Single-Supply Cryptocurrency: What It Is and Why It Matters

When you hear single-supply cryptocurrency, a digital asset with a fixed, unchangeable total number of coins issued at launch. Also known as fixed supply crypto, it means no more coins can ever be created — not by developers, not by miners, not by any committee. This isn’t just a technical detail. It’s a promise. A promise that the money won’t be diluted, that inflation won’t sneak in through backdoors, and that scarcity is baked into the code.

Compare that to traditional money, where central banks print more bills whenever they want. Or even to some crypto projects that keep minting new tokens to fund development or reward insiders. A single-supply cryptocurrency, a digital asset with a fixed, unchangeable total number of coins issued at launch. Also known as fixed supply crypto, it means no more coins can ever be created — not by developers, not by miners, not by any committee. This isn’t just a technical detail. It’s a promise. A promise that the money won’t be diluted, that inflation won’t sneak in through backdoors, and that scarcity is baked into the code.

Compare that to traditional money, where central banks print more bills whenever they want. Or even to some crypto projects that keep minting new tokens to fund development or reward insiders. A deflationary crypto, a token designed to lose supply over time through burning or locking mechanisms. Also known as burning token, it often pairs with single-supply models to make scarcity even stronger. Projects like Bitcoin, with its 21 million cap, set the standard. But many others — like limited supply token, a crypto with a predetermined maximum number of units, often used to create artificial scarcity. Also known as hard-capped token, it’s a common feature in meme coins and DeFi projects trying to sound serious — copy the idea without the real-world demand. That’s where things get messy. You’ll see tokens with a fixed supply but zero trading volume, no team updates, and no real use case. They look like single-supply coins on paper, but act like digital ghosts.

The real value of a single-supply cryptocurrency isn’t in the number itself. It’s in the trust behind it. If a project says it has 10 million coins and never adds more, but the code allows it to change later — that’s not trust. That’s a lie written in smart contracts. The best single-supply coins are open-source, audited, and have proof that the supply can’t be altered. That’s why you’ll find posts here digging into coins that claimed to be fixed-supply but turned out to be scams, or projects that burned millions of tokens to shrink supply even further — turning a single-supply model into a shrinking-supply one.

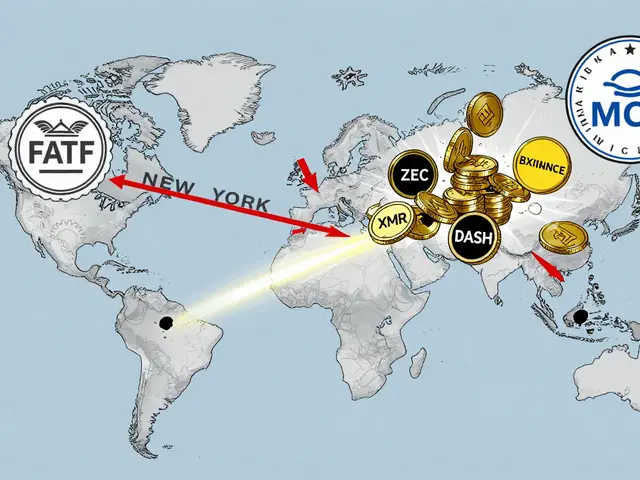

What you’ll find below isn’t a list of top coins. It’s a collection of real stories — some about coins that vanished, others about platforms that promised scarcity but delivered nothing. You’ll see how single-supply crypto gets misused in meme tokens with quadrillions of coins, how privacy coins get delisted not because of supply but regulation, and how fake airdrops try to trick you into thinking a token is rare when it’s worthless. This isn’t about hype. It’s about spotting what’s real — and what’s just a number on a screen.

O Intelligence Coin (OI) is a unique cryptocurrency with only one coin in existence, split into 100 million units. Built on Solana, it powers a decentralized AI ecosystem called Sovereign Super Intelligence, designed to operate without corporate or government control.

Categories

Archives

Recent-posts

Privacy Coin Delisting Wave from Crypto Exchanges: Why Major Platforms Are Dropping XMR, ZEC, and DASH

Dec, 4 2025

Finance

Finance