Kraken Fees – What You Need to Know

When you check out Kraken fees, the charge structure used by the Kraken cryptocurrency exchange for trades, deposits and withdrawals, you quickly see why they matter for every trader. Also known as Kraken trading costs, these fees shape profit margins, affect order types, and influence which assets you move. Understanding the details helps you keep more of your gains and avoid surprise charges.

How the fee system breaks down

The first thing to grasp is the difference between a maker fee, the cost you pay when you add liquidity to the order book with a limit order and a taker fee, the charge applied when you remove liquidity using a market or instant order. On Kraken, makers typically pay less because they help keep the market fluid, while takers pay a bit more for the convenience of instant execution. The exact percentages vary with your 30‑day trading volume, so higher‑volume users often see fees drop into the low‑tenths of a percent.

Next up is the withdrawal fee, the flat or percentage charge for moving crypto off the platform. Each coin has its own rate, usually reflecting network costs. For example, Bitcoin withdrawals cost a few cents, while smaller, less‑used tokens may have higher fees to cover miner expenses. Deposits, on the other hand, are generally free, making it cheap to bring money into Kraken before you start trading.

Kraken also runs a tiered fee schedule based on your 30‑day trading volume. If you trade under $50,000, you stay in the base tier with maker fees around 0.16% and taker fees near 0.26%. Once you cross $1 million, maker fees can fall below 0.00% and taker fees dip to roughly 0.10%. The volume brackets are transparent on Kraken’s site, and they update automatically each month, so you always know where you sit.

Why do these tiers matter? Different trader styles feel the impact in distinct ways. Day traders who flip positions many times a day pay taker fees on almost every trade, so even a tenth of a percent adds up fast. Swing traders who set limit orders and let them sit earn maker rebates and enjoy lower overall costs. Long‑term holders may only trade a few times a year, making the base tier sufficient for them.

Comparing Kraken to other cryptocurrency exchange, platforms where users buy, sell and trade digital assets like Binance or Coinbase can give you perspective. Binance often advertises ultra‑low taker fees (as low as 0.04% with BNB rebates), while Coinbase tends to sit higher, especially for smaller accounts. Kraken lands in the middle, offering a predictable fee model and a strong reputation for security and regulatory compliance. If you value a balance between cost and trust, Kraken’s fee structure usually feels fair.

There are a few proven tricks to shave off extra costs. First, use limit orders whenever possible—that way you become a maker and capture the lower rate. Second, increase your monthly volume by consolidating trades on Kraken instead of spreading them across multiple platforms; the tiered system rewards that concentration. Third, consider staking Kraken’s native token (if available) or participating in its fee‑rebate programs, which can offset taker fees by a few basis points. Finally, keep an eye on network congestion; moving assets during low‑traffic periods can reduce withdrawal fees for certain coins.

Kraken occasionally updates its fee schedule to reflect market conditions, regulatory changes, or new asset listings. These updates are posted on the exchange’s blog and often come with brief explanations. Staying aware of such changes helps you adjust your strategy before a fee hike catches you off guard. Most of the time, the core structure—maker vs taker, volume tiers, and coin‑specific withdrawals—remains stable, giving you a reliable baseline for planning trades.

Armed with this overview, you can now dive into the specific articles below. Whether you’re hunting the exact maker‑taker percentages for a given pair, checking the latest Bitcoin withdrawal charge, or learning how to optimize your trading volume for lower costs, the collection covers the full spectrum of Kraken fees topics you’ll need to master.

A detailed 2025 review of Kraken crypto exchange covering fees, security, features, pros/cons, and how it compares to competitors like Coinbase.

Categories

Archives

Recent-posts

Different Variations of Proof of Stake Explained: How Ethereum, Cardano, and Others Validate Blocks

Jan, 4 2026

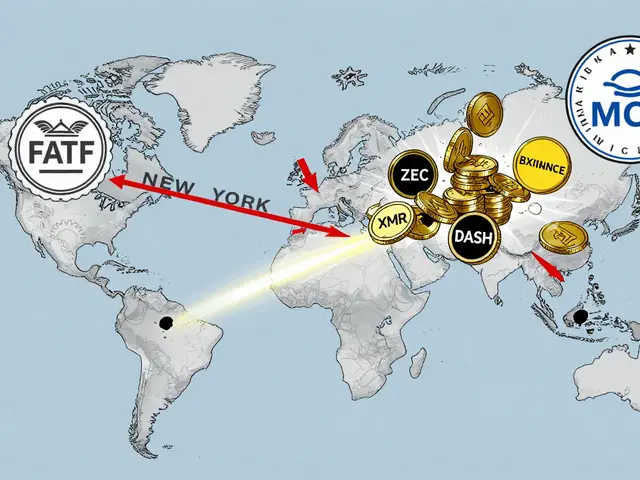

Privacy Coin Delisting Wave from Crypto Exchanges: Why Major Platforms Are Dropping XMR, ZEC, and DASH

Dec, 4 2025

Finance

Finance