Ethereum Token: Everything You Need to Know

When working with Ethereum token, a digital asset that runs on the Ethereum blockchain and follows specific token standards. Also known as ETH token, it powers a huge range of applications from DeFi to NFTs.

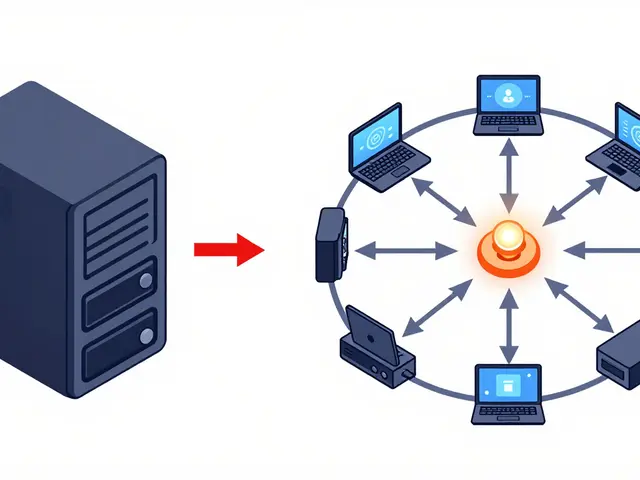

The Ethereum token ecosystem revolves around a handful of key concepts. ERC‑20, the most common token standard that defines how tokens are transferred, approved, and queried provides the basic blueprint for fungible assets like stablecoins or utility tokens. ERC‑721, a non‑fungible token (NFT) standard that lets each token carry unique data expands the landscape to collectibles, gaming items, and digital art. Both standards rely on smart contracts, self‑executing code on Ethereum that enforces token rules without a central authority. Finally, tokenomics, the economic design behind supply, distribution, and incentives determines how value is created, shared, and sustained over time. Together these entities form the backbone of every Ethereum token you’ll encounter.

How These Pieces Fit Together

Ethereum token encompasses ERC‑20 standards, which in turn require smart contracts to enforce balance accounting and transfer logic. Smart contracts also enable ERC‑721 tokens to embed metadata, making each NFT distinct. Tokenomics influences Ethereum token value by shaping supply curves, reward mechanisms, and governance rights. Meanwhile, crypto exchanges, platforms where users can buy, sell, or swap tokens list both ERC‑20 and ERC‑721 assets, turning on‑chain activity into real‑world liquidity. The interaction between token standards, contract code, and economic design fuels a vibrant market where projects can launch airdrops, raise funds through IDOs, or build decentralized finance products.

Our collection below mirrors this diversity. You’ll find step‑by‑step guides on claiming airdrops like the Bull Finance or SupremeX tokens, deep dives into exchange reviews such as OpenSwap, SuperEx, and Coinext, and practical analyses of token regulations across India, China, and Taiwan. If you’re curious about how tokenomics affect price movements, the utility‑token compliance guide breaks down MiCA and the Howey test. For those wanting to build, the Merkle tree article shows how to secure token data, while the blockchain energy piece illustrates real‑world uses beyond finance. All of these pieces tie back to the core idea: an Ethereum token is more than a ticker—it’s a programmable asset shaped by standards, contracts, economics, and the platforms that trade it. Dive into the articles to see how each concept plays out in today’s market.

Explore the Manyu (MANYU) crypto coin-its link to a viral Shiba Inu, Ethereum tech, market data, risks, and how to buy. A full guide for meme‑coin fans.

Finance

Finance