Minswap Review: What You Need to Know Before Using This DeFi Exchange

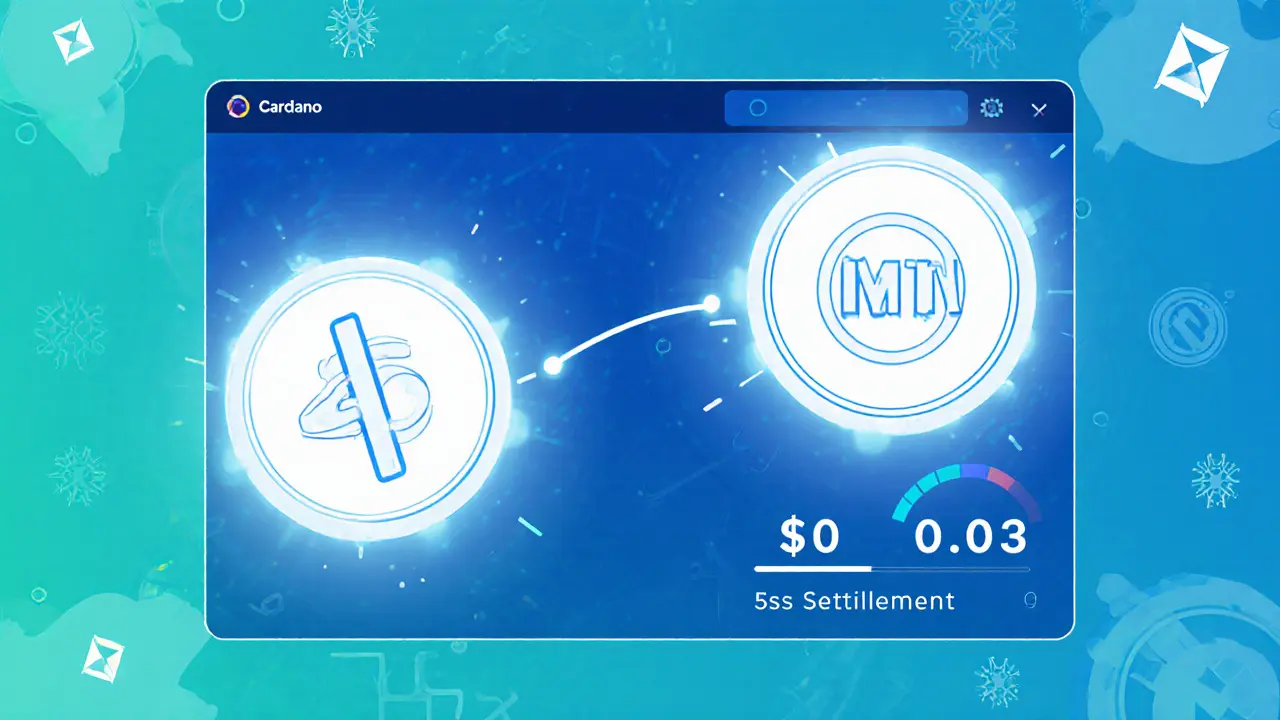

When you hear Minswap, a decentralized exchange built on the Cardano blockchain that lets users trade tokens without intermediaries. It's one of the few native DeFi platforms on Cardano, designed for people who want to swap tokens, provide liquidity, and earn rewards—all without giving up control of their wallet. Unlike centralized exchanges like Binance or Coinbase, Minswap runs entirely on smart contracts. That means no company holds your funds, no KYC is required, and no one can freeze your account. But that also means you’re fully responsible for what happens—good or bad.

Most users come to Minswap for its liquidity pools, where traders deposit pairs of tokens to help others swap them, and in return, earn a share of trading fees. These pools are the engine behind Minswap’s operation, and they’re what make it different from simple token swap tools. You’ll also find FLM token, the native governance token of Minswap that lets holders vote on platform upgrades and earn staking rewards. But here’s the catch: FLM’s value isn’t guaranteed. Its price swings with trading volume, and if liquidity dries up, your rewards drop fast. Many users don’t realize that high APYs often come with high risk—especially on newer chains like Cardano where projects can vanish overnight.

What’s missing from Minswap? A lot of the polish you’d find on Ethereum-based DEXs. The interface is functional but clunky. Customer support is nearly nonexistent. And while Cardano’s low fees are a plus, the network can still get slow during big price moves. There’s no insurance for lost funds, no audit reports from top firms like CertiK, and no clear roadmap beyond vague promises of "future upgrades." If you’re looking for a safe, long-term DeFi platform, Minswap isn’t it. But if you’re comfortable taking risks, understand impermanent loss, and want to be early on Cardano’s DeFi scene—it’s one of the only real options out there.

Below, you’ll find real user experiences, breakdowns of its tokenomics, and warnings from traders who lost money because they assumed Minswap was as secure as a big exchange. Some posts reveal hidden fees. Others show how a simple typo in a token address wiped out someone’s entire position. There’s no sugarcoating here—just what actually happened to real people using Minswap. If you’re thinking about trading there, read these first. You might save yourself a lot of grief—and a lot of ADA.

Minswap V2 is the fastest, cheapest DEX on Cardano with near-zero fees, smart routing, and a clean interface. Perfect for traders who want speed and control without the bloat of other platforms.

Finance

Finance