ASIC Mining Profitability: How to Maximise Returns

When diving into ASIC mining profitability, the net earnings you can expect from running application‑specific integrated circuit miners after accounting for hardware cost, electricity, and network difficulty, you quickly see it’s not just a number. It’s a mix of Bitcoin mining, the process of validating transactions on the Bitcoin blockchain and earning new coins dynamics, the hash rate, the speed at which a miner solves cryptographic puzzles, measured in TH/s or GH/s, and the cost of power you feed into the rig. In plain terms, ASIC mining profitability encompasses hash rate calculations, requires electricity cost data, and is influenced by Bitcoin mining difficulty adjustments. If you know your machine’s hash rate, your local kilowatt‑hour price, and the current block reward, you can plug those into a profitability calculator and see whether you break even within months or years.

Key Factors that Shape Your Earnings

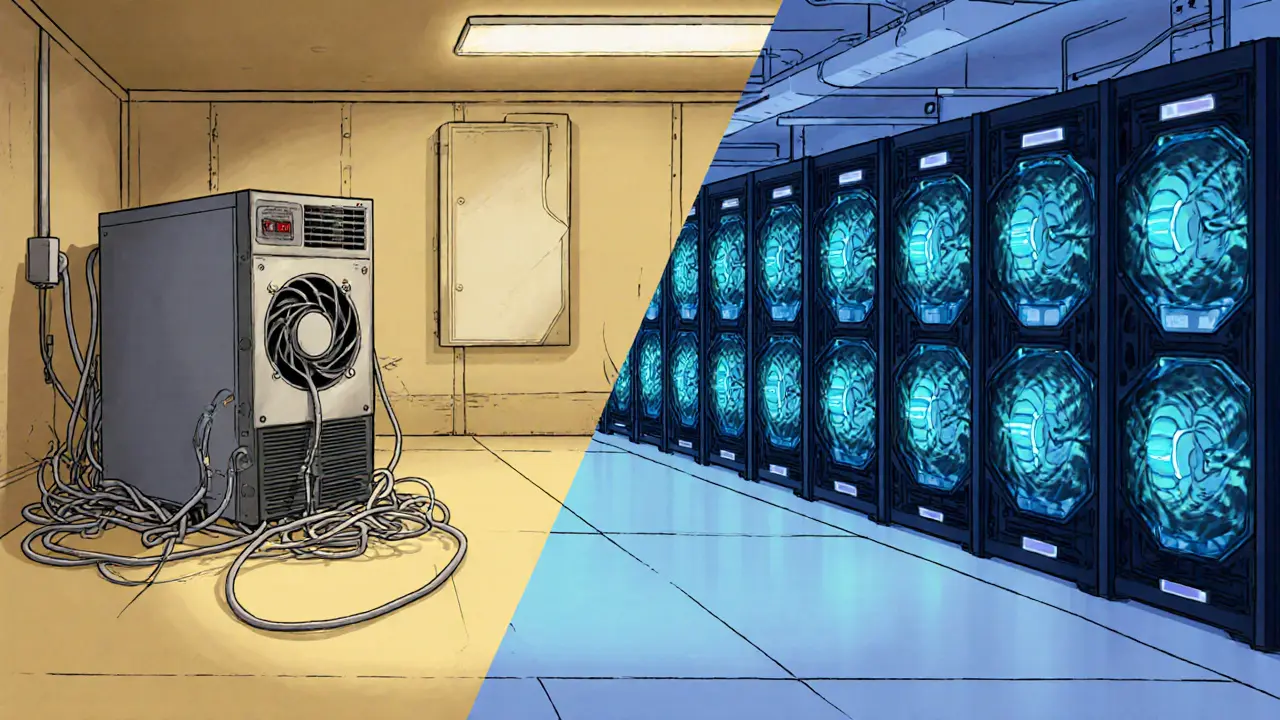

One of the first things to understand is the role of mining hardware, ASIC devices specifically built to perform SHA‑256 hashing at high efficiency. Newer generations often deliver more hashes per watt, which directly improves profitability. However, price volatility of the hardware itself can swing your ROI: a steep upfront cost needs to be amortised over a longer period, especially if the network difficulty spikes. Power consumption, the amount of electricity a miner draws, measured in watts is the other half of the equation. Even a small difference in watts per terahash can mean hundreds of dollars each month, because electricity bills are the single biggest ongoing expense for most operators. Coupled with the fact that Bitcoin’s difficulty adjusts roughly every two weeks, the profitability landscape shifts constantly, making regular recalculation essential.

Finally, don’t overlook the impact of regional factors. Some jurisdictions offer cheaper energy rates or even subsidies for crypto mining, which can tilt the profitability balance dramatically. Others impose higher taxes or stricter environmental regulations that add hidden costs. By tracking these variables—hardware efficiency, electricity price, network difficulty, and local policy—you can build a realistic profitability model and decide whether scaling up or diversifying into other coins makes sense. Below you’ll find a curated list of articles that dive deeper into each of these topics, from real‑world case studies to step‑by‑step calculator guides, giving you the tools to turn raw numbers into actionable decisions.

A clear, conversational guide explains what ASIC miners are, how they differ from GPUs/CPUs, key manufacturers, setup steps, cost factors, and future trends for cryptocurrency mining.

Categories

Archives

Recent-posts

BiKing Crypto Exchange Review: Risks, Security Issues, and Why It’s Not for Most Traders

Nov, 28 2025

Finance

Finance