymore. You’re forced into smaller, less secure exchanges—or peer-to-peer networks. That increases risk. But it also means privacy coins are becoming a niche for the technically savvy, not the casual investor. And that’s exactly why regulators want them gone. They don’t want decentralized, untraceable money. They want control. The real question isn’t whether Zcash is safe—it’s whether you believe financial privacy is worth fighting for. Some exchanges still list ZEC, but they’re often unregulated, poorly audited, or outright scams. The ones that remain are either in countries with weak enforcement or are running on borrowed time. Meanwhile, the rest of the market is moving toward compliance, not anonymity. You can still use Zcash, but you’ll need to work harder for it. You’ll need to understand wallets, bridges, and decentralized swaps. You’ll need to avoid phishing sites pretending to be Zcash exchanges. You’ll need to know the difference between a real ZEC wallet and a fake one. And you’ll need to accept that the days of easy Zcash trading are over.

Below, you’ll find real reviews and warnings about crypto exchanges that have either banned Zcash, faced regulatory crackdowns, or got caught trying to hide their own compliance issues. Some are outright scams. Others are just poorly managed. All of them show how the crypto world is changing—and why privacy isn’t just a feature anymore. It’s a battleground.

Major crypto exchanges are removing privacy coins like Monero and Zcash due to new global regulations. Here's why it's happening, where you can still trade them, and what it means for your crypto holdings in 2025.

Finance

Finance