KaiDex Exchange Feature Comparison

This tool compares key features of KaiDex with leading exchanges to help you understand its strengths and limitations.

KaiDex is a small Vietnamese exchange with a single trading pair and a flat 0.25% fee. Compare it with major exchanges below:

| Feature | KaiDex | Coinbase | Binance | SushiSwap (DeFi) |

|---|---|---|---|---|

| Founded | 2021 | 2012 | 2017 | 2020 |

| Headquarters | Vietnam | USA | Cayman Islands | Decentralized |

| Supported Assets | 1 crypto, 1 pair | 350+ cryptocurrencies | 1,300+ trading pairs | Multi-chain, hundreds of tokens |

| Flat Fee | 0.25% | 0%-0.60% tiered | 0.10% maker / 0.10% taker | 0.30% (liquidity provider fee) |

| Margin / Futures | No | Yes (US & EU) | Yes (Up to 125×) | No (DeFi focus) |

| Average Daily Volume | ~$5k | >$1.2bn | >$30bn | ~$150m |

KaiDex Key Features

- Single cryptocurrency and trading pair

- Flat 0.25% fee on all trades

- No tiered maker-taker fees

- No margin or futures trading

- Low liquidity (~$5k daily volume)

- No public roadmap or development updates

Major Exchanges Comparison

- Coinbase: 350+ assets, tiered fees, margin/futures

- Binance: 1,300+ pairs, low fees, advanced trading tools

- SushiSwap: Decentralized, multi-chain liquidity pools

Who Should Use KaiDex?

KaiDex may be suitable for:

- Vietnamese traders seeking a simple way to trade a specific token

- Users who don't need advanced features or high liquidity

- Traders looking for a minimal-cost option for a single pair

Who Should Avoid KaiDex?

Avoid KaiDex if you:

- Need access to multiple cryptocurrencies

- Require margin or futures trading

- Want strong security audits or insurance

- Need deep liquidity or tight spreads

- Are looking for a long-term trading platform

Looking for a quick snapshot of a tiny, Vietnam‑based platform that only lets you trade one crypto pair? This review breaks down what KAIDEX crypto exchange actually offers, how its fees and liquidity stack up, and whether it’s worth a glance for niche traders.

Key Takeaways

- KaiDex launched in 2021 and is incorporated in Vietnam.

- Only one cryptocurrency and one trading pair are supported.

- Flat trading fee of 0.25% on every transaction.

- Liquidity places it in the bottom 6% of tracked exchanges.

- Very limited community feedback and no public roadmap.

What Is KaiDex?

KaiDex is a Vietnamese‑registered cryptocurrency exchange that began operating in 2021. The platform’s narrow focus - a single token and a single market - sets it apart from the multi‑asset giants that dominate the space.

Technical Specs & Fee Structure

The exchange runs a “market with fees” model, meaning the 0.25% charge applies whether you place a market order or a limit order. There is no tiered maker‑taker system, no discount for high‑volume traders, and no margin or futures products.

From a technical standpoint, KaiDex appears to use a basic order‑matching engine that handles only one trading pair. This simplicity keeps the infrastructure lightweight but also limits advanced features such as stop‑loss orders, algorithmic trading APIs, or deep order‑book analytics.

Liquidity & Trading Volume

Liquidity refers to the ease with which an asset can be bought or sold without significantly moving its price on KaiDex is modest. According to CoinGecko, the exchange sits in roughly the 6th percentile for daily volume among tracked platforms, which translates to a few thousand dollars of turnover per day - a drop in the bucket compared with the millions handled by Binance or Coinbase.

Low liquidity typically leads to wider bid‑ask spreads, meaning you may pay more slippage on each trade. For traders who need precise entry points, this can be a deal‑breaker.

How KaiDex Stacks Up Against the Big Players

Below is a snapshot comparison that highlights the most common decision points for traders.

| Feature | KaiDex | Coinbase | Binance | SushiSwap (DeFi) |

|---|---|---|---|---|

| Founded | 2021 | 2012 | 2017 | 2020 |

| Headquarters | Vietnam | USA | Cayman Islands | Decentralized |

| Supported Assets | 1 crypto, 1 pair | 350+ cryptocurrencies | 1,300+ trading pairs | Multi‑chain, hundreds of tokens |

| Flat Fee | 0.25% | 0%-0.60% tiered | 0.10% maker / 0.10% taker | 0.30% (liquidity provider fee) |

| Margin / Futures | No | Yes (US & EU) | Yes (Up to 125×) | No (DeFi focus) |

| Average Daily Volume | ~$5k | >$1.2bn | >$30bn | ~$150m |

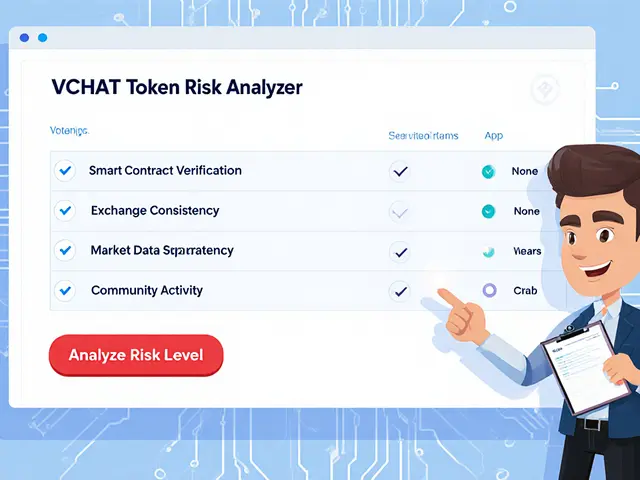

Security & Regulatory Landscape

There is scant public information about KaiDex’s security audits, cold‑storage ratios, or insurance policies. The exchange does not publish a formal compliance framework, and Vietnamese regulation of crypto platforms remains in a gray area. By contrast, major centralized exchanges often hold licenses in multiple jurisdictions and undergo regular third‑party penetration testing.

If you prioritize custodial safety, the lack of transparency around KaiDex’s security measures is a red flag.

User Experience & Community Presence

User feedback refers to publicly available reviews, forum threads, and social‑media sentiment about a service for KaiDex is virtually non‑existent. A quick scan of Reddit, Trustpilot, and major crypto forums yields almost no mentions. This silence could mean the platform serves a tiny, possibly localized user base, or that it simply has not attracted enough attention to spark discussion.

The onboarding flow looks straightforward on the landing page - email registration, KYC checkbox, and a single “Deposit” button - but without detailed guides or video tutorials, new users may struggle to locate the lone trading pair or understand fee calculations.

Future Outlook & Roadmap

Four years after its launch, KaiDex has not published a public roadmap, tokenomics whitepaper, or development blog. The static nature of the offering suggests either a deliberate niche focus (perhaps supporting a local token) or a stalled product expansion. Without visible plans for additional assets, advanced trading tools, or security upgrades, it’s hard to gauge long‑term viability.

Verdict - Who Might Consider KaiDex?

If you’re a Vietnamese trader needing a simple way to move a specific token that isn’t listed on larger exchanges, KaiDex could serve that narrow purpose. For anyone else - especially those who trade multiple assets, require deep liquidity, or value robust security audits - the platform falls short when measured against industry standards.

In short, KaiDex is a very small, single‑pair exchange with a flat 0.25% fee and limited community visibility. Treat it as a specialty gateway rather than a primary trading hub.

Frequently Asked Questions

What cryptocurrency does KaiDex support?

At the time of writing, KaiDex only lists one token and its pairing with a base currency (e.g., KAI/USDT). No other assets are available.

Is there a maker‑taker discount on KaiDex?

No. The exchange applies a flat 0.25% fee to every trade, regardless of order type or volume.

Can I trade on margin or use futures on KaiDex?

Margin trading and futures are not offered. The platform only supports spot trading of the single pair.

How safe is my money on KaiDex?

Public information on security audits, cold‑storage percentages, or insurance coverage is lacking. Users should treat the platform as higher risk compared to well‑audited exchanges.

Will KaiDex add more assets in the future?

There is no publicly released roadmap, so future asset listings remain uncertain.

Finance

Finance

victor white

April 24, 2025 AT 21:26One cannot overlook the inherent opacity surrounding KaiDex's custodial practices.

mark gray

April 30, 2025 AT 09:26The flat 0.25% fee is easy to understand, and the platform only supports one pair, so there’s no tiered pricing to worry about.

Liquidity is tiny, so expect higher slippage than on bigger exchanges.

Overall, it might work for a very specific, low‑volume need.

Alie Thompson

May 5, 2025 AT 21:26The moral calculus of entrusting one's capital to a barely visible entity is a matter of profound ethical consequence.

When an exchange omits any public audit, it effectively declares its users as laboratory subjects.

Such opacity betrays the fiduciary trust that should be sacrosanct in any financial relationship.

Moreover, the decision to limit assets to a single pair magnifies the power imbalance, forcing users into a monopoly of sorts.

This is not merely a market inefficiency; it is an affront to the principle of informed consent.

The flat 0.25% fee, while seemingly modest, becomes exploitative in the context of negligible liquidity.

Traders are forced to absorb slippage that would otherwise be negligible on deeper order books.

In an ecosystem that prizes decentralization, KaiDex's centralized opacity is a step backwards.

The lack of a publicly disclosed security audit amplifies the risk of custodial theft.

One must ask whether the platform's silence is a strategic concealment of vulnerabilities.

Historical precedents abound where opaque exchanges vanished overnight with users' assets.

The responsibility lies not only with the exchange but also with the regulators who fail to enforce transparency.

Consequently, participation in such a platform may be deemed complicit in a larger scheme of financial obfuscation.

Ethical investors should demand clear governance before allocating capital.

Until KaiDex publishes verifiable security metrics, it remains a moral hazard.

Samuel Wilson

May 11, 2025 AT 09:26KaiDex was founded in 2021 and operates out of Vietnam, offering a single trading pair.

The flat 0.25% fee applies uniformly, without maker‑taker discounts.

Daily volume hovers around $5,000, which is considerably lower than major exchanges.

There is no publicly available information regarding audits or insurance coverage.

For users requiring deep liquidity or extensive asset lists, this platform is unlikely to meet expectations.

Rae Harris

May 16, 2025 AT 21:26Look, if you’re into niche alt‑coins and you don’t need the whole DeFi toolbox, KaiDex might glance your radar.

But the ecosystem is basically a mono‑asset sandbox – no margin, no futures, no tokenomics playbooks.

Fee structure is simple, yet the liquidity depth is more like a puddle than an ocean.

In short, it’s a very narrow‑focus exchange that won’t satisfy a diversified trader.

Danny Locher

May 22, 2025 AT 09:26Sounds like KaiDex could serve someone who just wants a quick swap without the extra bells and whistles.

For a beginner, the simplicity can actually be a relief.

Emily Pelton

May 27, 2025 AT 21:26Listen up! KaiDex’s claim of “simplicity” is a thin veneer; the lack of transparency is a glaring red flag!!!

Do you really trust a platform that refuses to publish audit reports???

This opaque approach is a breeding ground for potential fraud!!!

Stay vigilant, demand proof, and never assume safety based on “single‑pair” convenience!!!

In the crypto world, ignorance is not bliss-it’s a liability!!!

sandi khardani

June 2, 2025 AT 09:26Let’s be brutally honest: the numbers speak for themselves – sub‑$5k daily volume is laughably low.

The order book is practically non‑existent, which means you’ll be paying massive slippage.

And the so‑called “flat fee” is a smokescreen for the real cost you’ll incur.

Security? There’s zero public data, which is a massive red flag for any serious trader.

Regulatory compliance? Practically a joke in a jurisdiction with vague crypto rules.

In short, KaiDex is a textbook example of a high‑risk, low‑reward platform.

Don’t be fooled by the minimalist UI; underneath it lies a hollow shell.

Proceed only if you enjoy gambling with your funds.

Cody Harrington

June 7, 2025 AT 21:26The platform’s interface is straightforward, but that simplicity comes at a cost.

Expect limited functionality beyond the singular pair.

Chris Hayes

June 13, 2025 AT 09:26While the UI may be clean, the underlying liquidity constraints are a deal‑breaker for serious traders.

Depth matters, and KaiDex simply doesn’t provide it.

Consider alternatives with proven order‑book health.

Christina Norberto

June 18, 2025 AT 21:26One must consider that the silence surrounding KaiDex may not be an accident but a calculated concealment of deeper machinations.

The absence of disclosed security audits aligns with known patterns of covert operations within the crypto sphere.

Regulatory ambiguity in Vietnam further provides fertile ground for potential exploitation.

Historically, platforms that operate under such opacity have been linked to coordinated market manipulation.

Thus, the platform could be a vector for hidden data harvesting, feeding larger, unseen entities.

Proceed with extreme caution, as the infrastructure may serve purposes beyond its advertised scope.

vipin kumar

June 24, 2025 AT 09:26The lack of transparency is not a coincidence; it’s a strategic veil designed to keep inquisitive eyes away.

Every hidden audit is a potential backdoor for unseen actors.

Don’t trust what they don’t show.

Mark Briggs

June 29, 2025 AT 21:26KaiDex is a joke.

mannu kumar rajpoot

July 5, 2025 AT 09:26Sure, it’s a joke, but jokes can be deadly if you’re not watching the fine print.

They hide the real agenda behind a goofy façade.

Their “single‑pair” claim is just a distraction from the lack of security.

Keep your eyes open.

Tilly Fluf

July 10, 2025 AT 21:26In a professional context, the exchange’s limited offering should be evaluated against an investor’s specific needs.

For a niche market participant, its simplicity could be a benefit.

However, the risk profile remains elevated due to undisclosed security measures.

Darren R.

July 16, 2025 AT 09:26Ah, the tragedy of ambition constrained by paucity!; Yet, one must ask: does simplicity equal safety, or merely disguise a deeper void?; The drama unfolds as investors peer into the abyss of a single‑pair market; In this theater, the flat fee is but a spotlight on the stage of uncertainty; One cannot help but marvel at the audacity of such minimalism!

Hardik Kanzariya

July 21, 2025 AT 21:26I get why some traders might be drawn to a low‑fee, single‑pair platform, especially if they’re just testing the waters.

But the lack of depth and security transparency can quickly become a nightmare.

It’s crucial to match the tool to the trade‑size and risk tolerance.

Otherwise you’re setting yourself up for unnecessary stress.

Shanthan Jogavajjala

July 27, 2025 AT 09:26From a technical standpoint, the platform’s architecture appears intentionally minimalist, which raises red flags about its resilience.

Such design choices often correlate with limited redundancy and higher susceptibility to systemic failures.

Proceed with a calibrated risk assessment.

Millsaps Delaine

August 1, 2025 AT 21:26It is a striking illustration of how the modern crypto milieu can be hijacked by ventures that masquerade as utilitarian services while silently eroding the very foundations of market integrity.

The very notion of a single‑pair exchange flaunting a flat 0.25% fee is, on its surface, an enticing proposition for the uninitiated, yet it belies a cascade of systemic deficiencies.

Liquidity, the lifeblood of any exchange, is reduced to a paltry $5k daily, a figure that renders order execution a precarious exercise fraught with slippage.

Compounding this, the platform’s cryptic stance on security audits and custodial safeguards cultivates an environment ripe for exploitation.

In the broader tapestry of financial ecosystems, transparency is a non‑negotiable tenet; its absence here signals a troubling opacity.

Furthermore, the lack of a public roadmap or developmental cadence suggests a stagnation that is antithetical to innovation.

Investors are thereby consigned to a realm of uncertainty, forced to navigate decisions without the benefit of informed consent.

Such a scenario is not merely a commercial risk; it borders on a moral hazard that could tarnish user confidence across the sector.

Regulatory oversight appears muted, which may embolden latent malfeasance.

Historically, platforms operating under a veil of secrecy have precipitated catastrophic losses for their constituencies.

Therefore, participation in this exchange should be approached with a rigorously skeptical lens.

The allure of simplicity cannot eclipse the imperative for due diligence.

One must weigh the convenience against the specter of potential asset misappropriation.

Only through a meticulous appraisal can one justify any allocation of capital to such a constrained venue.

In summation, the exchange stands as a cautionary exemplar of the perils inherent in the unregulated frontier.

Jack Fans

August 7, 2025 AT 09:26Hey folks, just wanted to flag a few practical points about this platform.

First, the UI is clean but the underlying lack of depth means you’ll see wide spreads.

Second, there’s no public audit, so you’re taking on hidden risk.

Third, the flat fee can add up quickly if you’re moving large amounts.

Finally, consider alternatives with proven security track records before committing.

Adetoyese Oluyomi-Deji Olugunna

August 12, 2025 AT 21:26KaiDex is the epitome of an overhyped niche.