Understanding Cryptocurrency Bans: What They Mean for Traders and Investors

When talking about cryptocurrency bans, government actions that prohibit, restrict, or heavily regulate the use, trading or mining of digital assets, also known as crypto bans, you’re really looking at a mix of legal, financial and technical moves that reshape the whole market. Cryptocurrency bans encompass government‑imposed restrictions (central topic – subject‑predicate‑object), they require compliance measures from exchanges (central topic – requires – exchanges), and they often trigger new tax policies (central topic – influences – tax regimes). The first wave of bans came from countries fearing capital flight, but today the story includes everything from digital‑yuan promotion to mining‑power grants.

How Regulation Shapes the Scope of Bans

One of the biggest drivers behind bans is cryptocurrency regulation, the set of rules that define what crypto activities are allowed, who can operate and how they must report, often called crypto law. When regulators tighten rules, bans become a natural extension – think of China’s 2025 total prohibition that forced miners off‑shore and pushed the digital yuan to the forefront. In contrast, places like Taiwan adopt selective banking restrictions, letting stablecoins roam while keeping risky tokens out. These regulatory choices directly influence which assets get blacklisted, how exchanges adapt, and whether investors can still access foreign platforms.

Another layer comes from crypto tax, the fiscal obligations imposed on crypto transactions, holdings and mining income, often referred to as digital asset tax. When a jurisdiction imposes steep rates – for example India’s 30% flat tax or the U.S. penalties for evasion – authorities sometimes pair the tax burden with outright bans on specific services to force compliance. The link is clear: higher tax pressure can lead to tighter bans, especially on anonymous or cross‑border trades. This dynamic shows why tax policy is not just a side note but a core part of the ban ecosystem.

Beyond regulation and tax, exchange compliance plays a pivotal role. Platforms must adjust KYC/AML procedures, restrict access to banned tokens, and sometimes shut down entire services to stay legal. The FSC rules in Taiwan or the RBI’s stance on Indian exchanges illustrate how compliance requirements become a gateway for or barrier to market entry. When an exchange fails to meet these standards, it can be blacklisted, effectively turning a regulatory rule into a de‑facto ban for its users.

Geopolitics adds another twist. Countries with volatile currencies, like Nigeria, see crypto trading as a way to dodge inflation, prompting authorities to clamp down on foreign exchange conversions and limit stablecoin usage. Meanwhile, nations such as Pakistan are offering 2,000 MW of power to miners, turning a potential ban into an incentive. These opposing moves highlight that bans are not always about suppression; sometimes they aim to steer the industry toward national goals.

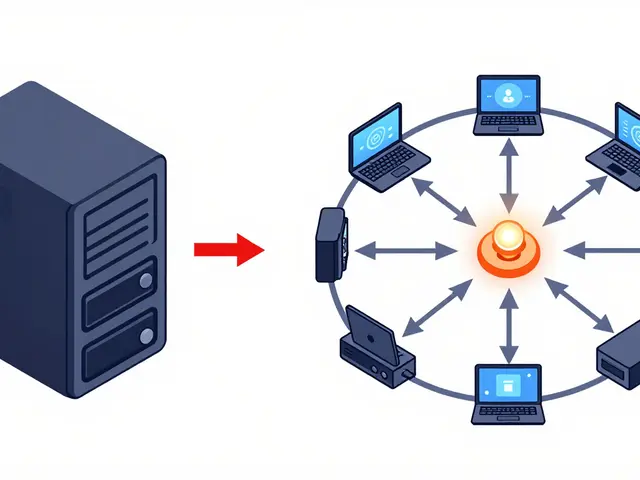

Technology also influences how bans are enforced. Blockchain’s pseudonymous nature makes it hard to police, so governments resort to exchange-level blocks, IP filtering, or even mining hardware restrictions. The rise of decentralized finance (DeFi) challenges traditional bans, forcing regulators to think about smart‑contract censorship and cross‑chain token flows. This tech‑regulation dance creates a constantly shifting landscape where yesterday’s ban could be tomorrow’s loophole.

All these factors – regulation, tax, exchange compliance, geopolitics and technology – intersect to form a complex web around cryptocurrency bans. Below you’ll find real‑world examples that illustrate each angle: from China’s outright prohibition and India’s steep tax regime to Taiwan’s selective banking rules and Pakistan’s mining power grant. Whether you’re a trader, an investor, or just curious, the collection gives you the practical details you need to navigate a world where bans can appear overnight and reshape your strategy.

Explore how communities worldwide adopt cryptocurrency despite bans, with a focus on Nigeria's grassroots movement, drivers, risks, and future regulatory trends.

Finance

Finance