ve(3) Token Lock Model – How Voting Escrow Shapes Crypto Governance

When working with ve(3), a voting‑escrow token‑locking system that boosts voting power and fee earnings for anyone who locks tokens for a fixed period. Also known as voting escrow, it aligns long‑term protocol health with community incentives. This model first appeared in DeFi protocols like Curve and has since spread to many newer projects. By committing assets for months or years, users earn extra governance tokens and a larger share of protocol fees, turning passive holdings into active revenue streams.

Key Elements that Power ve(3)

The ve(3) framework hinges on three core ideas. First, token lock duration directly determines voting weight and reward share. Shorter locks give modest influence, while multi‑year locks can dominate decision‑making. Second, the governance token acts as both a voting credential and a source of fee rebates. Third, the overall tokenomics of a ve(3)‑enabled protocol reshapes emission schedules, reducing inflation as more users lock their tokens. The result is a self‑reinforcing loop: higher lock rates curb token supply growth, which lifts token price, encouraging even more locking.

Understanding ve(3) helps you evaluate why a project’s token price might stay steady while its fee pool explodes, or why a governance proposal can be swayed by a handful of long‑term lockers. Below you’ll find deep dives into airdrops, exchange reviews, and regulatory news—all of which intersect with ve(3) dynamics, from how locked‑token incentives affect token distribution to the way voting escrow shapes market sentiment. Keep reading to see how these concepts play out across real‑world examples and what they mean for your own crypto strategy.

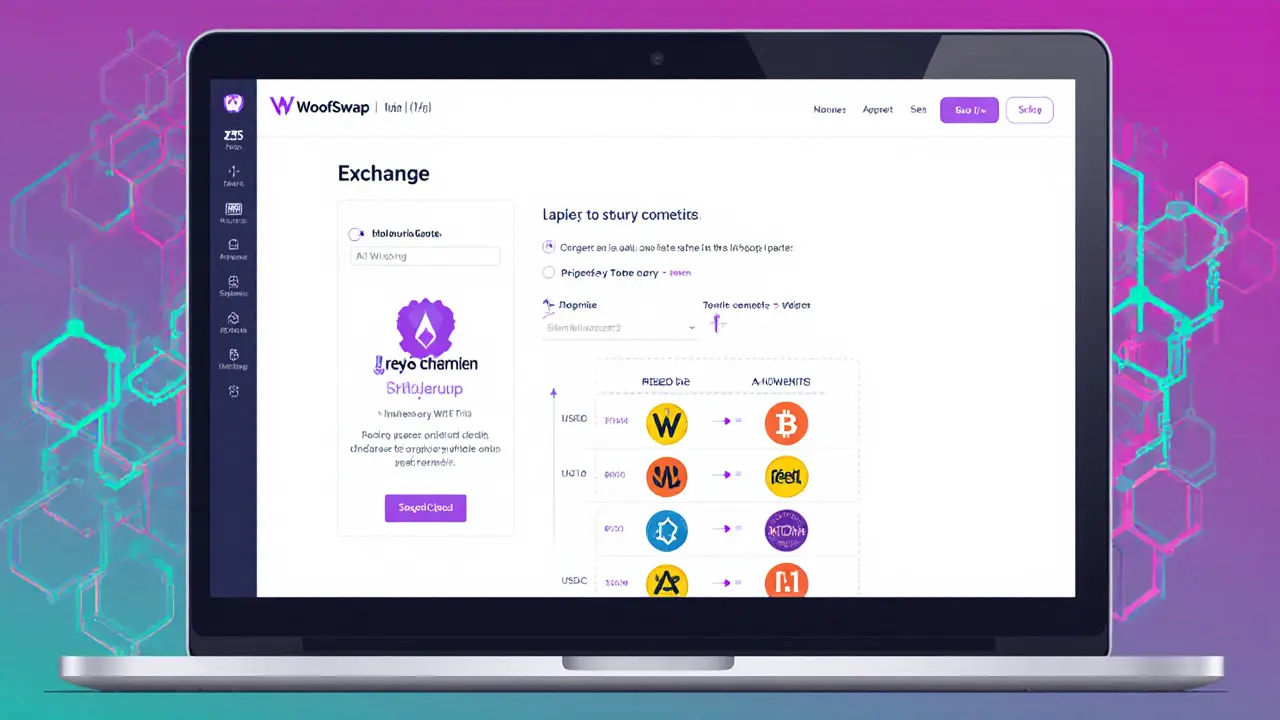

A detailed WoofSwap crypto exchange review covering fees, tokenomics, liquidity, controversy, and future outlook for traders and investors.

Finance

Finance