Blockchain Transparency: What It Really Means and Why It Matters

When we talk about blockchain transparency, the open, verifiable record of transactions on a decentralized network. Also known as public ledger integrity, it’s the foundation that keeps crypto from becoming just another untrustworthy financial system. If a project claims to be built on blockchain but hides who’s behind it, what the code does, or how funds move—you’re not dealing with transparency. You’re dealing with risk.

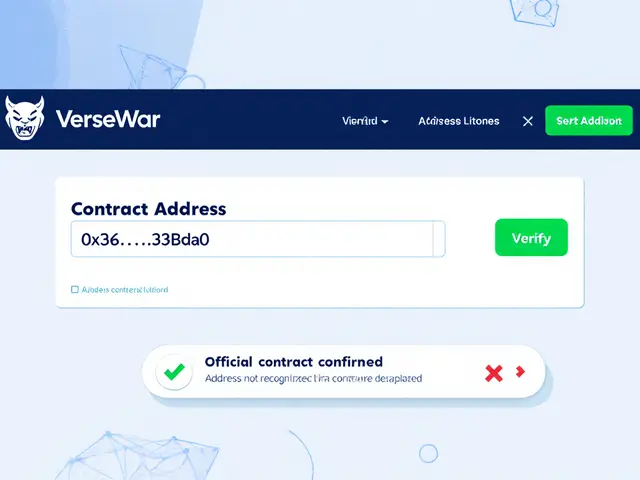

Real blockchain transparency, the open, verifiable record of transactions on a decentralized network. Also known as public ledger integrity, it’s the foundation that keeps crypto from becoming just another untrustworthy financial system. isn’t about flashy websites or marketing slogans. It’s about seeing every transaction, knowing who controls the keys, and understanding if the team has ever updated the code. That’s why platforms like Bitfinex, a crypto exchange known for deep liquidity and advanced trading tools. Also known as Bitfinex crypto exchange, it’s a platform where experienced traders expect full visibility into order books and fee structures. get trusted by pros—because they don’t hide behind anonymity. Meanwhile, exchanges like Chronos Exchange, a platform claiming zero fees but offering no regulation or user verification. Also known as Chronos Exchange crypto, it’s a classic example of a system that avoids transparency to avoid accountability. vanish overnight because there’s nothing to verify. And when crypto regulation, government rules that demand identity checks, transaction tracking, and anti-money laundering controls. Also known as AML crypto compliance, it’s becoming the global standard for any exchange that wants to stay alive. tightens, projects without transparency get delisted—like privacy coins on major exchanges, or fake airdrops that vanish after stealing wallets.

Transparency isn’t just about security. It’s about trust. If a token’s supply is locked, the team is doxxed, and the smart contract is audited—you can check it yourself. If a project’s website is gone, the team is anonymous, and the token price crashed 99%? That’s not a coin. That’s a gamble. The posts below show you exactly what to look for: which exchanges are open about their security, which tokens have real activity, and which ones are built on lies. You’ll see how decentralized finance, financial services built on blockchain without banks or middlemen. Also known as DeFi, it’s only as strong as the transparency behind each protocol. projects rise or collapse based on this one factor. And you’ll learn how to spot the red flags before you send your money into the void.

Blockchain offers transparency but clashes with privacy laws like GDPR. Discover how zero-knowledge proofs, off-chain storage, and privacy-by-design are solving this conflict in 2025 - without sacrificing trust or compliance.

Finance

Finance