OI Crypto: What It Is, Why It Matters, and What You Need to Know

When you see OI crypto, open interest in cryptocurrency derivatives. It's not just a number—it's a live pulse of how many active contracts are out there, and who’s betting big. Think of it like this: if you and ten friends each place a bet on whether Bitcoin will go up or down tomorrow, the total number of those bets is the open interest. It doesn’t matter if you win or lose—what matters is that those bets are still live. That’s OI crypto in a nutshell.

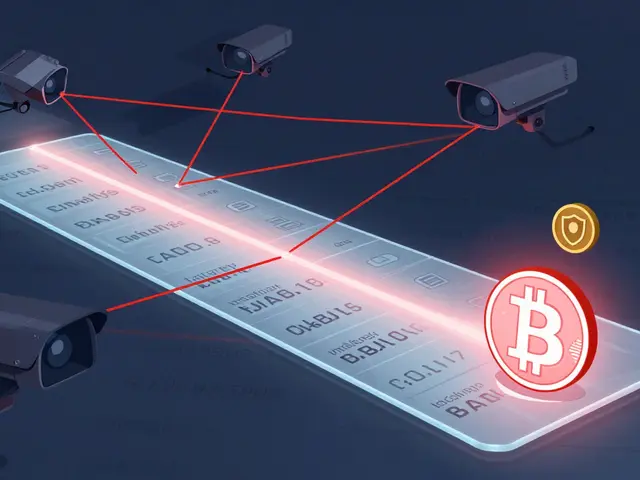

Open interest doesn’t tell you the price direction, but it tells you how much conviction is behind it. If OI climbs while the price rises, it means new money is coming in, and the trend might have staying power. If OI drops while price falls? That’s likely traders bailing out, not new bears pushing down. This is why smart traders watch OI alongside volume and price—not as a crystal ball, but as a warning light. You’ll see this pattern repeated across platforms like Bitfinex, Minswap V2, and even the high-leverage setups on THENA FUSION—all places where traders use derivatives to bet on crypto moves.

Related to OI crypto are crypto derivatives, financial contracts tied to crypto assets like Bitcoin or Ethereum, which include futures, options, and perpetual swaps. These aren’t for buying and holding—they’re for betting on price swings. And where there are bets, there’s open interest. You can’t understand why prices spike or crash on exchanges like BiKing or Chronos without checking OI. High OI means more liquidity, tighter spreads, and better execution. Low OI? That’s when a small trade can swing the price wildly—and that’s where scams and manipulations hide.

Also tied to OI crypto is trading volume, the total amount of crypto traded over a period. Volume shows how much is changing hands; OI shows how many bets are still active. If volume spikes but OI stays flat, it’s likely just traders closing positions—not new entries. If both rise together? That’s the real signal. This is why posts about Bitfinex, Minswap, and Chronos all mention liquidity and fees—because OI and volume are the hidden drivers behind those metrics.

And then there’s crypto market analysis, the practice of reading price action, volume, and open interest to predict movement. It’s not guesswork. It’s pattern recognition. When you see a post warning about a fake airdrop like CoPuppy or Sonar Holiday, or exposing a scam exchange like CEEX or GCOX, they’re often using the same tools: checking OI to see if the hype matches real trading activity. If a token surges but OI is near zero? That’s a red flag. Real momentum needs open contracts behind it.

What you’ll find below isn’t just random posts. It’s a collection of real-world examples where OI crypto, derivatives, and market analysis actually matter. From deep dives into exchanges with real liquidity to exposes of platforms with no open interest and zero trust, every article here helps you separate noise from signal. You won’t find fluff. You’ll find what works—and what gets traders burned.

O Intelligence Coin (OI) is a unique cryptocurrency with only one coin in existence, split into 100 million units. Built on Solana, it powers a decentralized AI ecosystem called Sovereign Super Intelligence, designed to operate without corporate or government control.

Finance

Finance