Bitfinex Crypto Exchange: What It Is, Why It Matters, and What You Should Know

When you hear Bitfinex crypto exchange, a long-standing digital asset trading platform founded in 2012 that once handled nearly half of all Bitcoin trades worldwide. Also known as Bitfinex Tether, it's a platform that helped shape how crypto markets operate—especially when it comes to liquidity, leverage, and controversy. Unlike newer exchanges that focus on simplicity, Bitfinex caters to serious traders who want advanced tools, deep order books, and margin trading up to 10x. But it’s not for everyone. It’s been hit by major hacks, regulatory scrutiny, and a long-standing link to Tether (USDT), the world’s most traded stablecoin.

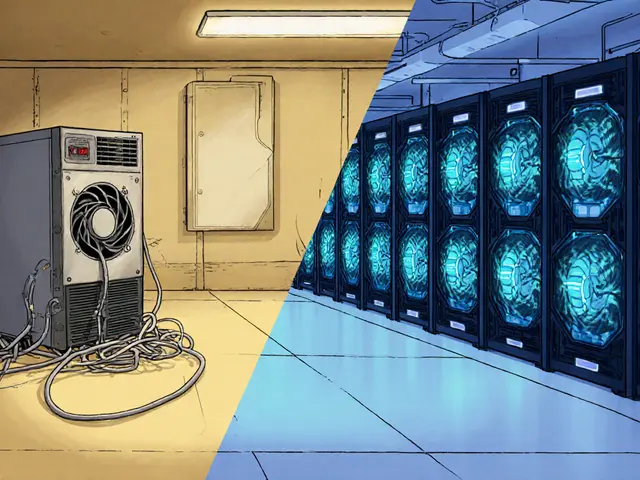

The crypto exchange review, a critical evaluation of a platform’s safety, features, and reliability. Also known as exchange analysis, it's something you can’t skip when choosing where to trade. Bitfinex has survived because it delivers what professional traders need: tight spreads, high volume, and sophisticated charting. But it also has a history of downtime during market spikes, frozen withdrawals, and a lack of clear regulatory licensing in major markets like the U.S. and EU. That’s why many traders keep only what they’re actively trading on Bitfinex—and store the rest elsewhere. Its Bitfinex security, the measures taken to protect user funds and data on the platform. Also known as exchange cybersecurity, it's been tested repeatedly. After the 2016 hack that lost $72 million, it took years to recover trust. Today, it uses multi-sig wallets and cold storage, but there’s still no insurance fund like Coinbase’s. If you’re trading on Bitfinex, you’re essentially trusting its internal controls—no third-party safety net.

It’s also tied to the broader debate around cryptocurrency trading, the act of buying and selling digital assets on exchanges for profit or hedging. Also known as crypto speculation, it's the core activity that keeps markets moving. Bitfinex was one of the first to offer perpetual futures, leverage trading, and dark pool liquidity—features now common across top exchanges. But it also became a battleground for regulators. The New York Attorney General’s office investigated it for allegedly hiding losses with Tether. That’s why some countries have blocked access, and why many U.S. users can’t trade on it anymore. Still, for non-U.S. traders, it remains a major hub for altcoins, stablecoins, and high-volume pairs.

What you’ll find in the posts below isn’t just another list of exchange reviews. It’s a real-world look at what happens when platforms push boundaries—some succeed, some vanish, and others get exposed. You’ll see how Bitfinex fits into a landscape where exchanges like BiKing and CEEX are outright scams, while others like Minswap and Chronos try to compete with gimmicks or empty promises. This isn’t about hype. It’s about what actually works, what’s risky, and what you should avoid.

Bitfinex is a powerful crypto exchange for experienced traders, offering deep liquidity, low-latency trading, and advanced features-but it's not for beginners. Learn the real pros, cons, and who should use it in 2025.

Finance

Finance