Russia doesn’t ban cryptocurrency - but it doesn’t let you use it like cash either. If you’re wondering whether you can buy Bitcoin, send Ethereum, or mine Dogecoin in Russia, the answer is: yes, but only under strict rules. The government lets you own crypto, mine it, and even trade it - but only if you’re rich, only through approved channels, and never to pay for groceries, rent, or a taxi ride.

Ownership is legal. Spending is not.

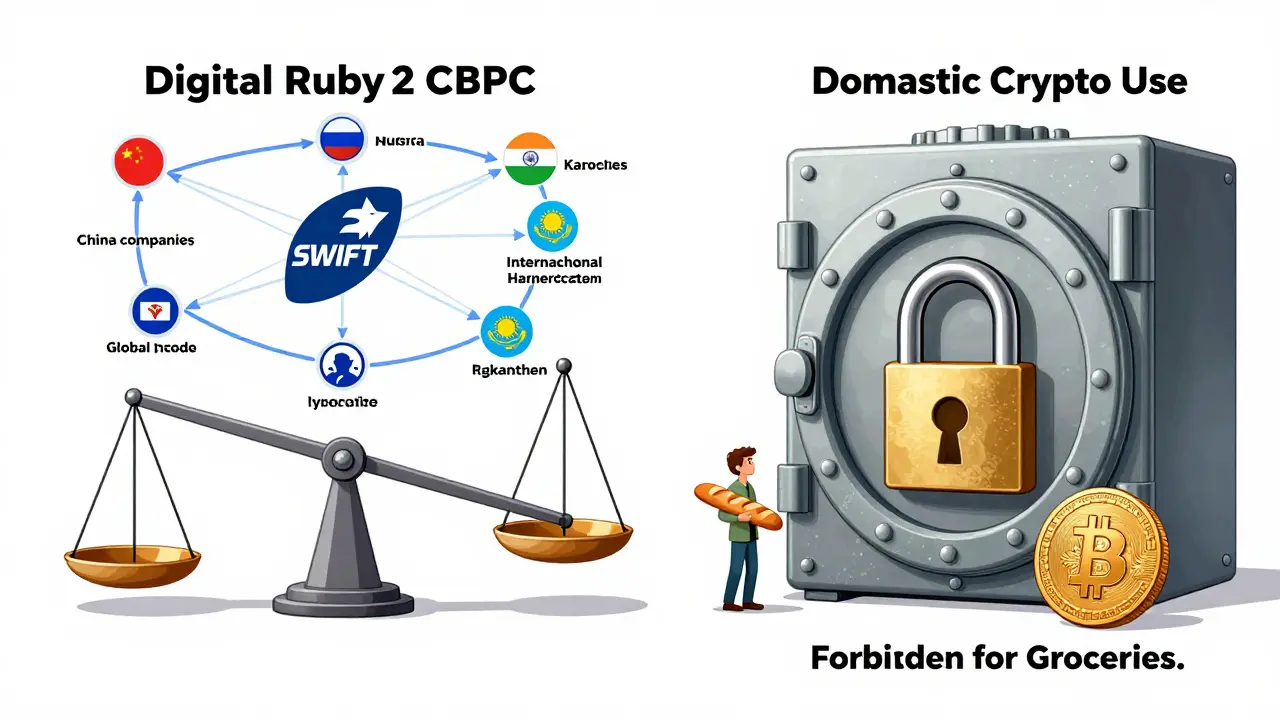

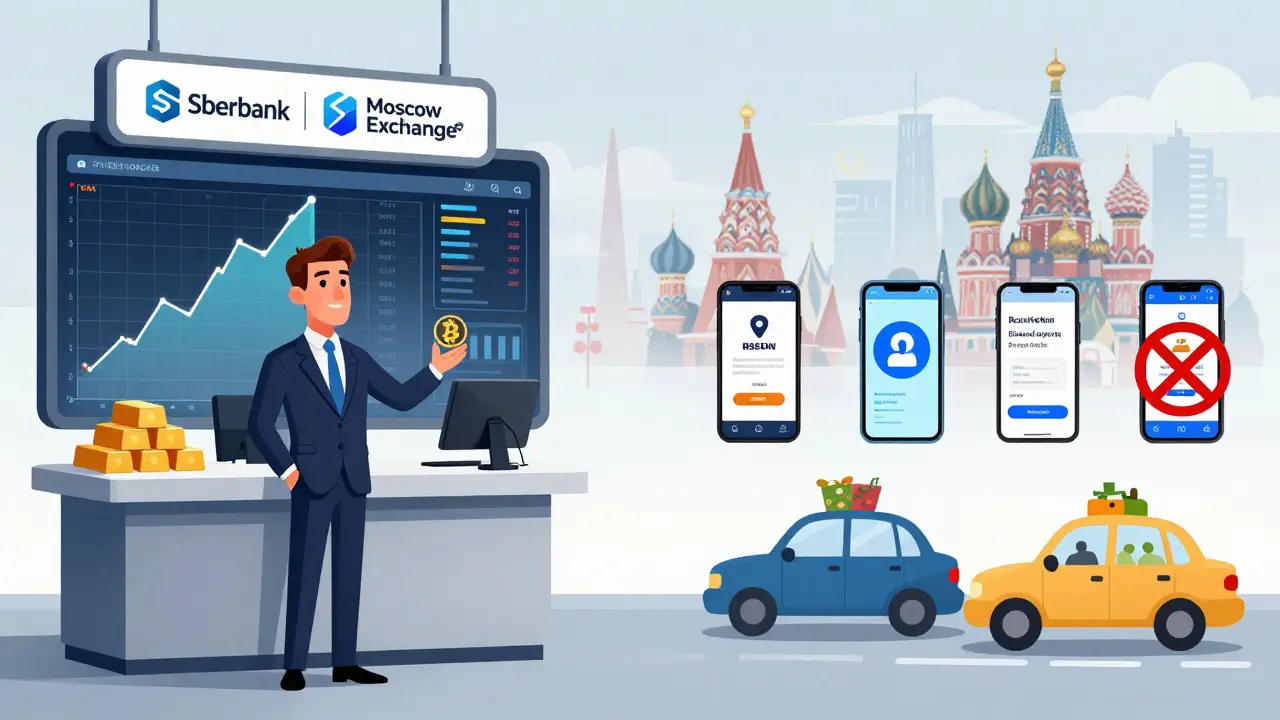

Since January 2021, it’s been illegal to use Bitcoin, Ethereum, or any other cryptocurrency to pay for goods or services inside Russia. That means no buying coffee with Litecoin, no paying your plumber in Solana, and no tipping your Uber driver in USDT. The law is clear: digital assets can’t be used as money in daily life. But owning them? Totally fine. Russians hold over $25 billion in crypto, according to official estimates. Most of that is stored on foreign exchanges like Binance or Bybit because there are no licensed domestic crypto exchanges for regular people. You can’t open a trading account at Sberbank unless you meet the elite criteria - more on that later.The two-tier system: rich investors vs. everyone else

Russia created a secret club for crypto: the Experimental Legal Regime (ELR). Launched in March 2025, this is the only legal way to trade crypto derivatives - like Bitcoin futures - inside the country. But you don’t just sign up. You have to qualify. To join, you need to be a "highly qualified investor." That means either:- Have over 100 million rubles ($1.2 million) in securities or bank deposits, OR

- Earn at least 50 million rubles ($600,000) per year

Crypto mining: Russia’s secret economic weapon

While regular people are locked out of trading, Russia is actively encouraging crypto mining. It’s the only crypto activity with full government backing. The state runs a registry of mining companies. They pay taxes. They get access to cheap electricity. President Putin himself has pushed regions with surplus power - like Siberia and the Far East - to turn idle power plants into mining farms. Why? Because mining isn’t just about Bitcoin anymore. Boris Titov, Putin’s advisor on business development, says mining rigs can be repurposed for artificial intelligence. "The infrastructure built for crypto mining can be used for AI tasks," he said in 2025. Russia’s AI market is projected to hit $100 billion by 2030. Mining rigs, once used to solve crypto puzzles, are now being rewired to train neural networks. It’s a smart play: use your energy surplus to build a future tech industry.

International trade: bypassing sanctions with crypto

Russia’s biggest crypto success story isn’t trading - it’s trade. After Western sanctions cut off access to SWIFT and dollar clearing systems, Russian companies turned to crypto to pay for imports and exports. In the first half of 2025, Russian businesses settled over 1 trillion rubles ($12 billion) in international trade using cryptocurrencies. That’s not a small side hustle. That’s a full-blown alternative financial system. Boris Titov calls it a "historic opportunity" - combining private crypto assets with Russia’s own Digital Ruble to create a payment system outside U.S. control. The Digital Ruble, launched in August 2023, is a central bank digital currency (CBDC) used by 12 banks and over 2,500 wallets. It’s not meant to replace cash. It’s meant to replace the dollar in global trade. So while you can’t buy a loaf of bread with Bitcoin in Moscow, you can use it to pay for machinery from China, oil from India, or grain from Kazakhstan. That’s the real goal: economic independence.Who’s in charge? The battle inside the government

There’s a quiet war inside Russia’s government. The Central Bank wants to keep crypto locked away - scared of ordinary people losing money. The Finance Ministry wants to open it up - because they see the money, the jobs, and the geopolitical power. Alexey Yakovlev from the Finance Ministry said in late 2025: "We believe these criteria can be adjusted downwards. It’s being discussed now." He’s talking about lowering the $1.2 million threshold. If that happens, thousands more Russians could legally trade crypto derivatives. But the Central Bank is holding back. They’ve spent years warning that crypto is a "financial danger." They’re not ready to let middle-class Russians in. Until they agree, the two-tier system stays.

What’s next? The clock is ticking

The Experimental Legal Regime is set to expire in March 2028. That’s three years from now. By then, the government will decide whether to make it permanent - and who gets in. Expect more changes in 2026:- Investment funds may be allowed to buy crypto derivatives

- Lowered qualification thresholds - possibly

- More integration between the Digital Ruble and private crypto networks

- Expanded mining regulations for AI infrastructure

Bottom line: Is crypto regulated in Russia?

Yes - but only for the few. You can own it. You can mine it. You can use it to pay for imports. But you can’t use it to pay for your phone bill. You can’t trade it unless you’re rich. And you can’t buy it legally on a Russian exchange unless you’re part of the elite. The system isn’t broken. It’s working exactly as designed. Russia turned crypto from a threat into a tool - for sanctions evasion, energy monetization, and global financial leverage. For ordinary people? It’s a reminder that in Russia, crypto isn’t about freedom. It’s about control.Can I buy Bitcoin in Russia legally?

Yes, but only if you’re a qualified investor with over $1.2 million in assets or $600,000 annual income. You can buy Bitcoin futures through approved brokers like Sberbank or the Moscow Exchange. Regular Russians buy Bitcoin on foreign platforms like Binance, but those transactions aren’t regulated or protected by Russian law.

Is it illegal to use crypto to pay for things in Russia?

Yes. Since January 2021, using cryptocurrency to pay for goods or services within Russia has been illegal. You can’t use Bitcoin to buy food, pay rent, or order a taxi. The law allows ownership and trading, but not use as money domestically.

Can I mine cryptocurrency in Russia?

Yes, and it’s one of the few fully legal crypto activities. The government maintains a registry of mining companies, offers tax incentives, and encourages regions with cheap electricity to host mining farms. Mining is even seen as a stepping stone to building AI infrastructure.

What is the Digital Ruble?

The Digital Ruble is Russia’s central bank digital currency (CBDC), launched in August 2023. It’s a government-backed digital version of the ruble, used by 12 banks and over 2,500 wallets. Unlike Bitcoin, it’s not decentralized. It’s designed to replace traditional bank transfers and eventually serve as a foundation for international trade outside Western financial systems.

Why does Russia allow crypto if it bans its use?

Russia sees crypto as a tool, not a currency. It uses crypto mining to generate energy revenue and build AI infrastructure. It uses crypto for international trade to bypass sanctions. And it uses the regulated market to attract wealthy investors and financial institutions. By controlling access, it keeps the system stable while gaining economic advantages.

Will crypto become legal for average Russians in 2026?

Possibly - but not soon. The Finance Ministry is pushing to lower the $1.2 million investment threshold to let more people trade crypto derivatives. But the Central Bank is resisting, fearing risks to ordinary citizens. Any change will be slow, limited, and likely still exclude most people. Don’t expect to open a crypto account at your local bank anytime soon.

How much crypto do Russians hold?

Russians hold over $25 billion in cryptocurrency, according to official estimates. Most of it is stored on foreign exchanges because domestic trading options are extremely limited. Despite the restrictions, crypto adoption remains high, especially among those who use it for international trade or as a store of value.

Finance

Finance

christopher charles

January 2, 2026 AT 15:41This is wild-Russia’s basically turning crypto into a luxury sport for billionaires while the rest of us are stuck using cash like it’s 1998. I get the sanctions angle, but man… if you can’t buy coffee with Bitcoin, what’s the point?

Vernon Hughes

January 4, 2026 AT 12:08The Digital Ruble is the real story here. Not Bitcoin. Not mining. The state is building its own financial firewall. This isn’t about control-it’s about survival.

Alison Hall

January 6, 2026 AT 05:47Miners are basically Russia’s secret AI engineers now. Who knew crypto rigs could double as neural net trainers? That’s next-level resourcefulness.

Amy Garrett

January 7, 2026 AT 17:01so like… you can mine dogecoin but not pay your rent with it?? lmao this is peak bureaucratic chaos

Phil McGinnis

January 7, 2026 AT 23:29The notion that a nation would weaponize cryptocurrency while denying its citizens basic utility is not only ironic-it is a testament to the decay of liberal economic principles. This is not innovation. This is authoritarian engineering disguised as policy.

Ian Koerich Maciel

January 8, 2026 AT 17:45It’s fascinating how Russia has turned a perceived threat into a strategic asset. The way they’ve repurposed mining infrastructure for AI is genius. The government isn’t just regulating crypto-it’s architecting the future. Respect.

Andy Reynolds

January 10, 2026 AT 12:45Imagine being the guy who bought Bitcoin in 2020 just to pay for pizza… and now you can’t even use it to tip your barista. Meanwhile, the oligarchs are trading futures like it’s a country club. This system is less ‘regulation’ and more ‘class segregation with blockchain’.

Alex Strachan

January 11, 2026 AT 02:36So… you can’t buy a burrito with Bitcoin, but you can buy a whole damn oil tanker with it? 🤡 That’s not a policy. That’s a meme turned into a national strategy.

Rick Hengehold

January 12, 2026 AT 15:57They’re not banning crypto. They’re just making sure only the rich can play. That’s the whole point. Don’t pretend this is about security-it’s about power.

Brandon Woodard

January 13, 2026 AT 12:37It’s a paradox wrapped in a regulatory framework, embedded within a geopolitical strategy. The state permits ownership to extract value, prohibits circulation to maintain control, and leverages mining to build infrastructural dominance. This is not chaos-it is calculus.

Antonio Snoddy

January 15, 2026 AT 00:15Think about it: crypto was supposed to be the people’s money. The decentralized, borderless, anti-establishment dream. But now? It’s just another tool in the hands of the same elites who built the system it was meant to destroy. We traded one cage for another-only now the bars are made of blockchain and the key is held by a bureaucrat in Moscow who’s never even mined a single hash. The revolution didn’t fail. It got bought out.

Ryan Husain

January 15, 2026 AT 08:18The fact that Russia is using crypto to bypass sanctions while building a CBDC to replace the dollar is a masterstroke. It’s not about freedom-it’s about sovereignty. And honestly? Other nations should be paying attention, not just judging.

Rajappa Manohar

January 16, 2026 AT 04:23india also doin same thing but less extreme. we allow crypto trading but ban payments. its global trend now

rachael deal

January 16, 2026 AT 20:17Wait so if I mine crypto and then sell it to a rich guy who uses it to buy oil from India… does that count as me indirectly paying for oil? 😅