Proof of Stake isn’t just a buzzword anymore-it’s the backbone of most major blockchains today. Ethereum switched to it in 2022. Cardano, Solana, and Polkadot run on it. Even new projects are skipping Proof of Work entirely. But not all Proof of Stake is the same. There are real differences in how each network picks who validates blocks, who gets rewarded, and how they keep the system secure. If you’re trying to understand why some networks reward long-term holders while others let anyone join with a small stake, you’re not alone. Let’s break down the main variations you’ll actually see in use today.

Basic Proof of Stake: Staking as Collateral

At its core, Proof of Stake replaces mining with staking. Instead of burning electricity to solve math puzzles, you lock up your cryptocurrency-your stake-as collateral. The more you stake, the higher your chance of being chosen to validate the next block. If you try to cheat-like approving fake transactions-you lose part of your stake. It’s a financial incentive to play fair.

Think of it like a jury system. The more money you have on the line, the more the network trusts you to make the right call. But unlike a real jury, the system doesn’t pick people randomly. It uses algorithms that look at your stake size, how long you’ve held it, and sometimes even how often you’ve been online. That’s where the variations start.

Coin-Age Based Selection: Rewarding Patience

One early variation, used by Peercoin and later adapted by others, adds time to the equation. It doesn’t just look at how many coins you have-it looks at how long you’ve held them. This is called coin-age.

Coin-age = (number of coins staked) × (days held). So if you’ve held 100 coins for 30 days, your coin-age is 3,000. If someone else has 500 coins but only held them for 1 day, their coin-age is 500. Even though they have more coins, you have a higher coin-age and a better shot at being selected.

This design rewards loyalty. It stops rich newcomers from dominating the network right away. It also encourages people to keep their coins locked up instead of constantly trading. But it has a downside: if you’re holding coins just to build coin-age, you’re not spending or moving them. That can reduce liquidity and slow down network activity.

Effective Balance: Fighting Centralization

Some networks noticed a problem: if you have 10,000 coins, you get way more voting power than someone with 1,000. Even with coin-age, the ultra-rich could still control the network. So Ethereum and others introduced effective balance.

Effective balance doesn’t use your full stake. It caps it. For example, in Ethereum’s PoS, if you stake 1,000 ETH, the system only counts 32 ETH as your effective balance. Any amount above that doesn’t give you extra selection power. This prevents mega-wallets from becoming super-nodes.

It also adds other factors: how often you’ve been online, how consistently you’ve signed blocks, and whether you’ve been penalized before. Your effective balance is a score-not just a number. This makes it harder for one person or group to take over. It’s not perfect, but it’s a big step toward fairness.

Staking Pools: Small Stakeholders, Big Influence

Not everyone can afford 32 ETH to run a validator on Ethereum. That’s where staking pools come in. These are groups of users who combine their smaller stakes to meet the minimum requirement. The pool operator handles the technical side-keeping the node online, updating software, avoiding penalties. In return, they take a small cut of the rewards.

Staking pools are huge. Over 40% of Ethereum’s total stake is pooled through services like Lido, Coinbase, and Kraken. They let people with 1 ETH or even 0.1 ETH earn staking rewards. Without pools, PoS would be a game only for the wealthy.

But there’s a risk: if too many people use the same pool, you get centralization. If Lido controls 30% of the network’s stake and goes offline, the whole chain could stall. That’s why some networks limit how much any single pool can hold. Others require pools to disclose their ownership structure. Transparency matters.

Randomization-Enhanced Selection: Making It Unpredictable

Imagine if the same validator was picked every time they had the highest stake. That’s predictable. And predictable systems are vulnerable. Attackers could plan around them.

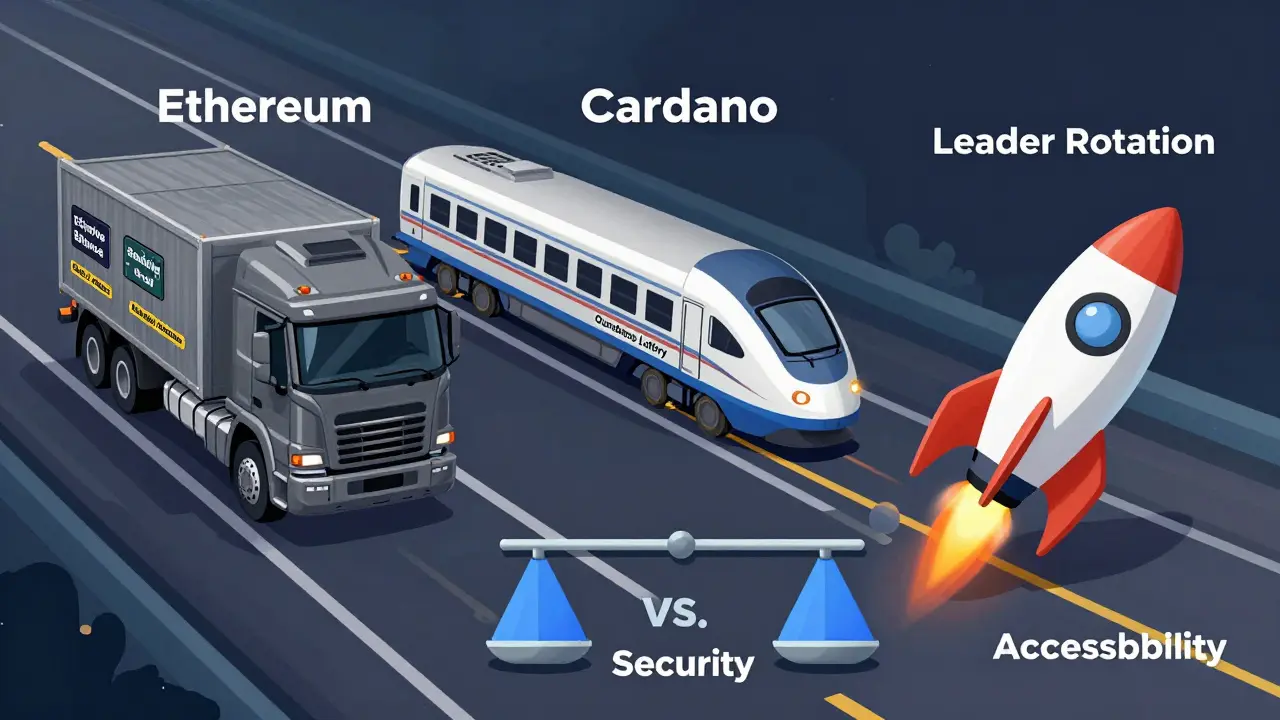

To fix this, most modern PoS networks mix in randomness. Ethereum uses a system called RANDAO, which combines the staking weights with a verifiable random number generated by validators themselves. Cardano uses Ouroboros, which selects validators through a cryptographic lottery based on stake and time.

This doesn’t mean big stakers lose out-they still have higher odds. But it prevents the top 5 wallets from controlling every block. It makes the system more decentralized and harder to attack. Think of it like a weighted lottery: you buy more tickets if you stake more, but the draw is still random.

Deterministic vs. Dynamic Reward Systems

Not all PoS networks pay the same way. Some use fixed rewards: you get 5% APY no matter what. Others adjust dynamically based on how many people are staking.

For example, if only 20% of the total supply is staked, the network might offer 10% APY to encourage more participation. If 80% is staked, rewards drop to 3%. This keeps the token supply from inflating too fast.

Cardano’s system adjusts rewards monthly based on total stake and network performance. Solana pays out rewards every epoch (about every 2 days), with bonuses for validators who stay online and respond quickly. Ethereum pays rewards every 6.4 minutes (one slot), with penalties for missed duties.

These differences matter. If you’re choosing where to stake, you’re not just picking a coin-you’re picking a reward model. Fixed rewards are simple. Dynamic ones can be more sustainable long-term.

Ethereum’s Model: The Gold Standard

Ethereum’s PoS is the most watched implementation. It requires 32 ETH per validator. Validators must run software 24/7. If they go offline for too long, they lose a small portion of their stake. If they try to double-spend or approve conflicting blocks, they lose everything.

It’s strict. But it works. Ethereum handles over 1 million transactions per day on PoS. Its validator count is over 800,000. The system has survived multiple network upgrades and a major attack simulation in 2024.

What makes Ethereum special isn’t just the 32 ETH requirement-it’s the combination of effective balance, randomization, slashing penalties, and a massive validator base. It’s not the easiest system to join, but it’s the most battle-tested.

What’s Next? Liquid Staking and Hybrid Models

The next wave is liquid staking. Instead of locking your ETH for months, you stake it and get a token in return-like stETH from Lido. That token can be traded, used in DeFi, or lent out. You still earn staking rewards, but your capital isn’t stuck.

Polkadot uses nominated proof of stake (NPoS), where token holders nominate validators instead of running them. Cardano uses a delegated PoS model where users delegate their stake to stake pools. Solana uses a combination of stake weight and leader rotation.

These aren’t just tweaks-they’re new ways to balance security, accessibility, and decentralization. The future of PoS won’t be one-size-fits-all. It’ll be a toolbox of models, each optimized for different goals.

Which Variation Is Best?

There’s no single winner. If you want maximum security and decentralization, Ethereum’s model is the gold standard. If you want lower entry barriers and more liquidity, staking pools with liquid staking tokens make sense. If you care about rewarding long-term holders, coin-age systems still have value.

The key is understanding what trade-offs each network makes. High rewards? Maybe higher centralization risk. Easy to join? Maybe slower finality. Fixed APY? Less incentive to adjust to network demand.

Choose based on your goals. Are you staking for passive income? Then liquidity and reliability matter most. Are you invested in the network’s long-term health? Then look at how the protocol prevents centralization and rewards honest behavior.

Proof of Stake isn’t just a technical upgrade. It’s a shift in how value is secured on the blockchain. The variations you see today are experiments in economic design. Some will fade. Others will define the next decade of crypto.

What’s the difference between Proof of Work and Proof of Stake?

Proof of Work (PoW) requires miners to solve complex math problems using powerful computers, which uses a lot of electricity. Proof of Stake (PoS) lets validators secure the network by locking up their own cryptocurrency as collateral. PoS is far more energy-efficient-Ethereum’s switch to PoS cut its energy use by over 99.9%. PoS also reduces the risk of centralization from mining hardware monopolies.

Do I need to stake 32 ETH to participate in Ethereum’s PoS?

You need 32 ETH to run your own validator node. But you don’t have to do it alone. Most users join staking pools through platforms like Lido, Coinbase, or Kraken, where you can stake any amount-even 0.1 ETH-and still earn rewards. The pool handles the technical side and splits the earnings among participants.

Can I lose my staked crypto in Proof of Stake?

Yes, but only if you act maliciously or fail to perform your duties. If your validator goes offline for too long, you lose a small portion of your stake-a penalty called "slashing." If you try to approve conflicting blocks or cheat the system, you can lose your entire stake. This is how PoS enforces honesty: your money is on the line.

Is Proof of Stake more secure than Proof of Work?

It’s different, not necessarily more secure. PoW is secure because it’s expensive to attack-you’d need more computing power than everyone else combined. PoS is secure because it’s expensive to attack-you’d need to own over 51% of all staked tokens. In practice, both are very secure. But PoS adds financial penalties for bad behavior, which makes attacks less likely and easier to detect.

Which cryptocurrencies use Proof of Stake?

Major PoS blockchains include Ethereum (post-Merge), Cardano, Solana, Polkadot, Avalanche, and Tezos. Some use pure PoS, others use variations like delegated PoS (Cardano), nominated PoS (Polkadot), or proof-of-history combined with PoS (Solana). Bitcoin still uses Proof of Work, but most new networks are choosing PoS for its efficiency and scalability.

Finance

Finance

Haritha Kusal

January 4, 2026 AT 13:20Mike Reynolds

January 5, 2026 AT 02:36dayna prest

January 5, 2026 AT 14:46Brooklyn Servin

January 6, 2026 AT 09:44Phil McGinnis

January 6, 2026 AT 16:16Ian Koerich Maciel

January 8, 2026 AT 02:11Andy Reynolds

January 8, 2026 AT 09:24Alex Strachan

January 8, 2026 AT 14:09Rick Hengehold

January 9, 2026 AT 13:06Antonio Snoddy

January 10, 2026 AT 23:46Ryan Husain

January 11, 2026 AT 14:43Rajappa Manohar

January 13, 2026 AT 14:31Jacky Baltes

January 13, 2026 AT 14:58Willis Shane

January 15, 2026 AT 08:12dina amanda

January 15, 2026 AT 21:08SUMIT RAI

January 17, 2026 AT 16:57Andrea Stewart

January 19, 2026 AT 15:42