HTX Fees – A Clear Look at Costs on the HTX Exchange

When you start using HTX fees, the charges applied by the HTX cryptocurrency exchange for trades, withdrawals, deposits and other services. Also known as Huobi Global fees, they directly affect how much profit you keep after each transaction. Right after that, you’ll notice that cryptocurrency exchange fees, the collection of costs that platforms levy for trading, withdrawing and using extra features vary widely. Understanding these fees is the first step to avoiding unwanted surprises on your account.

Breaking Down the HTX Fee Structure

The fee schedule on HTX is built around a maker‑taker model, a pricing system where users who add liquidity (makers) pay lower rates than those who take liquidity (takers). Makers typically enjoy rates as low as 0.02%, while takers can face up to 0.2% depending on volume. On top of that, HTX offers a Huobi token (HT) discount, a reduction in fee percentages for holders or stakers of HT on the platform. Holding 1,000 HT can shave a few tenths of a percent off both maker and taker fees, turning a small edge into a noticeable gain over many trades.

HTX fees also include withdrawal charges that differ by blockchain. For example, moving Bitcoin out of HTX usually costs a flat 0.0005 BTC, while ERC‑20 tokens might be subject to a $5 network fee. Deposit fees are generally free, but large fiat deposits may incur a processing fee of around 0.1%. These numbers matter when you’re scaling up a trading strategy; a few dollars per withdrawal can erode profits if you move assets frequently.

The fee layout isn’t static. HTX updates its rates quarterly, often rewarding higher monthly trading volume with better tiers. Traders who consistently hit $100k in volume can see maker fees drop to 0.015% and taker fees to 0.15% even without HT holdings. This tiered approach mirrors what you’ll find on other exchanges covered in our collection, such as OpenSwap or SuperEx, but HTX’s token‑discount feature gives it a unique lever for cost reduction.

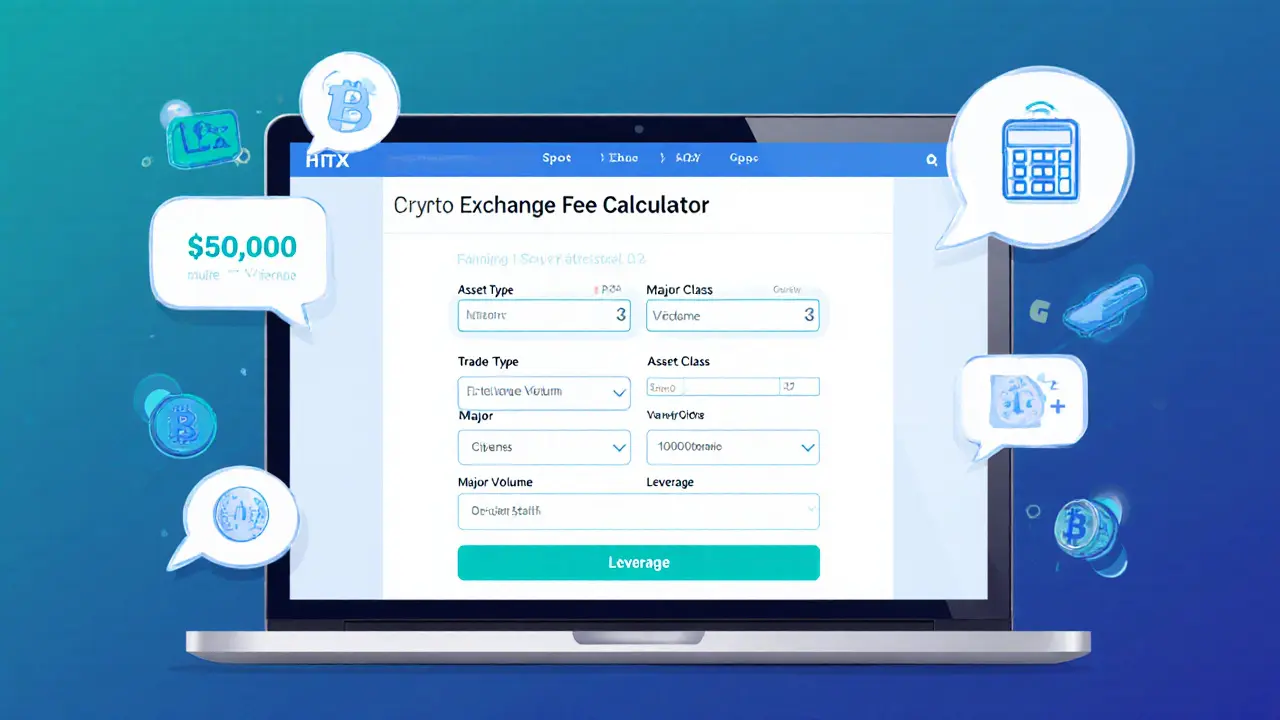

So how can you keep fees under control? First, check the live fee table on HTX before each trade; the numbers are displayed next to the order book. Second, consider consolidating withdrawals to reduce the number of network charges. Third, if you hold a decent amount of HT, enable the discount in your account settings – it’s a one‑click toggle. Finally, use the built‑in fee calculator that HTX provides to forecast the exact cost of a trade before you hit “confirm”. These habits let you stay ahead of the fee curve and protect your margins.

Below you’ll find a hand‑picked set of articles that dive deeper into each piece of the puzzle – from detailed exchange reviews to step‑by‑step guides on calculating fees, comparing HTX with rivals, and leveraging token discounts for optimal trading performance.

In-depth 2025 review of HTX crypto exchange covering fees, security, trading tools, user experience, and how it compares to Binance and Coinbase.

Finance

Finance