Ethereum DEX: Decentralized Trading on the Ethereum Network

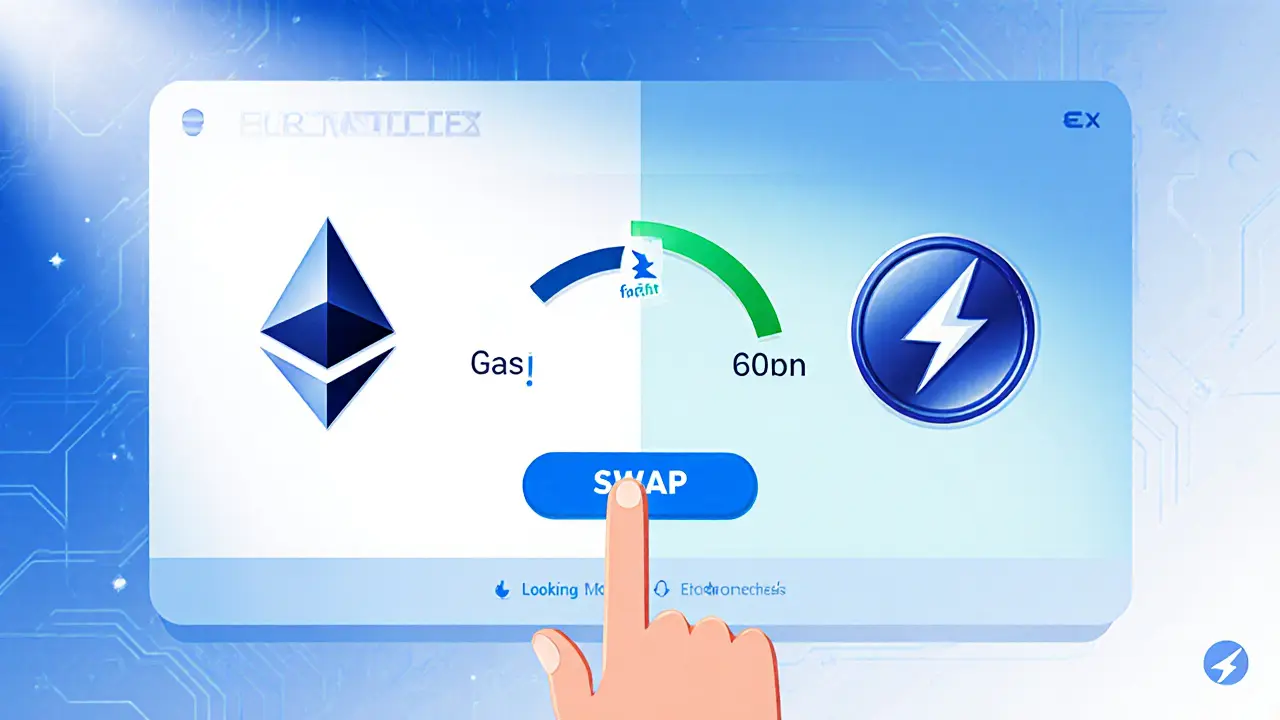

When working with Ethereum DEX, a decentralized exchange built on the Ethereum blockchain that lets users trade tokens directly from their wallets, also known as Ethereum‑based DEX, you’re tapping into a system that removes the need for a central intermediary. Ethereum DEX enables peer‑to‑peer token swaps, which means trades happen on‑chain and settlement is instant. The whole process depends on smart contracts, self‑executing code that enforces trade logic without human oversight and on liquidity pools, collections of token reserves that provide the depth needed for swaps. These pools power the Automated Market Maker (AMM), an algorithm that sets prices based on pool ratios, eliminating traditional order books. Because every asset follows the ERC‑20 standard, adding a new token is as easy as deploying a contract and registering it in the pool, which fuels rapid innovation. Together they create a trustless environment where anyone can list a token, earn fees, and trade 24/7.

Why Traders Choose Ethereum DEXs

One big draw is composability: because every piece runs on Ethereum, you can layer yield farms, lending protocols, and NFT marketplaces on top of the same liquidity. This means a trader can swap ETH for a DeFi token, then instantly supply it to a lending pool, all without moving funds off‑chain. Security also benefits from the network’s broad audit culture; popular contracts get multiple third‑party reviews, and code upgrades are transparent on public repositories. Compared with centralized platforms, you keep full custody of your assets, which reduces the risk of hacks that target exchange hot wallets. Fees are predictable too—most AMMs charge a flat 0.3% on swaps plus a small gas cost, so you always know what you’ll pay. For users worried about high gas, layer‑2 solutions like Arbitrum and Optimism now host Ethereum DEXs, cutting transaction fees while preserving security.

The collection below reflects the most relevant topics you’ll encounter while using Ethereum DEXs. From in‑depth reviews of specific platforms such as OpenSwap, Azurswap and Pangea Swap, to guides on how AMM fee structures work, you’ll find practical insights that help you pick the right pool, avoid common pitfalls, and stay ahead of regulatory changes. You’ll also see how liquidity incentives, token‑gate access and governance voting shape the future of these markets. Dive in to see real‑world examples, step‑by‑step tutorials, and the latest news shaping the decentralized trading landscape.

Learn what Loopring (LRC) is, how its zkRollup Layer2 tech works, token economics, real‑world use cases, risks, and how to start trading.

Finance

Finance