Tax Evasion Fines: What Traders and Investors Need to Know

When dealing with tax evasion fines, penalties imposed for hiding or misstating taxable income, especially in the fast‑moving crypto world. Also known as tax penalties, they can wipe out profits in minutes. In many jurisdictions these fines are not just a slap on the wrist – they can include hefty cash payments, asset seizures, or even criminal charges. Understanding the mechanics behind them helps you avoid the biggest financial surprise of your trading career.

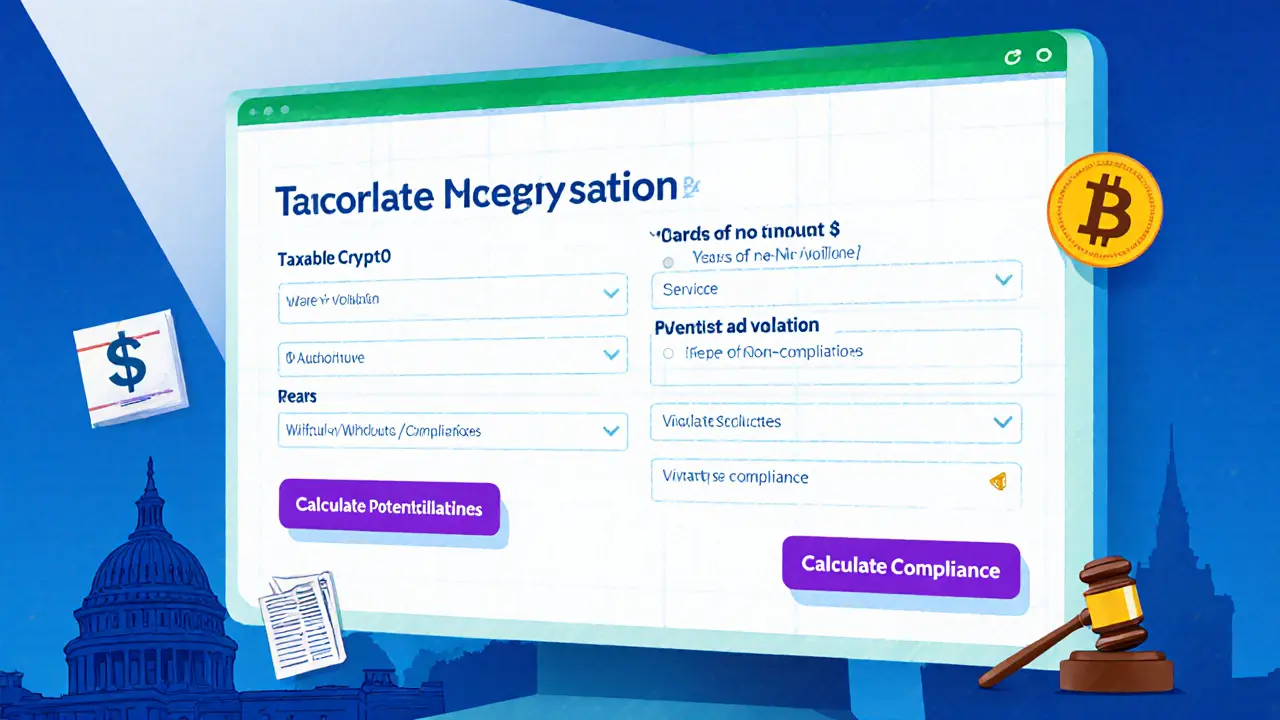

One major driver of tax evasion fines is the way crypto tax rules treat digital assets as property or income. Countries like India levy a flat 30% rate on crypto gains, while Germany offers a tax‑free window after a one‑year hold. If you ignore these nuances, the tax authority can classify omitted income as evasion, triggering fines that often exceed the original tax owed. Another key player is financial penalties the monetary charges levied for non‑compliance with tax codes. These penalties usually come in three flavors: a fixed surcharge, an interest‑based increase, and a punitive fine for intentional concealment. Together they create a layered risk profile that any crypto trader should map out.

Compliance isn’t just about paying the right amount – it also means following AML regulations anti‑money‑laundering rules that require reporting of suspicious transactions. Many tax evasion cases arise when a user tries to hide the source of crypto funds, which triggers AML red flags and can lead to investigations that end in fines. To keep things clean, investors increasingly rely on tax compliance tools software that tracks trades, calculates liabilities, and generates reports for tax filings. Platforms that integrate directly with exchanges simplify the data capture, reduce manual errors, and give you a clear audit trail. In short, the ecosystem links three core ideas: crypto tax rules shape the size of tax evasion fines, AML regulations dictate how authorities spot hidden income, and compliance tools help you stay on the right side of the law.

Why This Matters for Every Crypto Player

Whether you’re a casual holder, a day trader, or a project founder, the risk of facing a tax evasion fine is real. Below you’ll find posts that break down India’s 30% crypto tax, Germany’s 1‑year exemption, the impact of AML sweeps in Nigeria, and practical checklists for avoiding rogue exchanges. Armed with these insights, you’ll be better equipped to navigate the tax landscape without fear of a costly penalty.

Ready to see how the rules apply to your specific situation? Explore the articles below for step‑by‑step guides, jurisdiction‑specific examples, and tools that make compliance a breeze.

Learn how crypto tax evasion can lead to up to 5 years in prison and $250,000 fines, the IRS's enforcement tools, penalties, and practical steps to stay compliant.

Categories

Archives

Recent-posts

Understanding Bitcoin Network Hash Rate: How Computational Power Secures the Blockchain

Dec, 22 2025

Finance

Finance