Stablecoins Regulation: Rules, Risks, and Real‑World Impact

When working with stablecoins regulation, the collection of laws, licensing requirements, and supervisory tools that govern digital tokens designed to hold a stable value. Also known as stablecoin compliance, it often draws on the EU’s MiCA (Markets in Crypto‑Assets) framework and national anti‑money‑laundering (AML) standards. In addition, central bank digital currencies (CBDCs) create a parallel regulatory track, forcing lawmakers to compare peg mechanisms with sovereign digital money. The result is a three‑pillar system: reserve‑asset verification, consumer‑protection disclosures, and AML/KYC enforcement. Any issuer – whether an algorithmic design like Nirvana ANA, a fiat‑backed token in Taiwan, or a regulated stablecoin in India – must pass these checkpoints before it can be listed on an exchange or used for payments. This web of rules shapes market entry, pricing stability, and investor confidence across the crypto landscape.

Why Understanding These Rules Matters

Understanding stablecoins regulation is key because the rules dictate who can issue, list, or trade a stablecoin and under what conditions. For example, the EU’s MiCA sets a uniform reserve‑asset ratio, mandates public disclosures, and gives supervisors the power to halt non‑compliant projects. Meanwhile, China’s 2025 crypto ban forces all stablecoin activity onto the state‑run digital yuan, making compliance a matter of national policy rather than private licensing. In India, the 30% crypto tax couples with emerging AML guidelines, meaning traders must report gains and keep detailed transaction records to avoid hefty penalties. Taiwan’s selective banking restrictions require virtual‑asset service providers (VASPs) to register, prove solvency, and align with the country’s own CBDC roadmap. Across these jurisdictions, the common thread is that regulators use AML frameworks, reserve‑asset audits, and consumer‑protection clauses to keep stablecoins from becoming unchecked money‑laundering channels or sources of systemic risk. The semantic triple “stablecoins regulation requires AML compliance”, “MiCA influences stablecoins regulation”, and “CBDCs reshape the stablecoins regulatory landscape” captures how these entities interact.

Below you’ll find a curated set of articles that break down each of these pieces in detail. Whether you’re tracking the latest Chinese crackdown, comparing India’s tax regime, or digging into Taiwan’s VASP registration process, the posts offer real‑world examples, step‑by‑step guides, and risk assessments. Use them to gauge how the global patchwork of rules could affect your stablecoin strategy, from token design to exchange listing and beyond.

Explore how communities worldwide adopt cryptocurrency despite bans, with a focus on Nigeria's grassroots movement, drivers, risks, and future regulatory trends.

Categories

Archives

Recent-posts

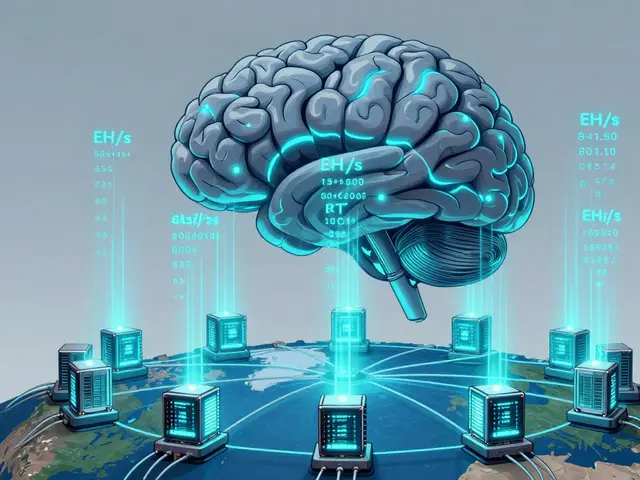

Understanding Bitcoin Network Hash Rate: How Computational Power Secures the Blockchain

Dec, 22 2025

Finance

Finance