Regional Crypto Exchanges: What You Need to Know

When navigating regional crypto exchanges, platforms that operate primarily within a specific country or geographic zone, offering local fiat pairs, compliance rules, and support tuned to that market. Also known as local crypto exchanges, they often face unique regulatory environments and liquidity patterns.

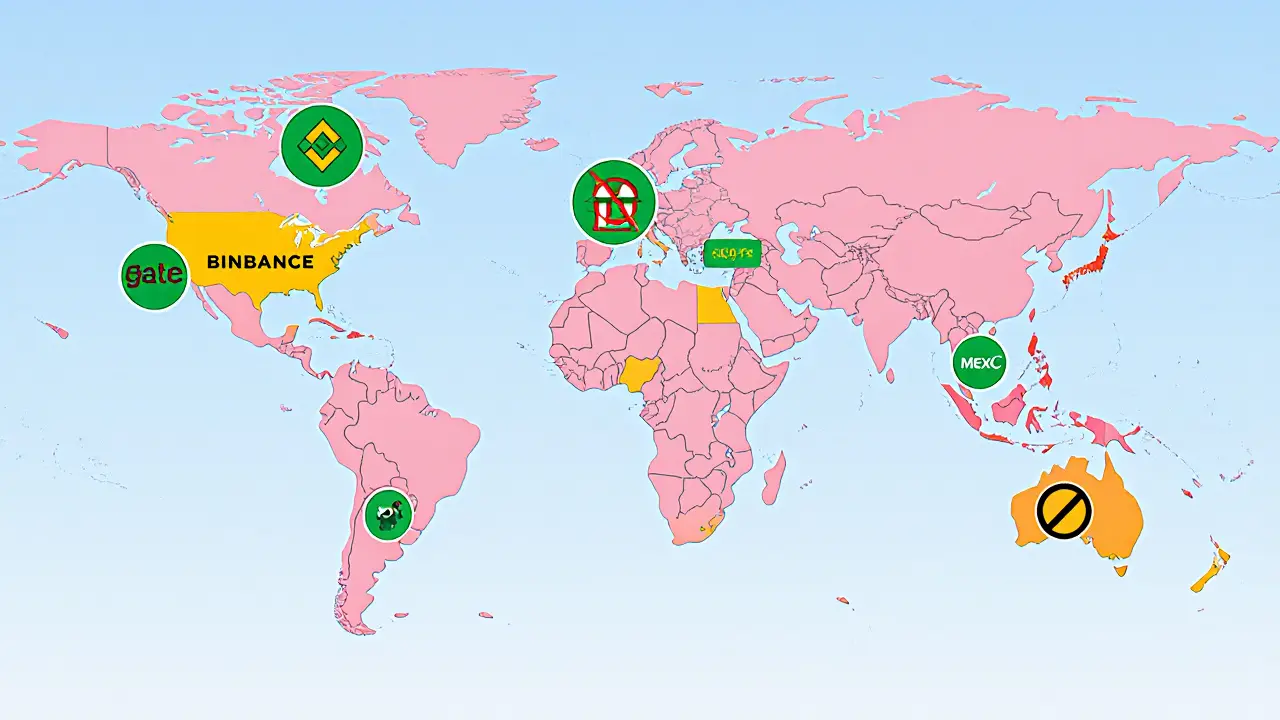

Understanding crypto exchange regulation, the set of laws, licensing requirements and AML/KYC standards each jurisdiction imposes on exchange operators is crucial because it directly shapes which coins you can trade, the fees you pay, and the security measures in place. For example, China’s 2025 ban forces every local platform to shut down, while Taiwan’s FSC rules demand VASP registration and strict AML reporting. These rules influence the user experience on regional exchanges and dictate how quickly new listings appear.

Our crypto exchange review, hands‑on assessment of features, security, fees, liquidity and compliance for each local platform breaks down the hard numbers. We compare fee structures on Coinext in Brazil, security protocols on SuperEx, and liquidity depth on OpenSwap. The goal is to show you which regional exchange offers the best balance of cost, safety, and local fiat access for your trading style.

Many regional platforms become the first stop for airdrop participants because they often require local KYC verification. Our crypto airdrop, free token distribution events that target users of specific exchanges or regions guide walks you through claiming the Bull Finance BULL tokens, the POTS token from Moonpot, and the VERSE giveaway tied to CoinMarketCap. By following the steps, you avoid common scams and meet eligibility criteria that differ from global airdrops.

Tax considerations round out the picture. India’s 30% crypto tax, Brazil’s emerging tax framework, and Nigeria’s impact on the naira all illustrate how regional policy shapes your bottom line. We break down filing steps, record‑keeping tips, and penalties for evasion so you stay compliant no matter where you trade.

regional crypto exchanges bring local convenience but also demand awareness of regulation, fees, airdrop rules, and tax obligations. Below you’ll find a curated mix of reviews, regulatory updates, airdrop guides, and tax insights that together give you a clear roadmap for trading on any local platform.

Explore how crypto exchange availability varies worldwide, what regulations shape access, and which platforms serve each region in 2025.

Finance

Finance