Stablecoin Framework: Rules, Models, and Real‑World Use

When navigating the Stablecoin Framework, the set of rules, mechanisms, and compliance standards that keep stablecoins pegged and operating smoothly in the crypto world. Also known as stablecoin model, it shapes everything from token design to exchange listings.

At the core are Stablecoins, digital assets that promise price stability by linking to fiat reserves, commodity baskets, or algorithmic collateral. The stablecoin framework dictates how these assets manage risk, maintain transparency, and meet legal expectations. In practice, the framework encompasses Regulatory Compliance, the collection of licensing, reporting, and consumer‑protection rules imposed by governments and financial watchdogs, which influences design choices and market access.

DeFi platforms rely heavily on stablecoin frameworks because they need predictable value for lending, borrowing, and liquidity provisioning. Decentralized Finance (DeFi), a network of smart‑contract‑driven services that operate without traditional intermediaries benefits when stablecoins offer a reliable anchor. The framework therefore enables seamless integration of stablecoins into yield farms, automated market makers, and cross‑chain bridges.

Tokenomics is another pillar. A solid Tokenomics, the economic design that defines supply, issuance, and redemption mechanics for a token ensures that a stablecoin can sustain its peg under market stress. Whether the coin is fiat‑backed, crypto‑backed, or algorithmic, tokenomics must align with the framework’s risk‑management rules. This alignment creates a feedback loop: strong tokenomics support regulatory confidence, while clear regulations encourage more innovative token designs.

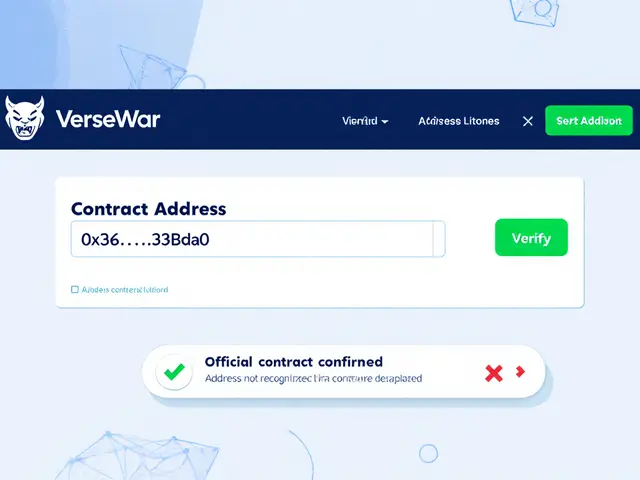

From a practical standpoint, exchanges adopt the stablecoin framework to meet both user demand and compliance obligations. When an exchange lists a new stablecoin, it checks the coin’s audit reports, reserve disclosures, and licensing status. This due‑diligence process is a direct outcome of the framework’s requirement for transparency and auditability. As a result, traders enjoy faster settlements and lower volatility, while regulators see reduced systemic risk.

Across the globe, jurisdictions differ in how they apply the framework. Some focus on reserve verification, others on algorithmic stability mechanisms. The variation creates a landscape where projects must tailor their compliance strategy to each market. Understanding these nuances helps developers choose the right peg model—fiat collateral for regions with strict reserve rules, or algorithmic designs for markets that allow more flexibility.

Beyond compliance, the framework drives innovation. New hybrid models blend fiat reserves with on‑chain collateral, leveraging smart contracts to automate redemption while satisfying auditors. These hybrids illustrate how the stablecoin framework can evolve: it encompasses regulatory compliance, supports DeFi integration, and adapts tokenomics to emerging tech.

Below you’ll find a curated set of articles that dive deeper into each of these aspects—regulatory updates, tax implications, airdrop opportunities, exchange reviews, and technical guides. Whether you’re a trader, developer, or regulator, the collection offers actionable insights that build on the stablecoin framework’s core principles.

A clear guide to Taiwan's selective banking crypto restrictions, covering VASP registration, stablecoin plans, CBDC prospects, and how users can navigate the rules.

Finance

Finance