MANYU token – Everything You Need to Know

When working with MANYU token, a utility-focused cryptocurrency built on a public blockchain, designed to power a decentralized finance ecosystem. Also known as MANYU, it combines staking rewards, governance rights, and cross‑chain compatibility. The token lives on a blockchain, a tamper‑proof ledger that records every transaction in real time, enabling transparent token distribution and secure smart‑contract execution. Because it is a cryptocurrency token, users can trade it, hold it in wallets, and use it to pay for services within its native platform.

The airdrop marketing method that distributes free tokens to eligible participants has become a primary way the MANYU team builds community awareness. By rewarding early adopters, airdrops generate buzz, increase wallet adoption, and create a baseline of liquidity. Most airdrop campaigns require simple actions—joining a Telegram group, completing a KYC step, or staking a partner token—making participation low‑barrier. Once users hold MANYU, they can list the token on various crypto exchanges, which act as marketplaces where traders buy, sell, and swap assets. Exchange listings amplify visibility, improve price discovery, and open the door to automated trading strategies.

Tokenomics, Utility and Risk

Understanding MANYU’s tokenomics is crucial for any investor. The total supply is capped at 500 million, with 40 % allocated to community incentives (airdrop, staking rewards, liquidity mining), 30 % reserved for development, 15 % for strategic partners, and the remaining 15 % held in a treasury for future upgrades. This allocation schema balances growth funding with scarcity, influencing price dynamics. Governance rights let token holders vote on protocol changes, tying utility directly to ownership. Because the token runs on smart contracts, any vulnerability in the contract code could affect user funds, so security audits are a non‑negotiable step before any major upgrade.

Regulatory environments also shape how MANYU operates. In jurisdictions with strict crypto rules, exchanges may delay listing, and airdrop participants might face tax obligations. Meanwhile, jurisdictions that encourage blockchain innovation often see faster adoption and more vibrant ecosystems. The interplay between regulation, exchange listings, and airdrop strategies creates a feedback loop: broader listings attract more users, which fuels larger airdrop pools, which in turn draw attention from regulators.

Below you’ll find a curated set of articles that walk through the latest MANYU news, detailed airdrop guides, exchange comparison tables, and deep dives into tokenomics. Whether you’re looking to claim a free MANYU tranche, evaluate its market performance, or understand the technical underpinnings, the collection offers actionable insights and practical steps to help you navigate the token’s ecosystem.

Explore the Manyu (MANYU) crypto coin-its link to a viral Shiba Inu, Ethereum tech, market data, risks, and how to buy. A full guide for meme‑coin fans.

Categories

Archives

Recent-posts

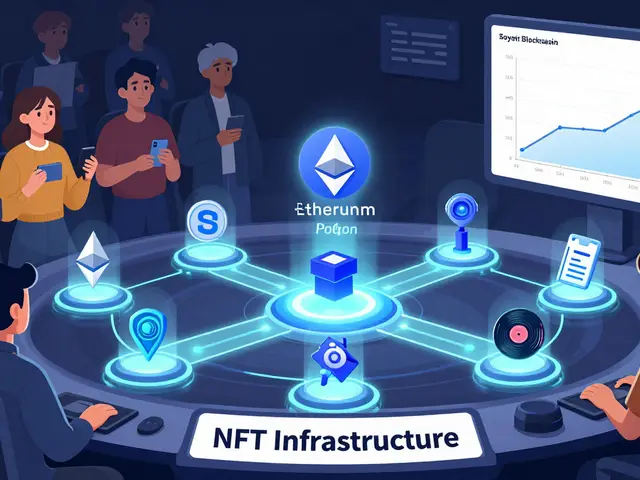

NFTs in the Creator Economy: How Digital Ownership Is Changing How Creators Earn in 2026

Feb, 18 2026

Finance

Finance