Staking Rewards: How to Earn, Track, and Maximize Crypto Returns

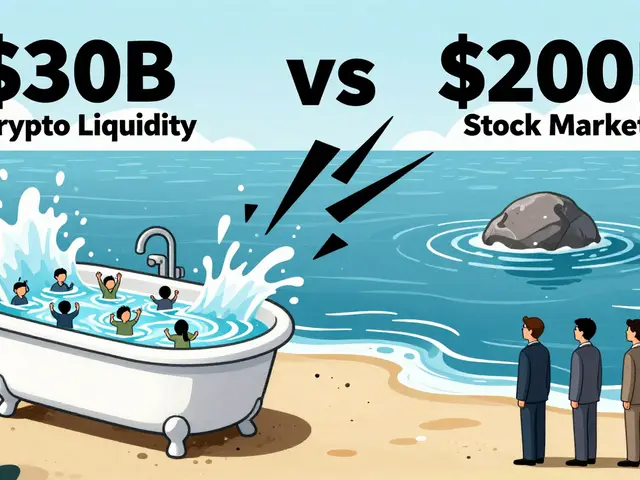

When you hear staking rewards, the periodic payouts you receive for locking up crypto in a proof‑of‑stake network. Also known as staking yields, they let holders earn passive income without mining. Proof‑of‑stake, a consensus model where validators are selected based on the amount they stake determines who gets those payouts. A validator, the node that confirms transactions and secures the chain earns a slice of the pool, while the network’s tokenomics, the economic design that sets inflation, supply, and reward rates defines the APY. Many projects also throw in a crypto airdrop, a free token distribution that can boost overall returns, but those are often marketing tricks. Knowing how these pieces fit helps you separate real earnings from hype. For example, Ethereum’s beacon chain typically offers 4‑5% annual yield, while newer chains like Polygon can reach double‑digit percentages because their reward pools are still expanding. The key is to understand that higher rates often come with higher risk or less mature security.

Key Factors to Maximize Your staking rewards

The first thing to check is the inflation rate built into the tokenomics. If a coin creates 5% new supply each year, that 5% is usually shared among all stakers, so the headline APY often reflects pure inflation. Some networks add transaction fees to the pool, which can push the effective yield higher, especially when the chain sees heavy usage. Compounding matters too – many wallets automatically restake earned tokens, turning a 5% return into roughly 5.1% after a year due to the extra earnings on earnings. Lock‑up periods also influence rates; longer commitments usually grant a premium because the network values stable security.

Next, pick a reliable validator. Not all validators are created equal – a validator with a strong uptime record, low commission fees, and transparent governance will deliver more consistent payouts. Check public performance dashboards and community feedback before delegating. Beware of “super‑high” airdrop promises that claim you’ll earn extra tokens simply by staking; most are either one‑time promotions or outright scams. A safe approach is to treat airdrops as bonus, not core income, and always verify the project’s legitimacy on official channels.

Finally, keep an eye on network upgrades and regulatory news. A shift from proof‑of‑stake to a hybrid model, or a sudden change in tokenomics, can instantly alter reward formulas. By staying informed, you can re‑delegate, adjust lock‑up times, or even move to a different chain before a major change hurts your earnings. Below you’ll find a curated selection of articles that dig deeper into each of these topics – from deep‑dive tokenomics analyses to step‑by‑step validator guides and airdrop safety checklists – so you can turn theory into action and make the most of your staking journey.

Learn what SecretSky.finance (SSF) really offers, how the token is distributed, real signs of an airdrop, and the risks behind its high‑yield promises.

Categories

Archives

Recent-posts

Healthcare Blockchain Implementation Examples: Real-World Use Cases and Lessons Learned

Jan, 14 2026

Finance

Finance