Crypto Regulation 2025: What’s Changing and How It Affects Your Investments

When it comes to crypto regulation 2025, the set of laws and enforcement rules governments are putting in place to control cryptocurrency use, trading, and taxation by 2025. Also known as digital asset oversight, it’s no longer a future concern—it’s here, and it’s changing how you interact with crypto every day.

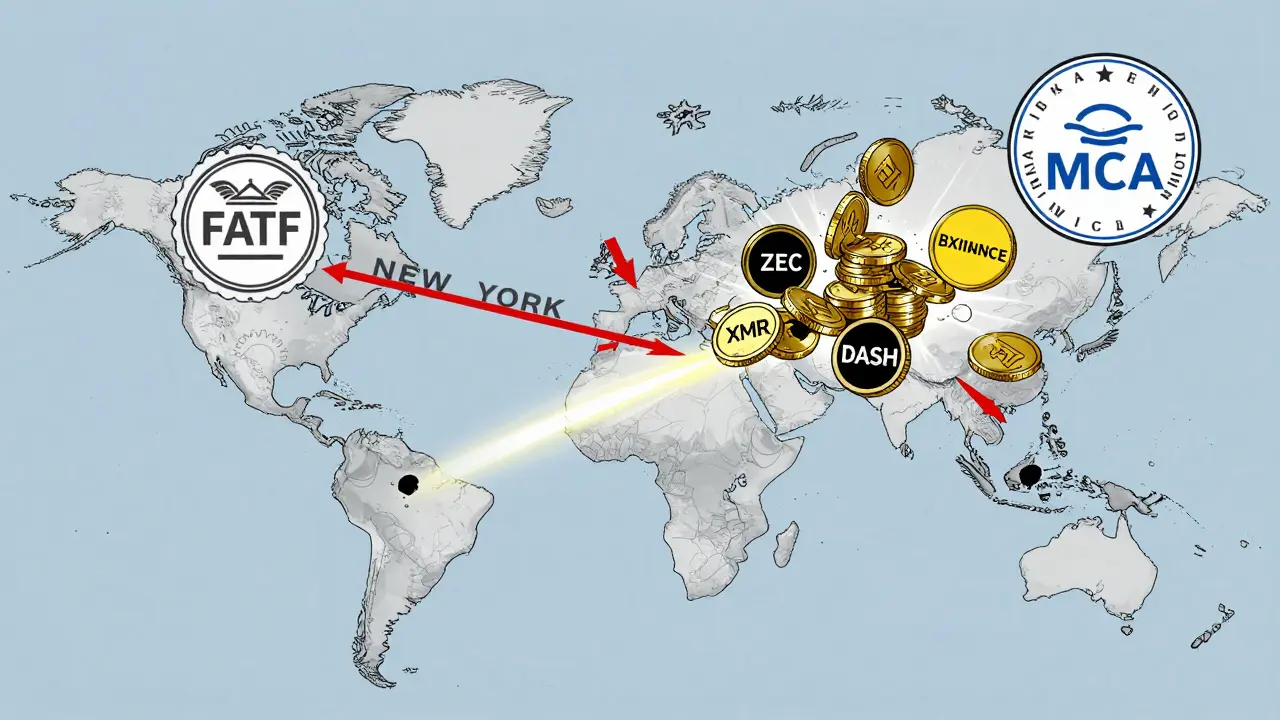

This isn’t just about banning or allowing Bitcoin. It’s about crypto compliance, the steps exchanges and wallets must take to prove they’re not helping money laundering or tax evasion. Think KYC checks, transaction tracking, and reporting to financial authorities. Countries like the UAE, Japan, and Singapore have already set clear rules—and their crypto markets are booming because of it. Meanwhile, places still dragging their feet are seeing users flee to safer, regulated platforms. The FATF crypto, the Financial Action Task Force’s global guidelines for anti-money laundering in digital assets are now the baseline. If an exchange doesn’t follow them, it’s flagged, delisted, or shut down.

And it’s not just exchanges. Airdrops, DeFi platforms, and even meme coins are under scrutiny. You’ve seen the scams—fake airdrops, phantom exchanges, projects with no team. Regulators are now using tools to trace wallet activity and shut these down fast. The result? Fewer shady projects, but also fewer easy wins. If you’re holding tokens from platforms with no clear legal status, you’re at risk. The crypto exchange rules, the specific requirements platforms must meet to operate legally in a country are tightening everywhere. That’s why you’re seeing more reviews of Bitfinex, Minswap, and CEX.IO—they’re the ones that passed the audit. And why you’re seeing warnings about BiKing, CEEX, and GCOX—they didn’t.

What does this mean for you? If you’re trading, staking, or holding crypto in 2025, you need to know where your assets are safe. Regulation isn’t the enemy—it’s the filter. It’s removing the crooks so the real projects can grow. The posts below show you exactly what’s happening: which exchanges made the cut, which airdrops are scams, and how countries like the UAE turned compliance into a competitive edge. You’ll see real examples of what works—and what gets you wiped out. No fluff. Just what you need to protect your money in this new era of crypto.

Major crypto exchanges are removing privacy coins like Monero and Zcash due to new global regulations. Here's why it's happening, where you can still trade them, and what it means for your crypto holdings in 2025.

Categories

Archives

Recent-posts

Homomorphic Encryption for Privacy: How Encrypted Data Can Be Computed Without Being Seen

Feb, 10 2026

Finance

Finance